Payroll processing can provoke no shortage of headaches for those new to small-business ownership. Setting up your company’s payroll — from computing employee taxes to establishing routine pay periods — can be a daunting task, but it doesn’t have to leave you perpetually frazzled and frustrated.

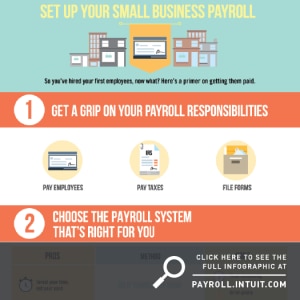

There are four essential (and surprisingly simple) steps involved in handling your company’s payroll.

1. Understand what’s involved. Familiarizing yourself with the basic concepts and legal requirements of employee payroll is the first step. “Payroll” simply refers to the total amount of money paid by an employer to his or her employees on a recurring basis. More complex, however, are payroll taxes. Every employer must meet specific payroll responsibilities, according to federal, state, and local laws. Paying employees means you must simultaneously withhold portions of their compensation to meet applicable income tax, social security, Medicare, and other requirements. As a result, it’s critical to report and deposit payroll taxes to the appropriate agency on time, every time.

2. Find what works for you. There’s more than one way to handle employee payroll. In fact, the options at your fingertips are plentiful:

- Do it yourself (a time-consuming process that, although cost-effective, could expose your business to the risk of costly payroll mistakes);

- Invest in commercial payroll software (a reliable and commonly preferred method);

- Invest in a full-service payroll software (this takes payroll off your hands completely);

- Hire an accountant (a means to obtain quality professional assistance, often at a fairly high price); or

- Outsource your payroll (a convenient choice, but one that brings a loss of control and flexibility).

Choose the method that makes the best sense for your business — and that’s easy on your nerves, your schedule, and your budget.