End of financial year (EOFY) refers to a period of time at the end of the fiscal year when businesses report on financial results.

In Australia, the financial year ends on 30 June 2024 and you must lodge your taxes with the Australian Taxation Office (ATO) by 31 October 2024. If you use a registered tax agent they can lodge it at a later date but you would need to engage them before 31 October.

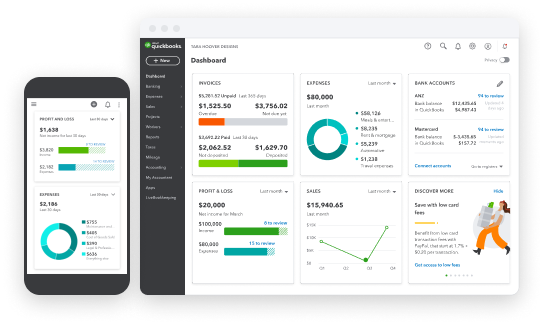

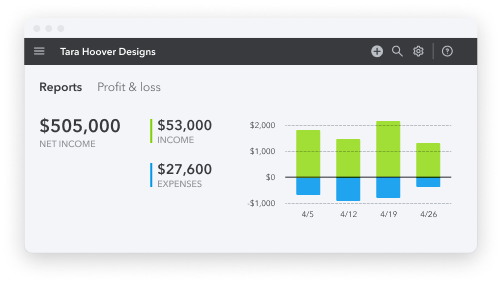

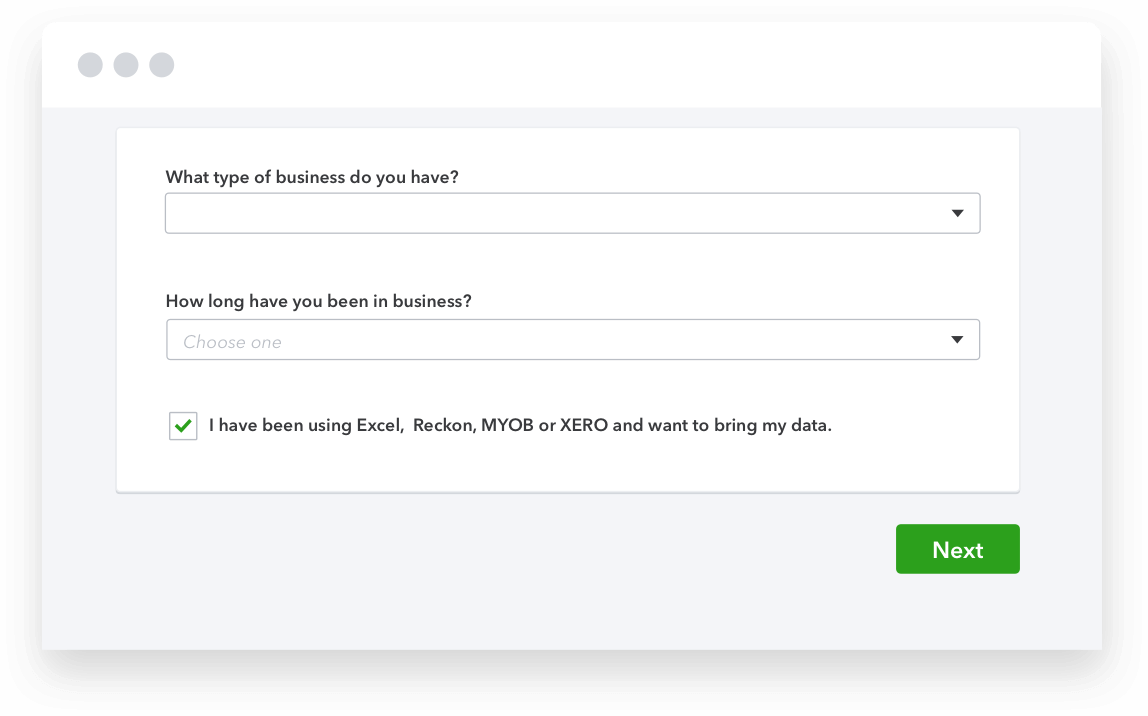

QuickBooks Online can help you prep and keep everything in order and ready for tax time.