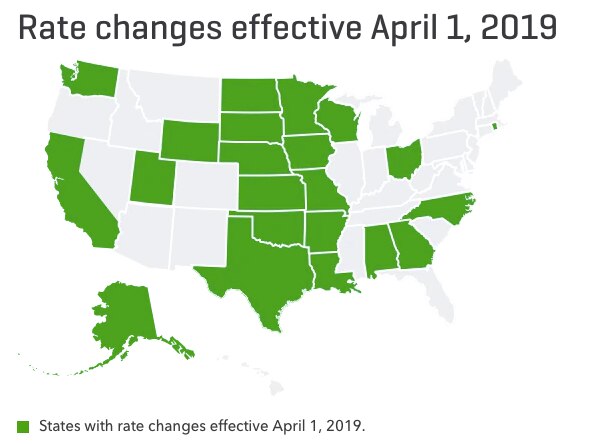

Despite all the jokes, April Fools’ Day marks a new quarter, and with that comes sales tax rate and law changes that may affect your business. These changes might be something as simple as a 0.1% change in a county level sales tax to a .125% rate change that only affects sales of food for home consumption in a county.

The tax calculation functionality that is now built into QuickBooks® Sales Tax has the depth and breadth to take all of the changes and seamlessly and effortlessly calculate the right tax, at the right rate, for every transaction. Users can also file their returns through QuickBooks Online (QBO).

This functionality eliminates the need for other sales tax return and calculation providers, streamlining the process and saving money. Additionally, Intuit® is a Certified Service Provider under Streamlined Sales Tax, and has its rates certified in several other states, which gives QBO customers even more assurance of high-quality and accurate results across all state and local jurisdictions in the United States.