Tips to avoid tool fatigue

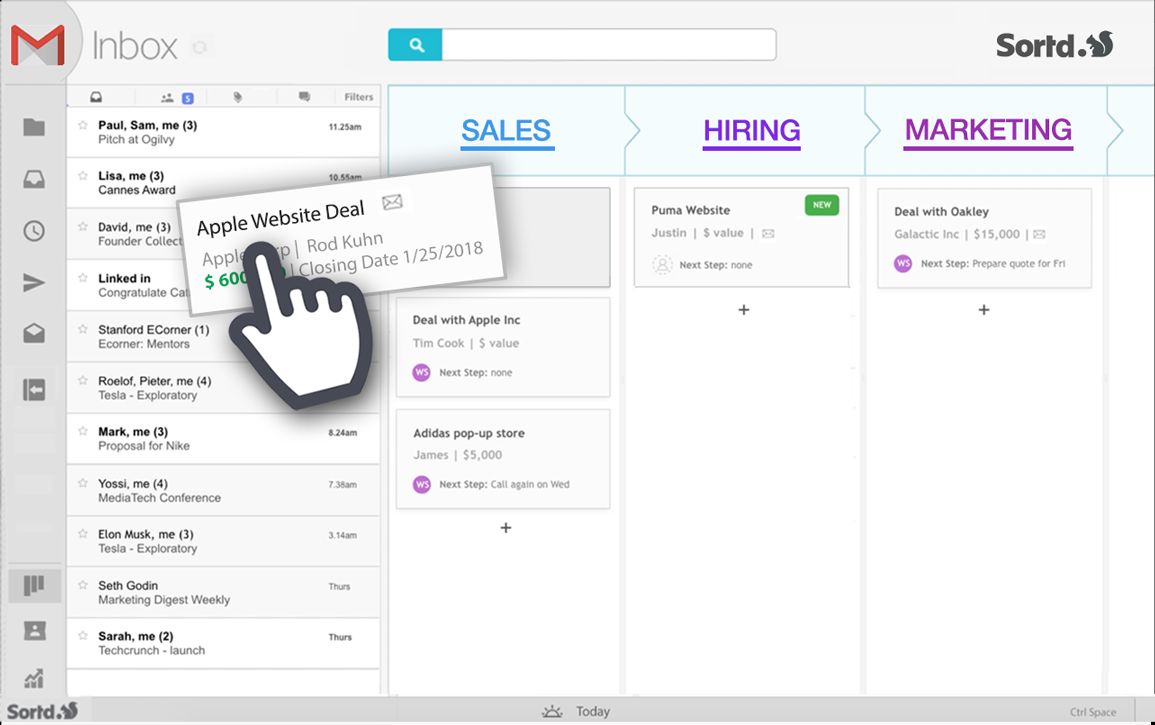

1. Start with a challenge or need

It is tempting to fall into the trap of downloading an app just because it sounds cool, but that is how you end up with more than you need. Work backwards by identifying a challenge within your business.

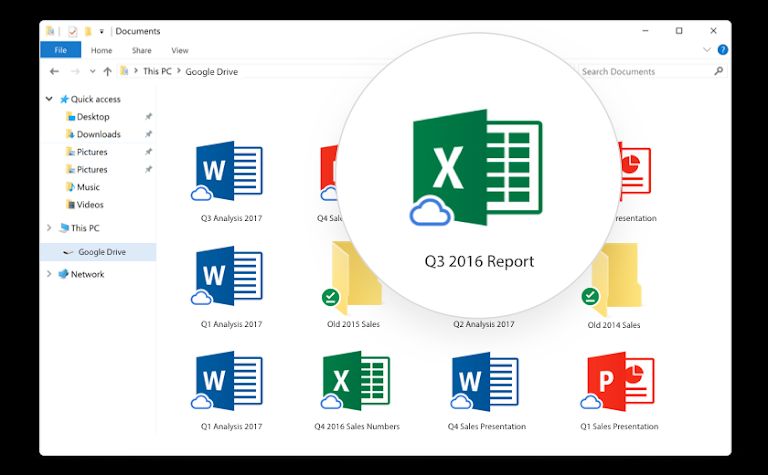

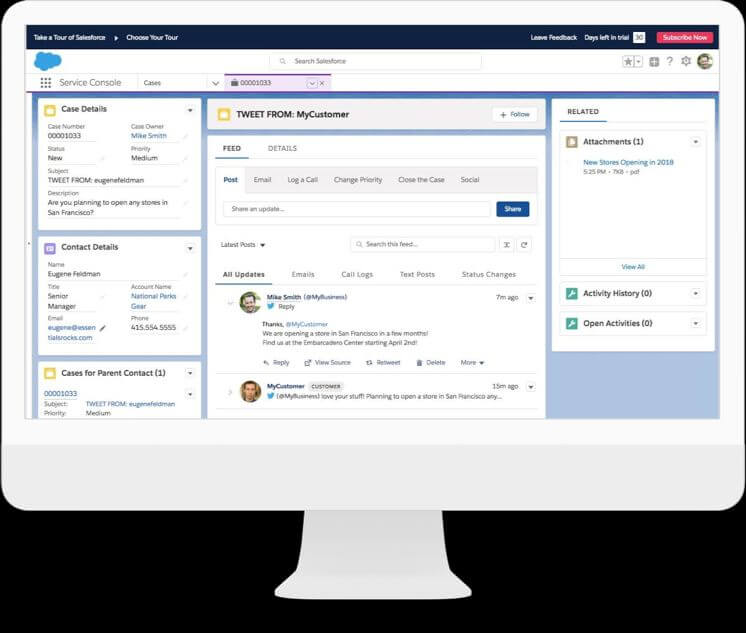

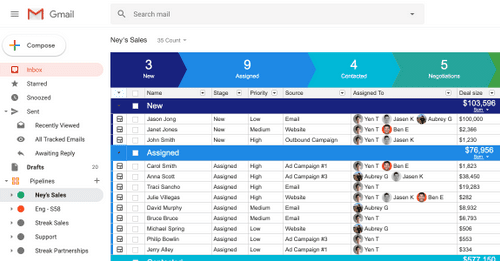

For example, do you wish you had a better way to track your customers? Are you sick of digging for the documents you need? Look for an app that solves that specific problem. That is far better than downloading something that does not actually address a struggle you are facing.

2. Carefully evaluate each new tool

Before clicking on “download,” ask yourself some pointed questions to make sure the tool is really what you are looking for. These can include:

- What business need will this app meet?

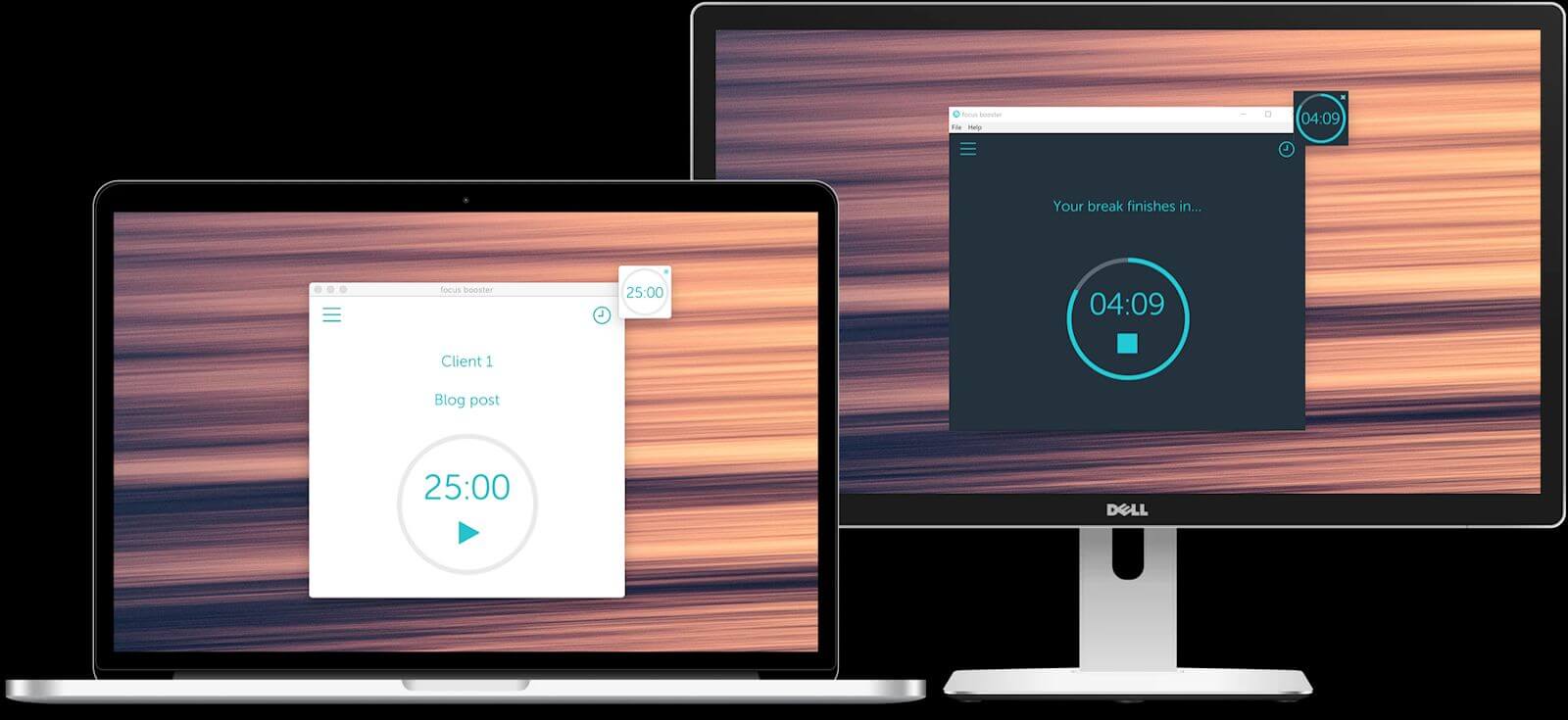

- How often will I use this app?

- Who in my business will use this app? What do they think?

- Is this app within my budget?

3. Schedule time to review your tools

Subscriptions can quickly pile up, and you do not want to be investing money in tools and platforms you are no longer actively using.

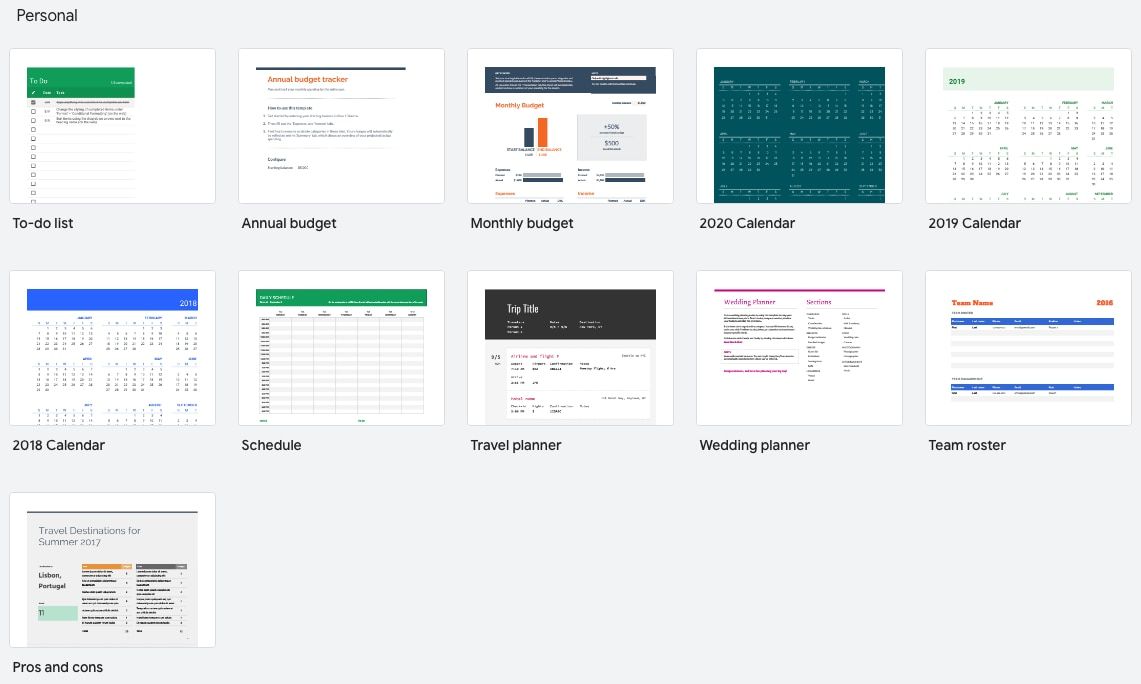

Put a recurring appointment on your calendar (at least quarterly!) to review your current tool arsenal and remove any that are not being utilised. That way you will keep a streamlined selection of tools, rather than having your business spread out across a bunch of different apps.

4. Invest time in tutorials and training

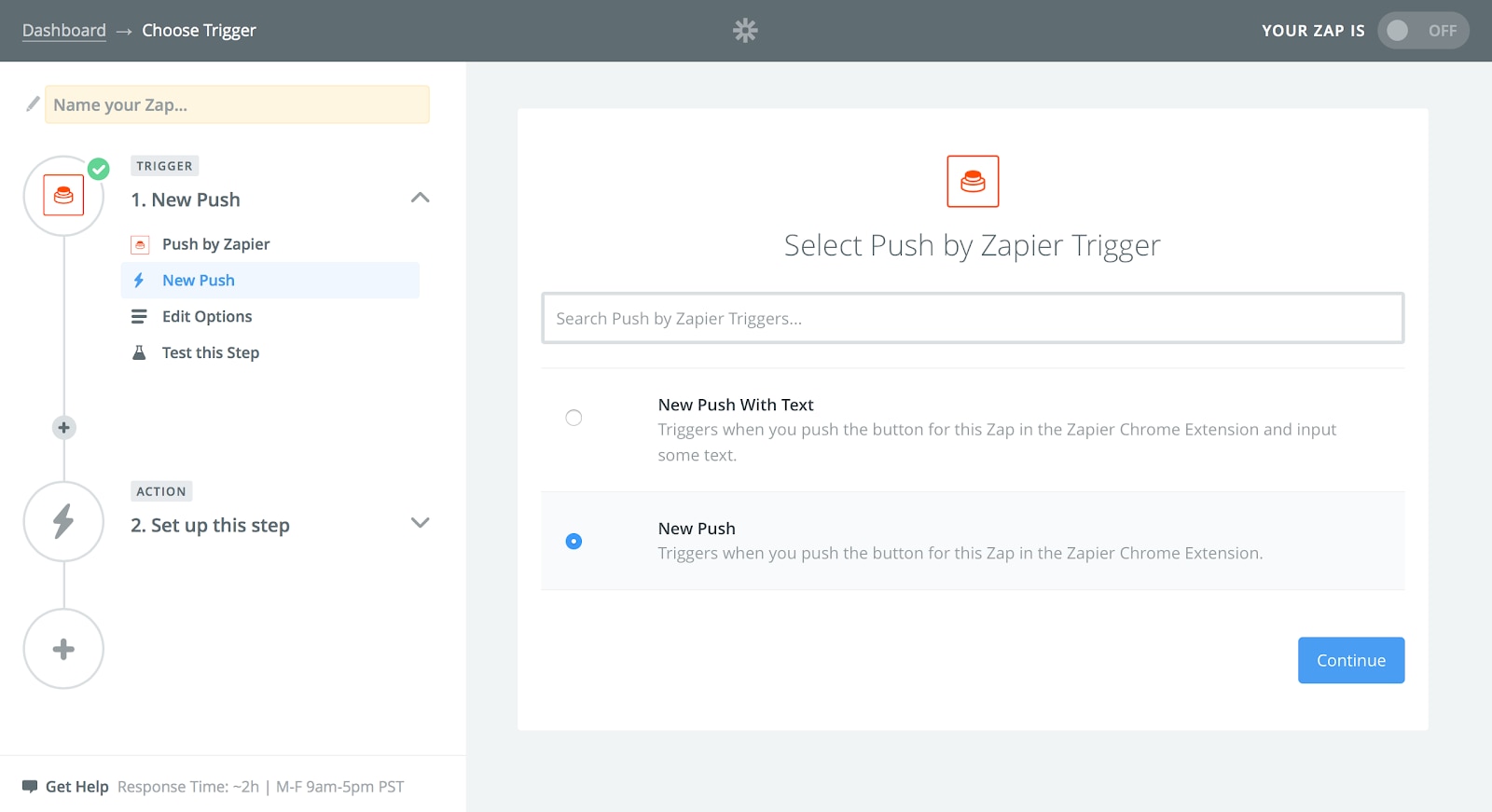

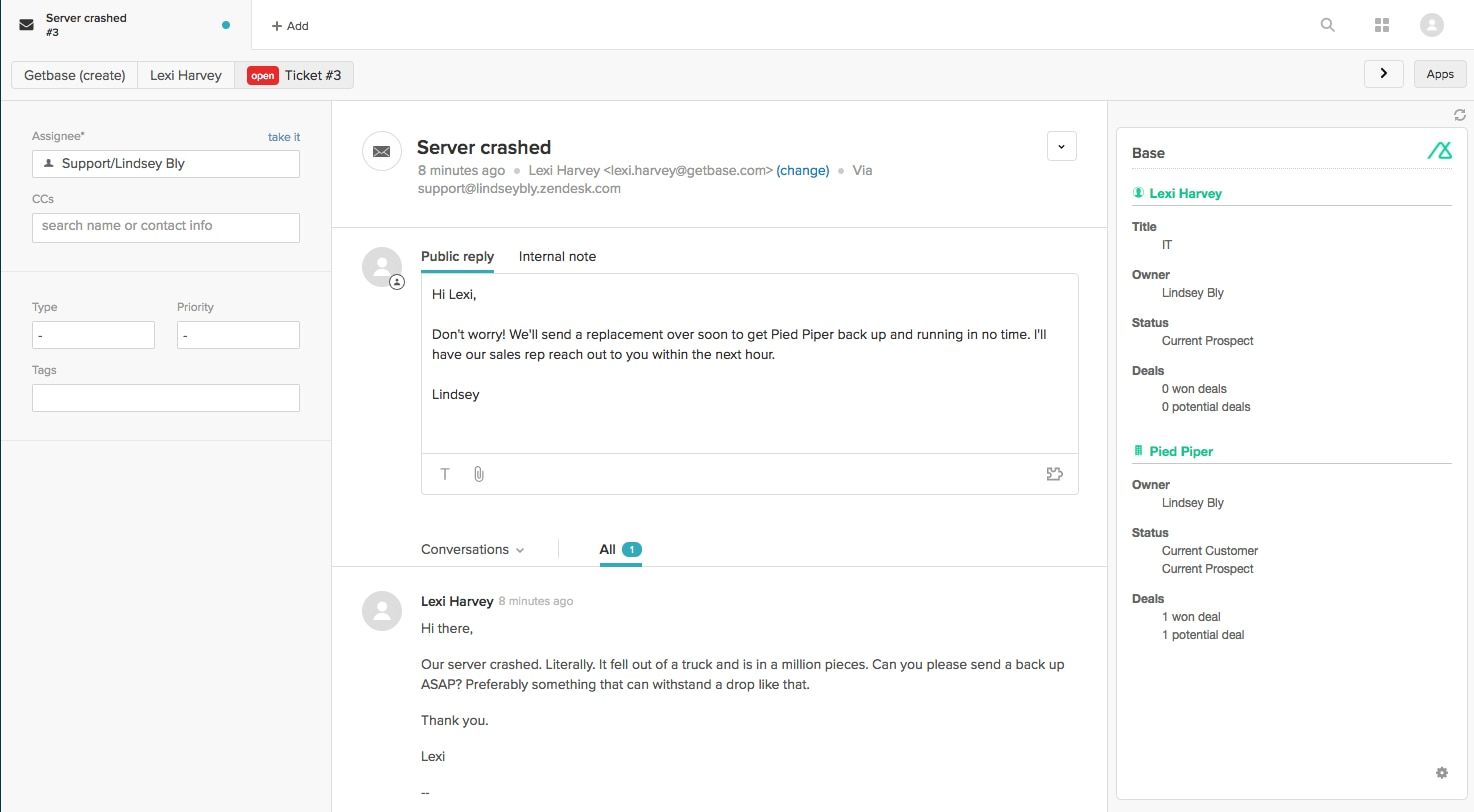

It is easy to end up with way more tools than you need if you do not understand the capability of what you are already using. Instead of using one solution to its full potential, you download yet another app to supplement it.

Before implementing a new tool for your business, lean on the available resources – like the tutorials and training guides your current apps offer. You will get the full rundown on everything you can do and will make the absolute most of that single tool (which is important, especially if you are paying for it).