Plans for every kind of business

Buy now and get Live Assisted Bookkeeping FREE for 30 days*

1

Select plan

2

Add Payroll

3

Checkout

Simple Start

$30

$15/mo

Save 50% for 3 months*

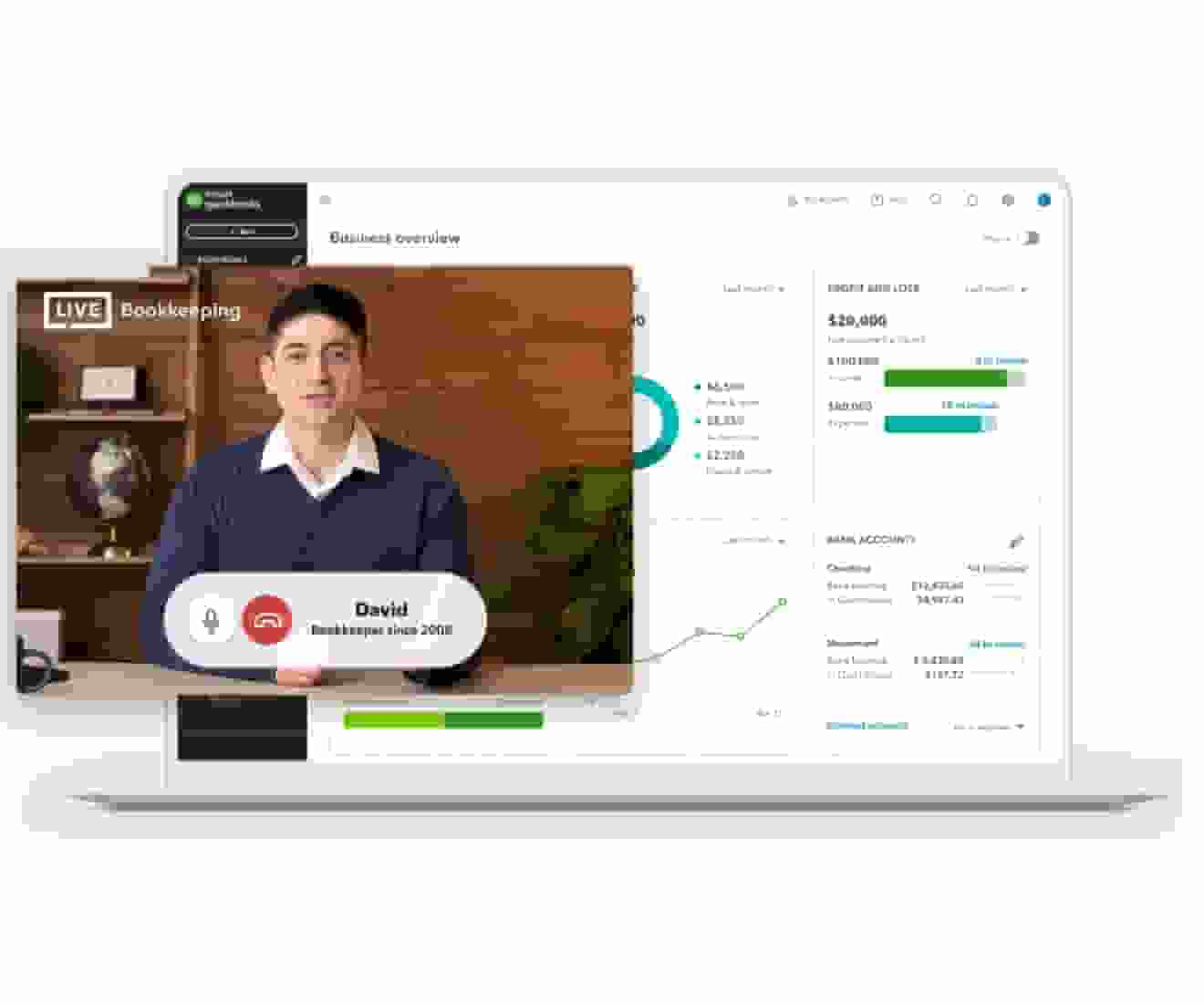

Assisted Bookkeeping

Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days.

Try expert help FREE for 30 days*

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

NEW

with QuickBooks Live Tax

Income and expenses

Securely import transactions and organize your finances automatically.

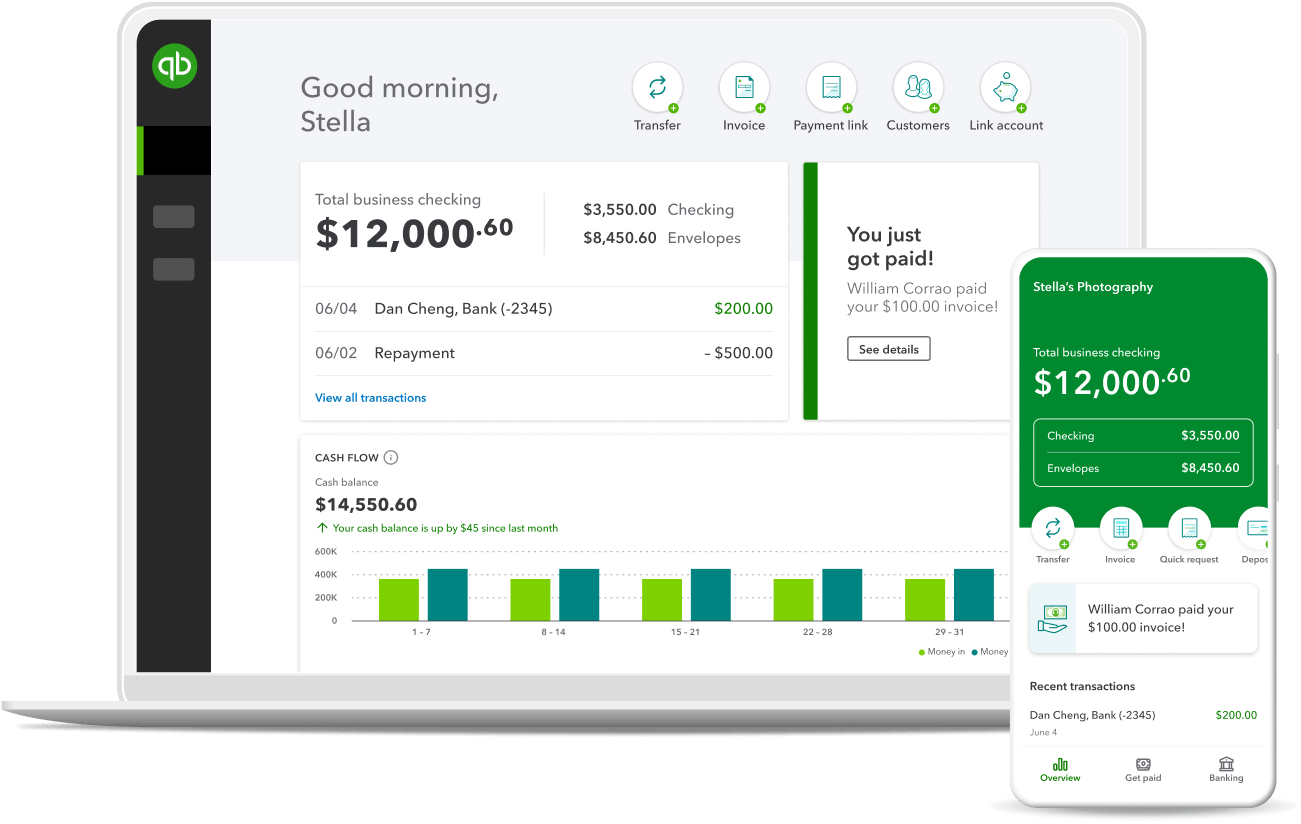

Banking with 5.00% APY

Every dollar put away in savings envelopes earns you interest at over 70x the U.S. average.

NEW

Bookkeeping automation

Automate bookkeeping to cut down on tedious tasks and get more time to focus on your business.

NEW

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

General reports

Run and export reports including profit & loss, expenses, and balance sheets.*

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible.

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 1 sales channel

Connect 1 online sales channel and automatically sync with QuickBooks.

Bill management

Organize and track your business bills online.

Essentials

$60

$30/mo

Save 50% for 3 months*

Assisted Bookkeeping

Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days.

Try expert help FREE for 30 days*

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

NEW

with QuickBooks Live Tax

Income and expenses

Securely import transactions and organize your finances automatically.

Banking with 5.00% APY

Every dollar put away in savings envelopes earns you interest at over 70x the U.S. average.

NEW

Bookkeeping automation

Automate bookkeeping to cut down on tedious tasks and get more time to focus on your business.

NEW

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

Enhanced reports

Know how your business is doing with sales, accounts receivable, and accounts payable reports.*

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible.

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect 3 sales channels

Connect up to 3 online sales channels and automatically sync with QuickBooks.

Bill management

Organize and track your business bills online.

Multiple currencies

Record transactions in other currencies without worrying about exchange rate conversions.

Includes 3 users

Invite your accountant to access your books, control user-access levels, and share reports without sharing a log-in.**

Enter time

Enter employee time by client/project and automatically add it to invoices.

Plus

$90

$45/mo

Save 50% for 3 months*

Assisted Bookkeeping

Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days.

Try expert help FREE for 30 days*

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

NEW

with QuickBooks Live Tax

Income and expenses

Securely import transactions and organize your finances automatically.

Banking with 5.00% APY

Every dollar put away in savings envelopes earns you interest at over 70x the U.S. average.

NEW

Bookkeeping automation

Automate bookkeeping to cut down on tedious tasks and get more time to focus on your business.

NEW

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

Comprehensive reports

Stay on track with inventory reports, enhanced sales reports, and profitability reports.*

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible.

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect all sales channels

Connect any available online sales channels and automatically sync with QuickBooks.

Bill management

Organize and track your business bills online.

Multiple currencies

Record transactions in other currencies without worrying about exchange rate conversions.

Includes 5 users

Invite your accountant to access your books, control user-access levels, and share reports without sharing a log-in.**

Enter time

Enter employee time by client/project and automatically add it to invoices.

Inventory

Track products, cost of goods, see what’s popular, create purchase orders, and manage vendors.

Project profitability

Track all your projects in one place, track labor costs, payroll and expenses.

Financial planning

Create budgets with real-time data you can collaborate with your team on.

NEW

Advanced

$200

$100/mo

Save 50% for 3 months*

Assisted Bookkeeping

Connect with Live experts when you need it. They can provide setup help and bookkeeping guidance in QuickBooks, so you can stay organized and run your business with confidence. Free for 30 days.

Try expert help FREE for 30 days*

Access expert tax help

Save time and effort by seamlessly moving from books to taxes, then prepare your current tax year return with unlimited expert help to get every credit you deserve. Access live tax experts powered by TurboTax and pay only when you file. Costs vary by entity type. Subject to eligibility.

NEW

with QuickBooks Live Tax

Income and expenses

Securely import transactions and organize your finances automatically.

Banking with 5.00% APY

Every dollar put away in savings envelopes earns you interest at over 70x the U.S. average.

NEW

Bookkeeping automation

Automate bookkeeping to cut down on tedious tasks and get more time to focus on your business.

NEW

Invoice and payments

Accept credit cards and bank transfers in the invoice with QuickBooks Payments, get status updates and reminders.**

Tax deductions

Share your books with your accountant or export important documents.**

Powerful reports

Monitor financial metrics and build customized dashboards that measure performance.

Receipt capture

Snap photos of your receipts and categorize them on the go.**

Mileage tracking

Automatically track miles, categorize trips, and get sharable reports.**

Cash flow

Get paid online or in person, deposited instantly, if eligible.

Sales and sales tax

Accept credit cards anywhere, connect to e-commerce tools, and calculate taxes automatically.**

Estimates

Customize estimates, accept mobile signatures, see estimate status, and convert estimates into invoices.**

Contractors

Assign vendor payments to 1099 categories, see payment history, prepare and file 1099s from QuickBooks.**

Connect all sales channels

Connect any available online sales channels and automatically sync with QuickBooks.

Bill management

Organize and track your business bills online.

Multiple currencies

Record transactions in other currencies without worrying about exchange rate conversions.

Includes 25 users

Invite your accountant to access your books, control user-access levels, and share reports without sharing a log-in.**

Enter time

Enter employee time by client/project and automatically add it to invoices.

Inventory

Track products, cost of goods, see what’s popular, create purchase orders, and manage vendors.

Project profitability

Track all your projects in one place, track labor costs, payroll and expenses.

Financial planning

Create budgets with real-time data you can collaborate with your team on.

NEW

Auto-track fixed assets

Automatically track fixed asset values, access all fixed asset info in one spot, and get insights about what may come next.

NEW

Data sync with Excel

Seamlessly send data back and forth between QuickBooks Online Advanced and Excel for more accurate business data and custom insights.

Employee expenses

Employees submit expenses in QuickBooks, so everything’s in one place and easy to track.

Batch invoices and expenses

Create invoices, enter, edit, and send multiple invoices faster.**

Custom access controls

Easily control who sees your data, assign work to specific users, and create custom permissions.

Workflow automation

Save time and mitigate risk with automated workflows and set reminders for improved cash flows and more.

Data restoration

Continuously and automatically back up your changes, restore a specific version of your company, and view version history.**

24/7 support & training

QuickBooks Priority Circle support and access to special training resources.

Revenue recognition

Stay consistent, compliant, and credible with automated revenue recognition.

NEW

NEW

You’re never alone with a Live expert in your corner

- Get set up by connecting accounts

- Automate tasks to save you time

- Discover features that work for your business

- Categorize and reconcile transactions correctly

- Build and review reports to make smart decisions

Call 1-800-816-4611 to get 50% off Live Assisted Bookkeeping for 3 months.*

All plans include

Mobile app

QuickBooks comes with a mobile app that help you run your business on the go—anytime, anywhere.

Free expert assistance

Now available with QuickBooks plans: a FREE 30-day Live Assisted Bookkeeping trial.

App integration

Use the apps you know and love to keep your business running smoothly.

See QuickBooks in action

Try QuickBooks for free with our test drive. You don’t even need a credit card.

We cover all kinds of businesses

Currently using QuickBooks?

Make the switch to QuickBooks Online from QuickBooks Desktop Pro, Premier, or Enterprise.

Looking to purchase QuickBooks Online for more than one company? Call (800) 595-4219 for a multi-company discount. Buy two or more QuickBooks Online subscriptions and get 50% off for 12 months*