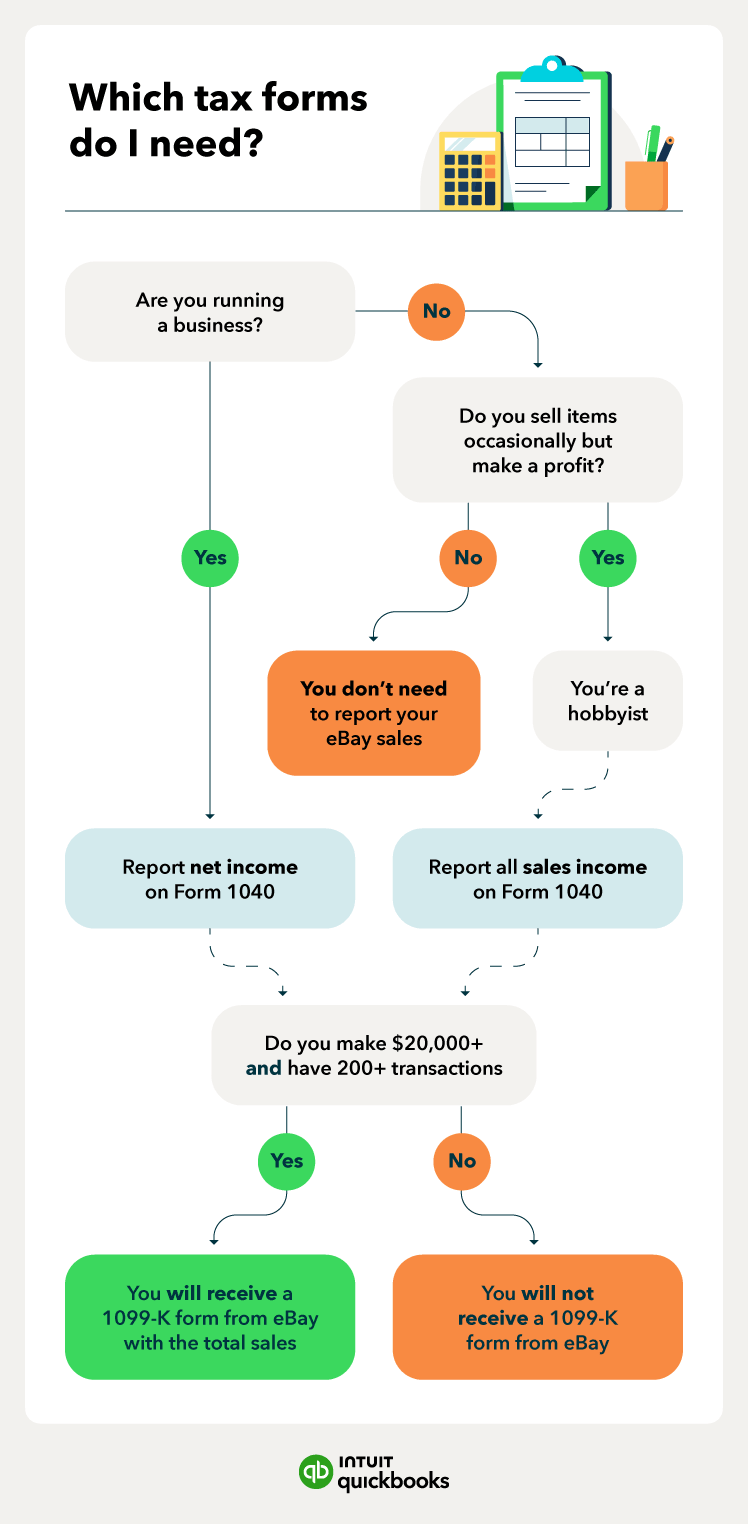

Will eBay send a 1099-K?

If you meet both the following criteria for the previous year, then eBay will automatically send you Form 1099-K by Jan 31:

- Made over $20,000 in unadjusted gross sales income in a year

- Had over 200 transactions.

Even if you don’t receive a 1099-K automatically, you still need to report any income you earn on eBay to the IRS on Form 1040.If your eBay payments are processed elsewhere, such as PayPal, you should receive a Form 1099-K from that processor if you meet the same criteria.

Which eBay sales are subject to income tax?

Let’s say you used eBay to sell off used items for less than you originally paid for them. These amounts are not considered taxable income since you made no profit. The IRS states that “If your online auction sales are the Internet equivalent of an occasional garage or yard sale, you generally do not have to report the sales.”

To show the IRS you did not make a profit on your sales of used goods, it’s always advisable to keep receipts of the original purchase. If you don’t have the receipt showing how much you spent on your inventory, you can use the fair market value to price your items. Remember, you can also add shipping and packing fees to the cost of the item.

However, if you sell the items for more than the original price, you’ll need to report that gain on Schedule D: Capital Gains and Losses and attach it to your Form 1040. So, for example, if you bought an antique chair for $100 and sold it for $150, you have a gain of $50 to report.

There can be exceptions. In addition to cases where you’ve made a profit selling a used item, the IRS may also categorize your eBay sales as taxable income if there are regular, recurring transactions like a business.

How to file taxes as an eBay seller

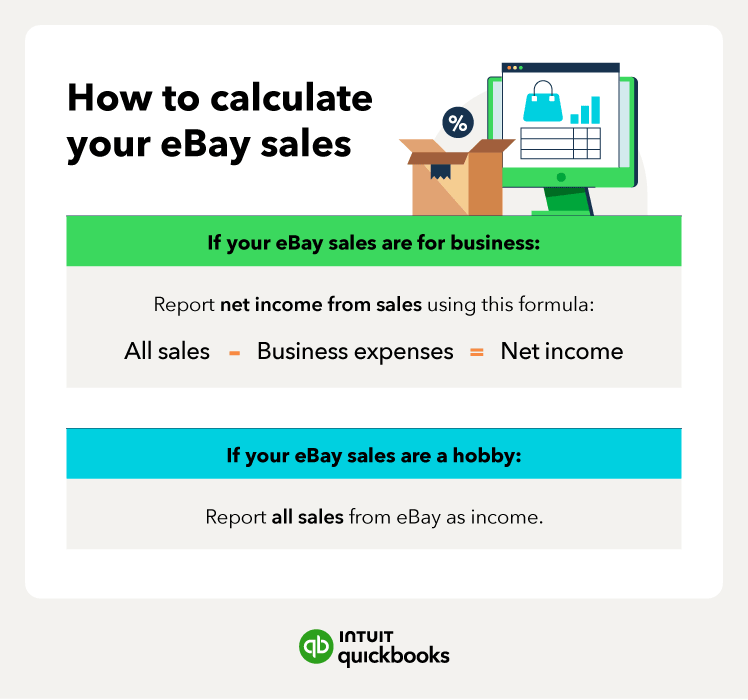

eBay sellers will generally need to report income on Form 1040. The process is different if your sales are a hobby or business:

If your eBay sales are a hobby:

You need to report expenses related to your hobby income on Form 1040, using Schedule A for itemized deductions. Your hobby income from sales on eBay will be reported on Schedule 1 of your Form 1040. Since your activities are considered a hobby, you won’t be able to claim losses. For deductions, you can claim expenses, such as eBay fees, shipping, packing, and mileage to bring down your net income.

You need to report income from eBay on Form 1040 and will not be able to deduct expenses. If you have more than $20,000 in sales, your total sales from eBay will be reported to you on Form 1099-K, a tax form that specifically covers credit, debit, and third-party online transactions. If you have less than $20,000 in third-party transactions, you will not receive a Form 1099-K for the 2023 tax year.

You might have heard about a new $600 threshold for third-party transactions, like payments made through Venmo and Paypal. What does this mean? There are plans to slowly lower this minimum to $600, starting with a $5,000 minimum for the 2024 tax year.

If your eBay sales are a business:

If you’re selling on eBay as a business, keep a paper trail of expenses and income and report your net income on Schedule C. Schedule C is for self-employed people who don’t have bosses who withhold taxes for them. Even if you’re employed part-time or full-time elsewhere, you’ll still need to fill out the Schedule for your eBay activities. To do this, you need to take the following steps:

- Keep a record of business expenses

- Keep a record of your business profits

- Subtract expenses from profits to get your net income

If you’ve made over $400 in net profit from your eBay sales, you’ll also need to fill out Schedule SE to figure out how much you owe in self-employment taxes.

Possible deductions include inventory costs, shipping fees, eBay and PayPal fees, travel expenses, software, as well as office expenses. Note that you can only claim home office expenses if you use the space exclusively for your eBay activities.

The same rules for reporting income on a 1099-K Form apply, whether you’re considered a business or hobby. You will receive a 1099-K form from eBay if your sales are more than $20,000.

Find peace of mind come tax time

Educating yourself about eBay taxes is the first step to preparing for a stress-free filing experience. Ease your tax season anxiety with QuickBooks accounting software that helps you keep your documents organized all year long, savings accounts that support your self-employment goals, and the resources you need to succeed. With these tools, you can maximize tax deductions and report eBay sales on your tax forms the right way.