At Intuit, we know that time is money for small businesses so you need to get things fast (and this is something Aussie small businesses tell us we’re great at by the way!)

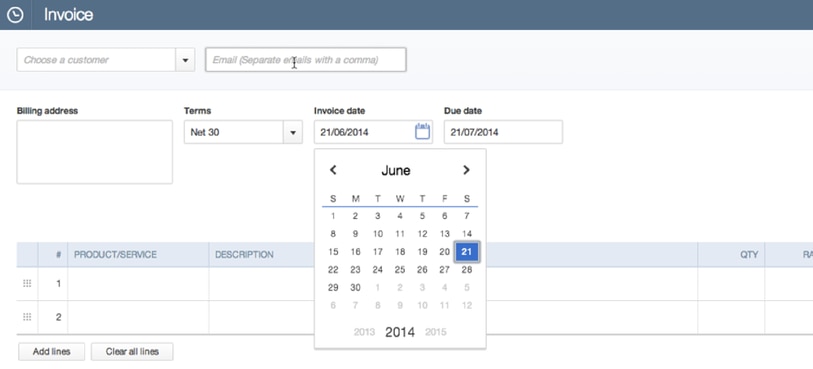

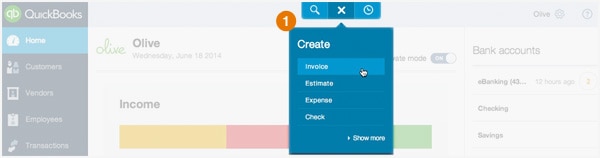

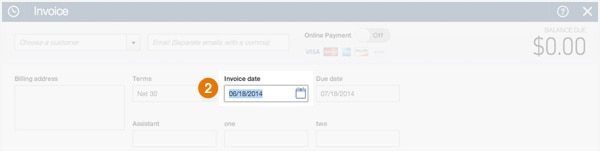

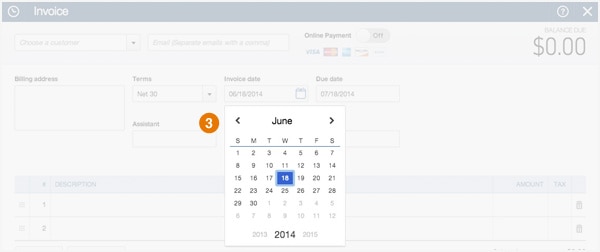

But here’s the small biz paradox: everyone likes sending invoices, but no one likes creating them. To help make the whole thing faster, we’ve made invoicing super-simple plus we’ve created time-saving shortcuts. For example, say you want to enter a new invoice…