If you’re self-employed and have a GST turnover of $75,000 or more a year, or drive for Uber or another taxi or rideshare service, you will need to keep records of income and expenses for both GST and income tax purposes and you will need to lodge a BAS with the ATO.

To lodge and pay your BAS you need to do 3 things:

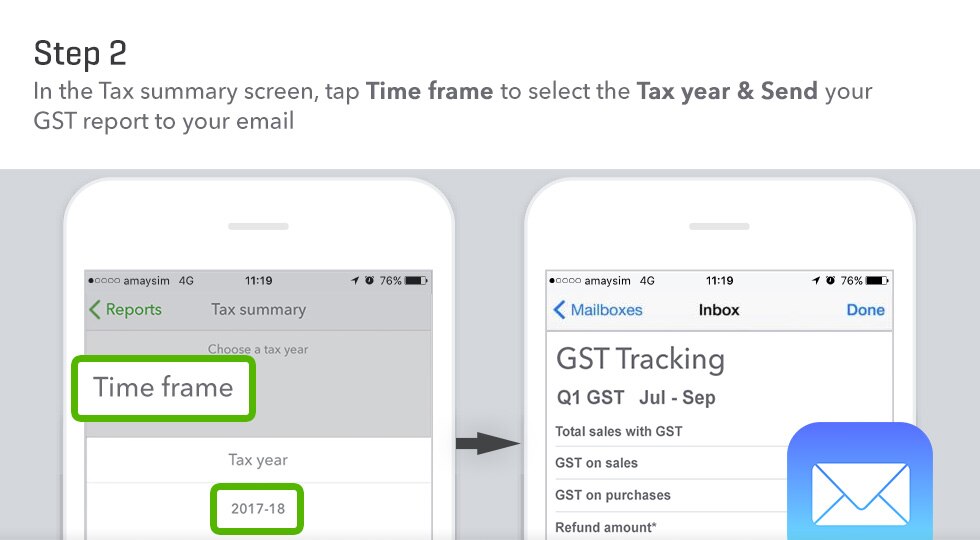

1) Keep track of GST on sales and purchases

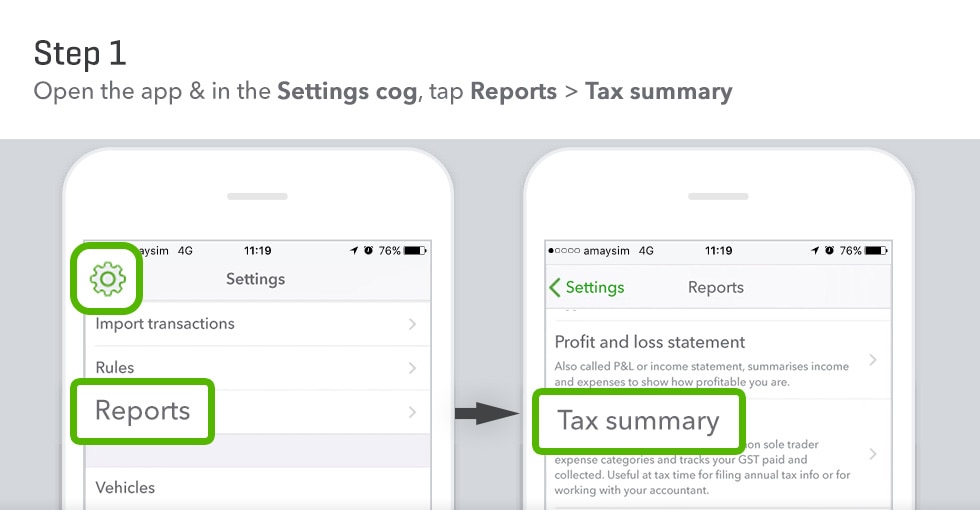

2) Calculate what you owe (or let QuickBooks Self-Employed do it for you)

3) Lodge and pay your BAS with the ATO