Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.2

★★★★★

I’m able to track purchase orders I created, and monitor our expenses to make sure we stay on budget.

★★★★★

It is an easy platform to use and I am able to track all of my money without second guessing.

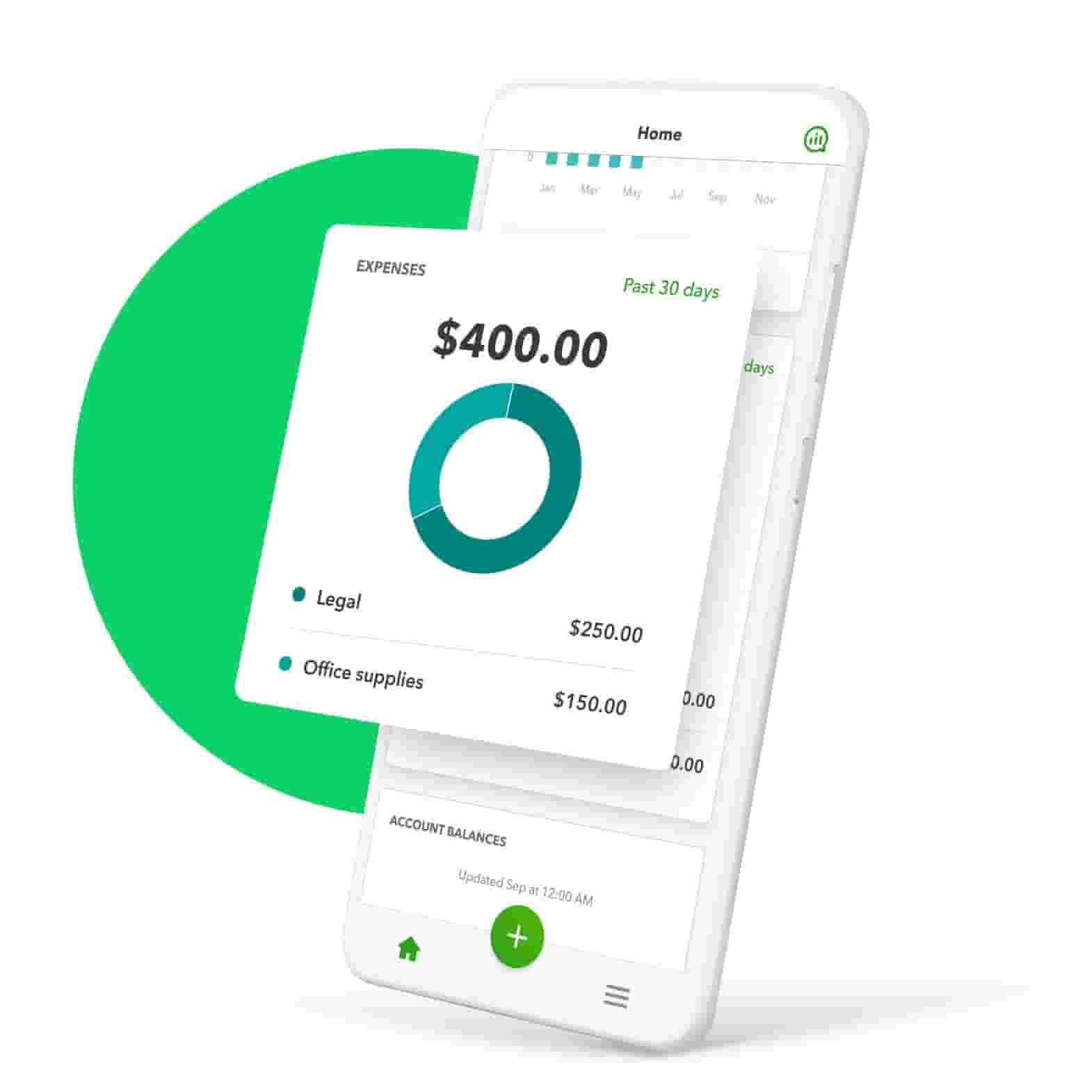

Never lose sight of your business expenses

Connect QuickBooks to your bank accounts, credit cards, PayPal, Square, and more, and we’ll import and categorize your expenses for you. Create custom rules to categorize your expenses, and run reports to see how you spend every dollar.

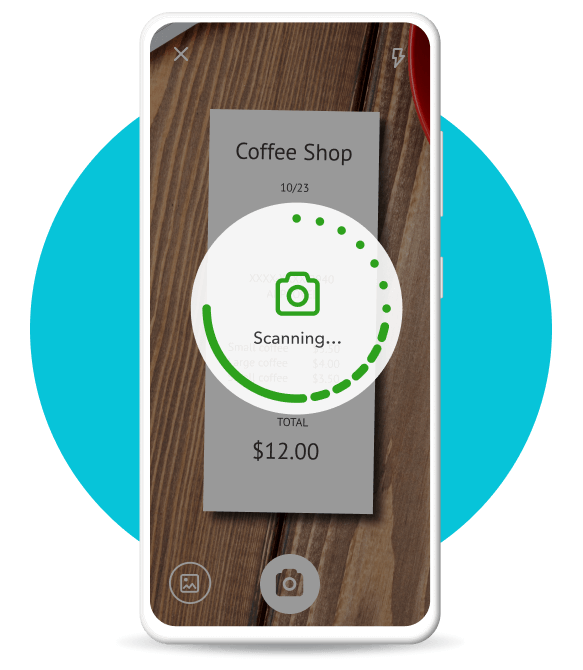

Snap and save photos of receipts with our mobile app, and we’ll automatically match all your receipt information to an existing transaction. Expense tracking has never been easier.**

QuickBooks automatically sorts expenses into categories to keep things organized. Easily track your business expenses all year long, so you never miss a tax deduction.

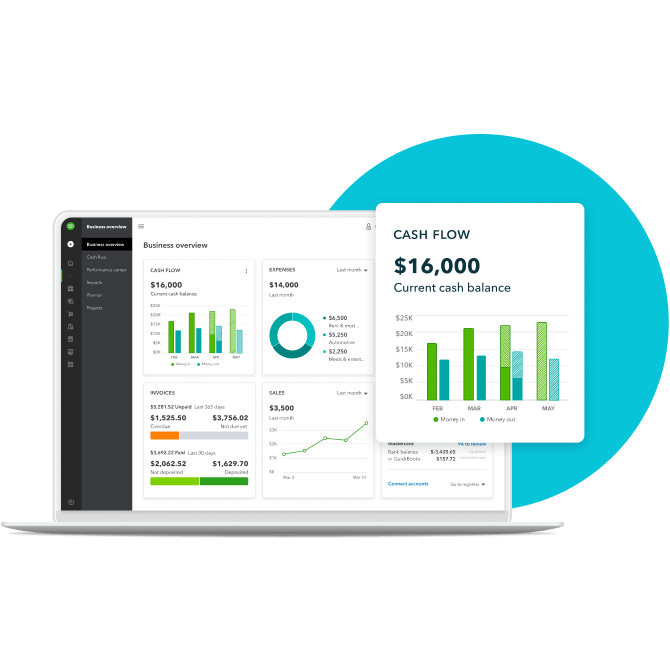

Stay in the know about cash flow

QuickBooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. View the built-in cash flow statement and see how much money you have—so you can cover your bills.**

Accessible expense reports. Designed for sharing.

Keep tabs on your finances

Make smarter decisions with instant access to key financials including income, expenses, outstanding invoices, and more.

See and share

Instantly see how you’re doing with profit & loss reports. Share them with your accountant for a better picture of your work.

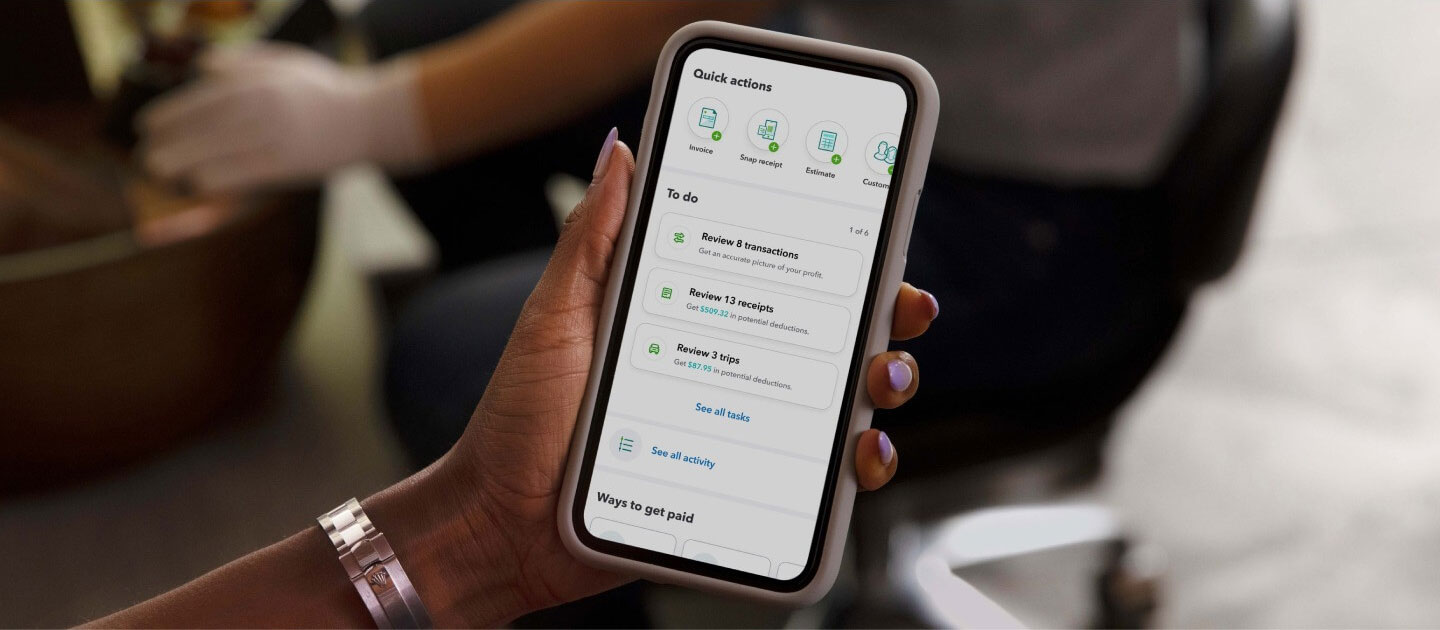

Expense tracking, on the go

Turn your camera phone into an instant receipt scanner with the QuickBooks app.**

All in one place

Simply snap photos of your receipts and upload using the mobile app. QuickBooks keeps all of your receipts in one convenient place, making it easy to track your business expenses.

Attach receipts to invoices

If you invoice your clients for expenses you’ve incurred, just snap a photo of the receipt and record the billable expense in your books. Then add the billable expense to the invoice and attach the receipt.

Confident at tax time

QuickBooks pulls info like date, vendor, amount, and payment method from your receipts. Then we match your receipts to existing expenses or create new expenses for you.

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

Success is in the story

Success is in the story