Monday - Friday, 8:30 AM to 6:30 PM AEST

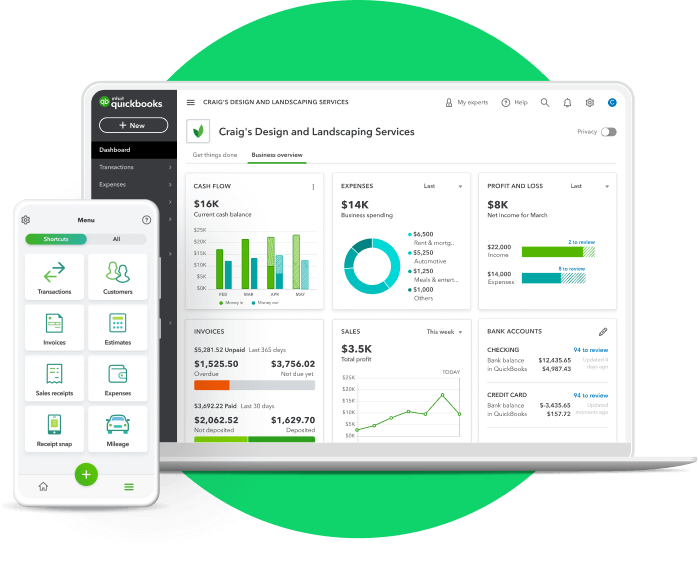

QuickBooks Online Accounting Software

Automate invoices and expenses

With QuickBooks invoicing and expense management you can feel confident about your business finances and focus on doing more of what you love.

Save up to 29 hours a month*

Manage everything in one place

Get a complete view of your business performing in real-time, right from your dashboard.

Build the right plan for your business

All Small Business plans include:

Cancel anytime

Try QuickBooks with no locked-in contract.

Integration with 500+ apps

Work seamlessly by connecting the apps you already use and love.

Free mobile accounting app

QuickBooks mobile accounting app is free to download on iPhone and Android. At home, in the office or on the go – take your business anywhere.

Invite your accountant

Invite your accountant or bookkeeper to share your books.

Secure cloud storage

QuickBooks uses advanced security safeguards to keep your data stored securely in the cloud.

Moving to QuickBooks Online is simple

We’ll migrate your data from Xero, Excel, MYOB or Reckon, so you’ll be up and running in no time.

Smart features that help you save time

Save an average 40 hours per month using QuickBooks*

Get paid 2x faster with automated invoices

Auto-track income and expenses

GST & BAS tracking

Painless payroll

Reports and insights

Cash Flow Confidence

Customer success stories

Customer success stories