Each time you add or remove an account from your business, it’s important to record it into the correct account. The chart of accounts helps you do just that. Read on to learn how to create and utilize the chart to keep better track of your business’s accounts.

What is the chart of accounts?

What is the chart of accounts?

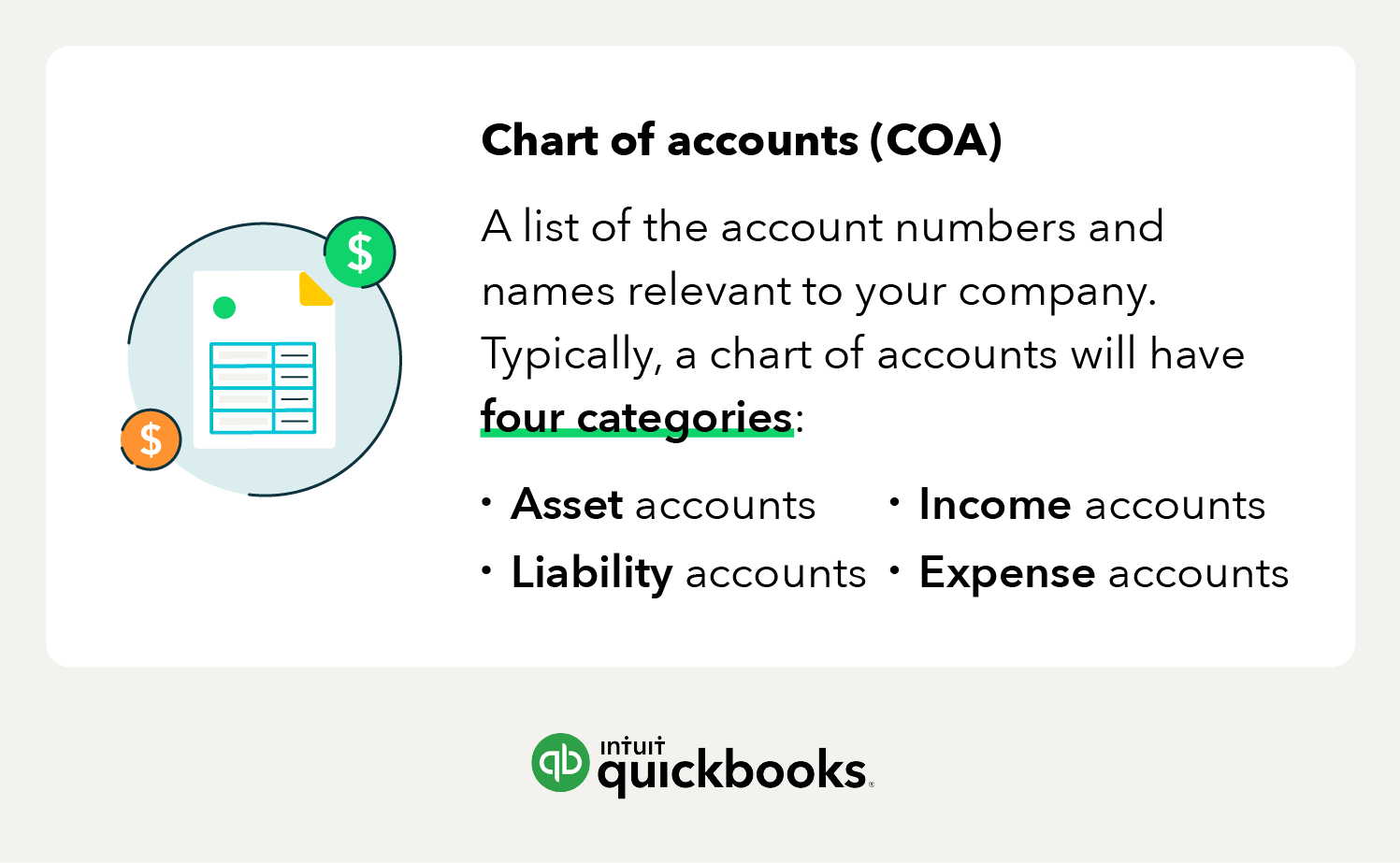

The chart of accounts, or COA, is a list of the account numbers and names relevant to your company. Typically, a chart of accounts will have four categories. The four primary account types, or general ledgers in a standard chart of accounts are:

- Asset accounts

- Liability accounts

- Income accounts

- Expense accounts

Put another way, a chart of accounts is a lot like the game Jenga. If you take a block away from one section of your business, you have to add it back someplace else.

Accounting systems, by definition, have a general ledger in which your asset accounts (what you own) match your liability accounts (what you owe).

While useful in theory, it’s challenging to implement in reality. Because current assets never quite match current liabilities, accountants often use other account types that serve as the “missing Jenga blocks” to ensure an accurate general ledger.

To better understand the balance sheet and other relevant financial statements, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information.

Within each category, line items will distinguish the specific accounts. Each line item represents an account within each category.

Some may also display equity accounts on their company’s chart. An equity account is a representation of anything that remains after accounting for all operating expenses and revenue accounts.

A breakdown of the main account types

The main account types include asset, liability, income, and expense accounts. See specifics on each account type below.

Asset accounts

Your asset accounts could include:

- Anything you own that has value, like:Buildings

- Land

- Equipment

- Vehicles

- Valuables

- Inventory

- Liquid assets, such as:Checking accounts

- Other bank accounts

- Additional asset accounts would include items like:Accounts receivable

- Notes receivable

The chart of accounts streamlines various asset accounts by organizing them into line items so that you can track multiple components easily. Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation.

Liability accounts

Your liability accounts include things like:

- Current or short-term liabilities:Accounts payable or bills

- Payroll taxes

- Income taxes payable

- Bank loans

- Credit card balances

- Non-current or long-term liabilities:Mortgages

- Deferred tax liabilities

- Personal loans

Current liabilities are classified as any outstanding payments that are due within the year, while non-current or long-term liabilities are payments due more than a year from the date of the report.

When entering a loan into your company’s chart, be sure to adhere to the following steps:

- Make sure that you only include the amount of the loan. Log just the principal amount and forgo the interest owed.

- When you make each monthly payment and enter the payment in your accounting system.

- Then, split the payment into an amount subtracted from what you owe, and an amount of interest paid, which will go into an expense account.

Income accounts

Income tends to be the category that business owners underutilize the most. Below are the most common types of revenue or income accounts:

- Sales income

- Rental income

- Dividend income

- Contra income

Most new owners start with one or two broad categories, like “sales” and “services.” While some types of income are easy and cheap to generate, others require considerable effort, time, and expense. It may make sense to create separate line items in your chart of accounts for different types of income.

Instead of lumping all your income into one account, consider what your various profitable activities may be and sort them by income type. When you can see which locations or events bring in the most cash flow, you can manage your business more wisely.

For instance, imagine you have a store that sells an array of items:

- On your chart of accounts, you could create line items for “income from food sold” and “income from books sold.”

- Then compare the profit levels and cost of goods sold from each category (which allows you to better determine your financial health).

- When compiling data in your income accounts category, consider anything that brings money into the company, including things like interest income.

Expense accounts

Expense accounts represent any money that you’ve spent. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.

Below are more examples of expense accounts to your business may use:

- Cost of sales

- Advertising expense

- Interest expense

- Depreciation expense

- Salaries or wages

- Interest expense

- Depreciation expense

It’s also a good idea to break up expenses into separate accounts. For instance, if you ship a lot of products, you may want to track your costs from different shipping carriers separately. Within each line account, you can create sub-categories for the various expenses associated with each carrier.

How to set up the chart of accounts

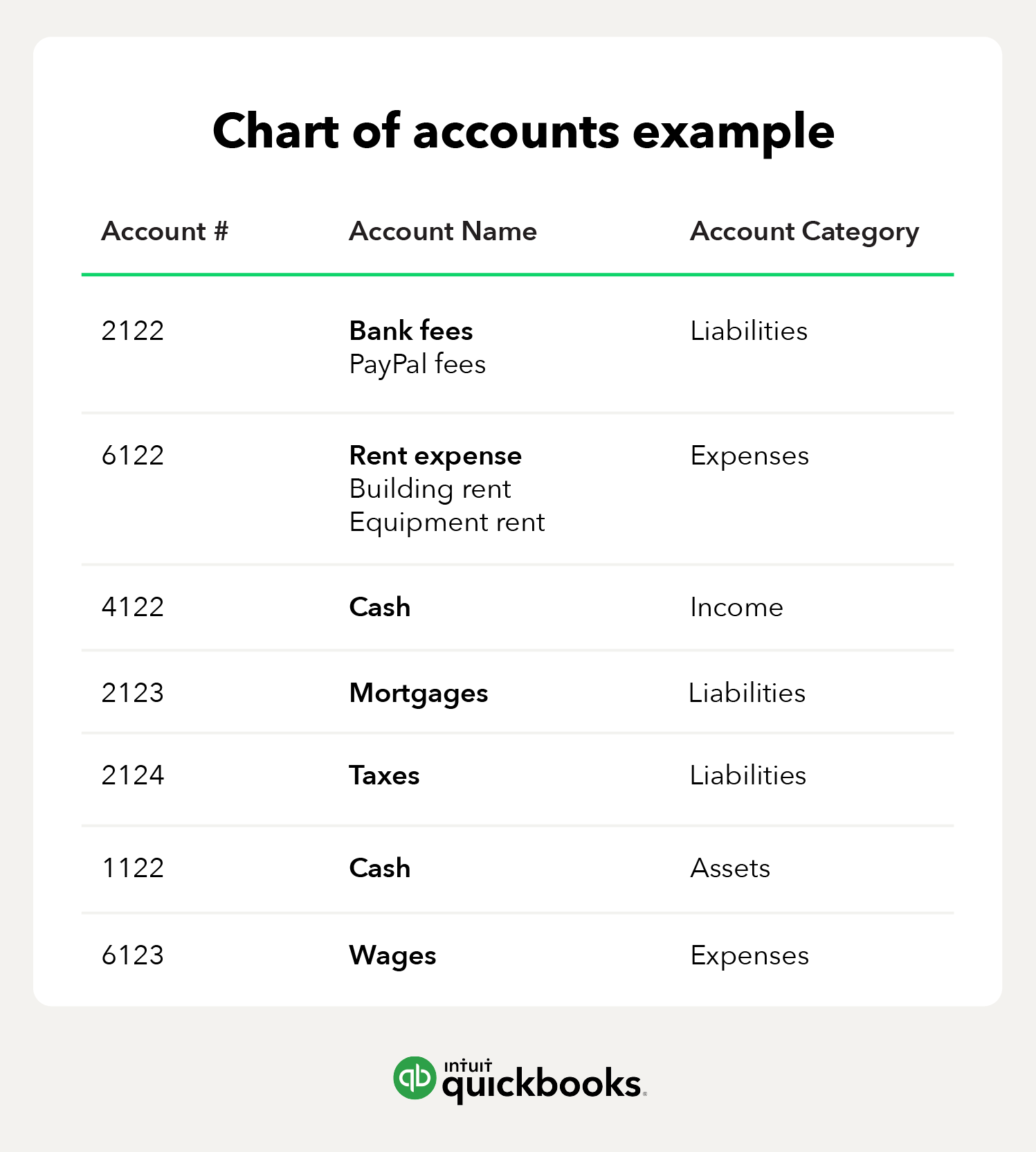

Setting up your chart of accounts is relatively simple. First you’ll need to create your blank chart and assign the columns. The chart of accounts is typically broken down into the following 3 columns:

1. Create business account names

The account name is the given title of the business account you’re reporting on (i.e., bank fees, cash, taxes, etc.).

2. Assign account numbers to business accounts

Account numbers are the numbers assigned to each account name. The most common number sequences for each account are:

- Assets: 1,000 to 1,999

- Liabilities: 2,000 to 2,999

- Income: 4,000 to 4,999

- Operating expenses: 6,000 to 7.999

3. Organize account names into one of the four account category types

Each of your account names should be assigned an account type or general ledger. Choose from the 4 main account types: asset, liability, income, and expense.

Below is an example of what your chart will look like once you’ve added all of the necessary components. Once you’ve set up your chart, you can then begin adding specific account names and the account category they’re associated with.

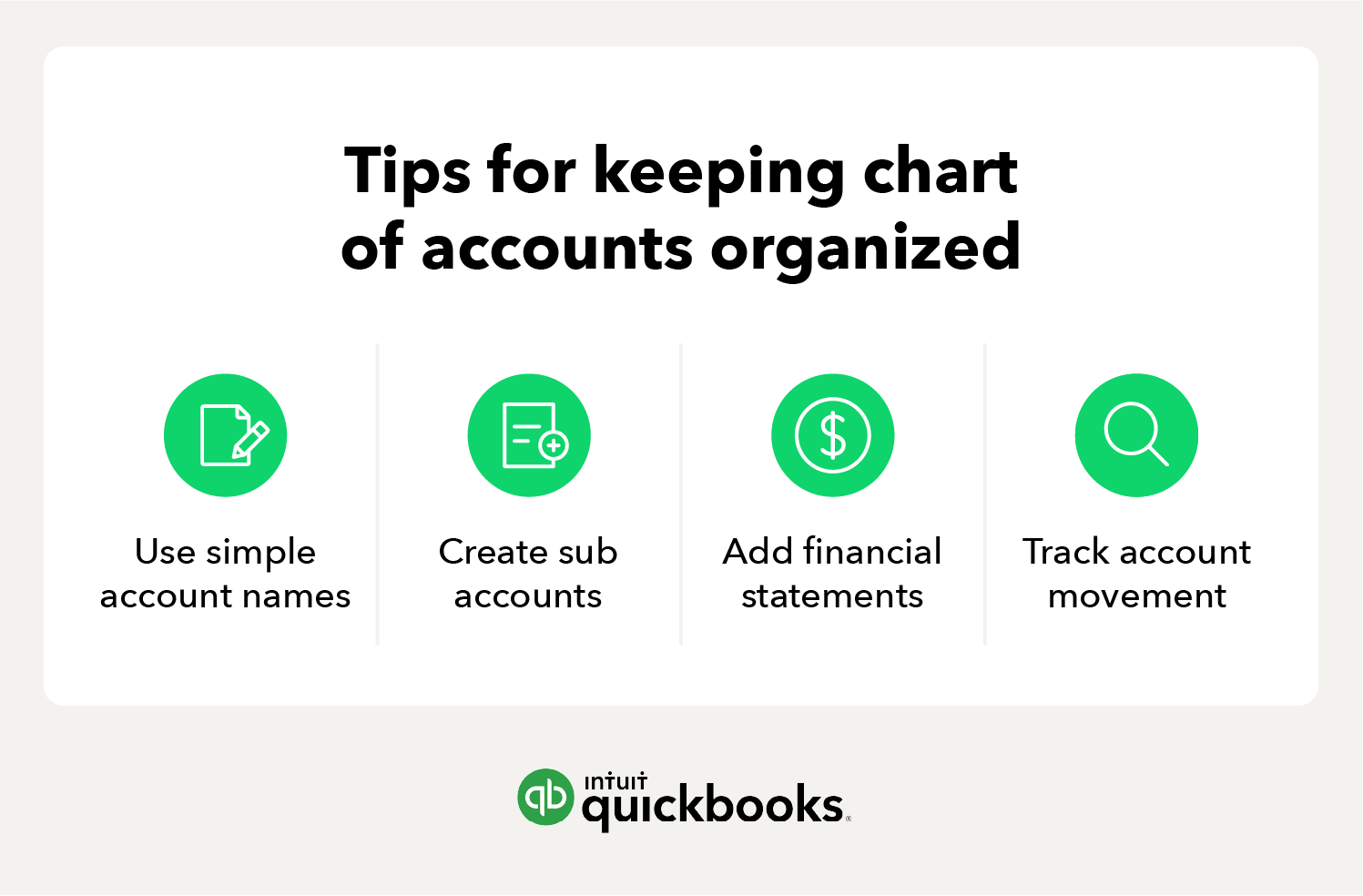

Tips for keeping your chart of accounts organized

Now that your COA is set up, it’s important to keep it organized as you continue to add or adjust accounts. The following tips will help you set your chart of accounts up for success.

Use simple account names

When setting up your line items for the first time, keep it simple. Make sure that your line items have titles that make sense to you and your accountant. Use straightforward titles like “bank fees,” or “bottling equipment.”

Create sub-accounts

As time goes by, you may find yourself wanting to create a new line item for each transaction. However, doing so could litter your company’s chart and make it confusing to navigate. Instead, take advantage of your accounting software’s sub-accounts.

For instance, imagine you need to create a new account for “PayPal fees.” Instead of creating a new line on your chart of accounts, you can create a sub-account under “bank fees.” Similarly, if you pay rent for a building or piece of equipment, you might set up a “rent expense” account with sub-accounts for “building rent” and “equipment rent.”

Add financial statements

Add an account statement column to your COA to record which statement you’ll be using for each account–cash flow, balance sheet, or income statement. For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts.

Track account movement

Your chart of accounts is a living document for your business and because of that, accounts will inevitably need to be added or removed over time. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts.

Accounting software can help manage your chart of accounts

As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future. A chart of accounts should keep your business accounting error-free and straightforward. This will allow you to quickly determine your financial health so that you can make intelligent decisions moving forward.

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.