Legal accounting software to free up your practice

QuickBooks is the ideal software for lawyers to spend less time on busywork, and more on real work.

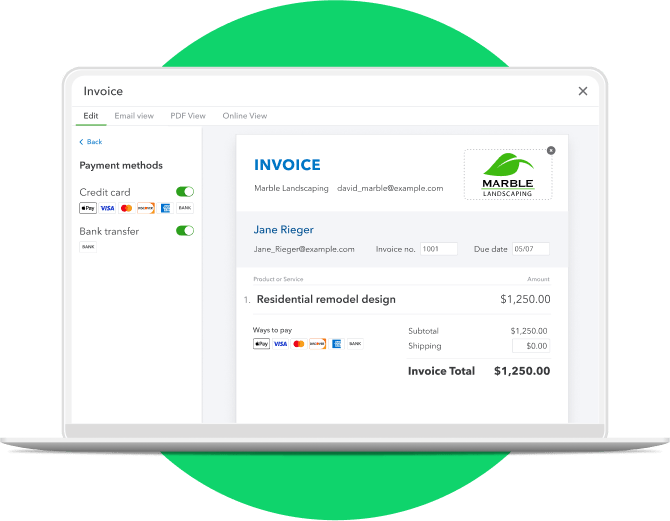

Sync your legal accounting software to apps that organize clients, billing, and documents in one place.

MOBILE APP

Enjoy legal billing software you can use anytime, anywhere. Send invoices from the app and get alerts the moment they’re paid.

Plans that work for your law practice

Now with Live Assisted Bookkeeping (add $50/month)

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

Ready to get started?

Or call 1-800-365-9606

Find more of what you need with these tools, resources, and solutions.

Learn more about what billable hours are, how to track them, and what kinds of time you can and can’t charge.

A retainer agreement helps establish terms for your services and payment. Learn how to set up your own retainer agreements and improve stability for your practice.