Depreciation expenses are posted to recognise an asset’s decline in value. The straight-line method is the most common method used to record depreciation. This article defines straight-line depreciation and explains the depreciation formula. Plus, learn more about ways to calculate the expense, and how depreciation impacts financial statements.

How to use the straight-line depreciation formula

What is straight-line depreciation?

The straight-line depreciation method posts an equal amount of expenses each year of an asset’s useful life. This is the easiest method to calculate. Business owners use it when they cannot predict changes in the amount of depreciation from one year to the next. You can calculate depreciation using a formula.

The straight-line depreciation formula

The straight-line method of depreciation posts the same dollar amount of depreciation each year. The formula first subtracts the cost of the asset from its salvage value. Then the formula divides that number by the useful lifespan of the asset. The formula follows:

(Cost of the asset – salvage value) / useful life of the asset

“Cost of the asset” refers to the amount you paid to purchase the asset. “Salvage value” is the cash you receive when you sell the asset at the end of its useful life.

The asset’s cost subtracted from the salvage value of the asset is the depreciable base. The base is the dollar amount you expense over time. Finally, the depreciable base is divided by the number of years of useful life.

How the straight-line method of depreciation works

Let’s say a business purchases office furniture for $50,000. The furniture has a $10,000 salvage value and a 10-year useful life.

Using the straight-line depreciation method, the business finds the asset’s depreciable base is $40,000. Finishing the formula, the business finds the asset’s annual depreciation amount is $4,000. The company will post $4,000 each year for 10 years. The entire value of the asset ($40,000 depreciable base) will be reclassified into the expense account over time. When you use the straight-line depreciation formula, the expense journal entry will be the same each year.

Recording straight-line depreciation in a journal entry

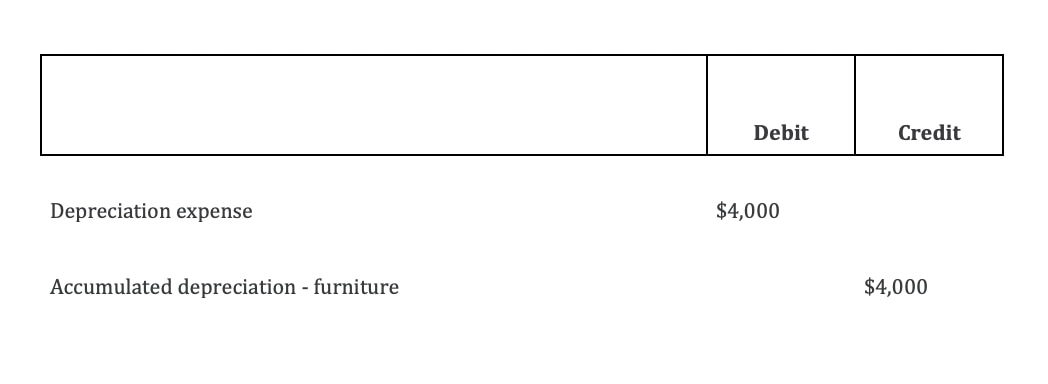

Using the furniture example, we can see the journal entry the business would use to record each year of depreciation.

The expense is posted to the income statement, and the accumulated depreciation is recorded in the balance sheet. Accumulated depreciation is a contra asset account, so the balance is a negative asset account balance. This account accumulates the depreciation posted each year, and each asset has a unique accumulated depreciation account.

Book value (or carrying value) is the asset cost subtracted from the accumulated depreciation. This system allows the financial statement reader to see each asset’s book value at any point. At the end of year one, the business would report the following balances:

The book value of the furniture at the end of year one is $46,000. There are other methods of depreciation, so why should you use the straight-line option?

Advantages of straight-line depreciation

When in doubt, use the straight-line method. The depreciation of an asset depends on how you use the asset to generate revenue. If you expect to use the asset more often in the early years and less in later years, choose an accelerated depreciation rate. The double-declining balance (DDB) method is an accelerated method. If you can’t determine a measurable difference in depreciation from one year to the next, use the straight-line depreciation schedule.

Other depreciation methods

The double-declining balance and the units-of-production method are two other frequently used depreciation methods. Both methods generate a different amount of expense each year.

Double-declining balance method

Let’s say Standard Manufacturing owns a large machine that they purchased for $270,000. The machine has a useful life of four years and is depreciated using the double-declining balance method. The salvage amount is $30,000.

How to calculate the depreciation expense for year one

Using the straight-line depreciation method, we find the annual depreciation rate for an asset with a four-year useful life is 25%. The DDB rate of depreciation is twice the straight-line method: 50% per year.

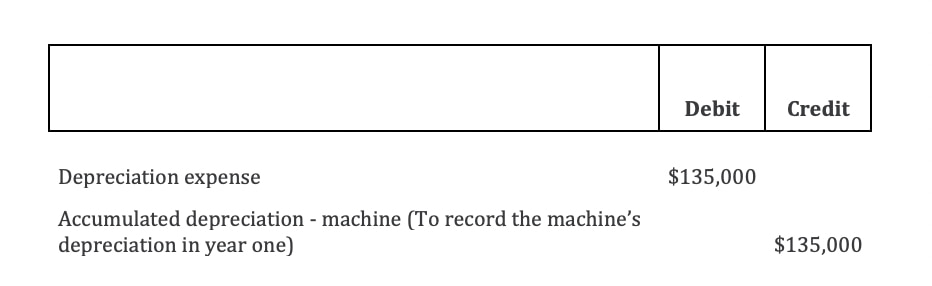

In year one, you multiply the cost (or beginning book value) by 50%. You then find the year-one depreciation by multiplying the $270,000 book value by 50% to get $135,000. The DDB method does not subtract the salvage amount from book value. In year two, the book value changes. The year-one depreciation journal entry follows:

How to calculate the depreciation expense for year two

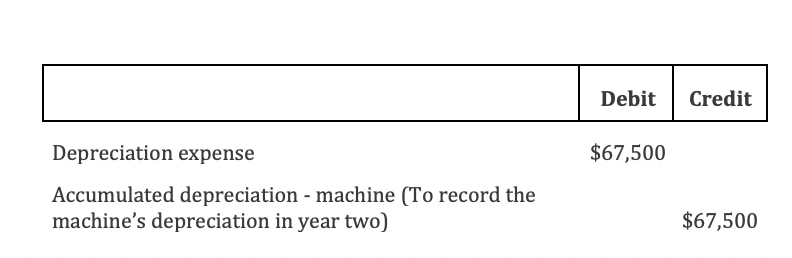

The book value at the start of year two is $270,000 subtracted from $135,000, or $135,000. To calculate the year-two expense, multiply the $135,000 book value by 50% to get $67,500. The year-two depreciation journal entry follows:

Each year, the book value is reduced by the amount of annual depreciation. The DDB expense stops when the book value reaches the salvage value. Remember that the salvage amount was not subtracted when the depreciation process started. When the book value reaches $30,000, depreciation stops because the asset will be sold for the salvage amount.

If the use of an asset will vary greatly from year to year, the units-of-production method may be appropriate.

Units-of-production method

This method calculates annual depreciation based on the percentage of total units produced in a year. Let’s assume that a business buys a machine with a $50,000 purchase price and a $10,000 salvage amount. The business’s use of the machine fluctuates greatly, according to production levels. The business expects the machine to produce 100,000 units over its useful life.

How to calculate the depreciation per unit

The depreciation per unit is the depreciable base divided by the number of units produced over the life of the asset. In this case, the depreciable base is the $50,000 cost minus the $10,000 salvage value, or $40,000. Using the units-of-production method, we divide the $40,000 depreciable base by 100,000 units. So the depreciation rate per unit is $0.40 per unit.

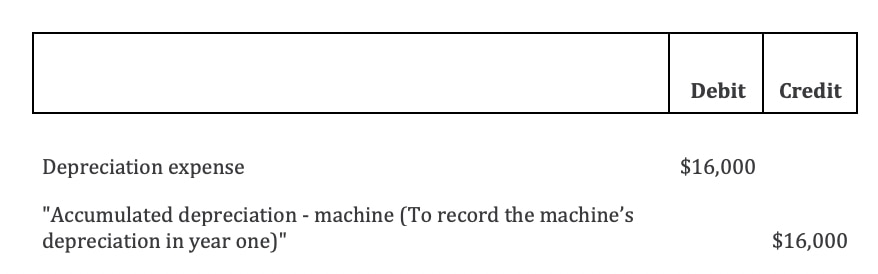

The year-one depreciation is $0.40 per unit multiplied by 40,000 units produced, or $16,000. The year-one journal entry follows:

The total depreciation over the asset’s useful life is $40,000, and the machine produces 100,000 units. The amount of expense posted to the income statement may increase or decrease over time. However, the total depreciation will be $40,000.

How depreciation impacts small business financial statements

Depreciation has a direct impact on the income statement and the balance sheet but not on the cash flow statement.

Changes in the income statement

Depreciation is posted to the income statement. The total dollar amount of the expense is the same, regardless of the method you choose. An asset’s initial cost and useful life are also the same using any method.

Straight-line depreciation posts the same amount of expenses each accounting period (month or year). But depreciation using DDB and the units-of-production method may change each year.

The expenses in the accounting records may be different from the amounts posted on the tax return. Consult a tax accountant to learn about IRS depreciation guidelines.

Changes in balance sheet activity

Accumulated depreciation is recorded in the balance sheet. As explained above, the cost of an asset minus its accumulated depreciation is its book value.

The asset account category includes intangible assets, which are not physical assets. Patents and copyrights are intangible assets. Amortisation expenses are used to post a decline in the value of these assets.

Capital expenditures are the costs incurred to repair assets and purchase assets. Your business should determine how you’ll pay for capital expenditures.

Working with the cash flow statement

Depreciation does not impact cash, so the cash flow statement doesn’t include cash outflows related to depreciation.

Every business needs assets to generate revenue, and most assets require business owners to post depreciation. Use this discussion to understand how to calculate depreciation and the impact it has on your financial statements.

Related Articles

Looking for something else?

Stay up-to-date with the latest small business insights and trends!

Sign up for our quarterly newsletter and receive educational and interesting content straight to your inbox.

Want more? Visit our tools and templates!