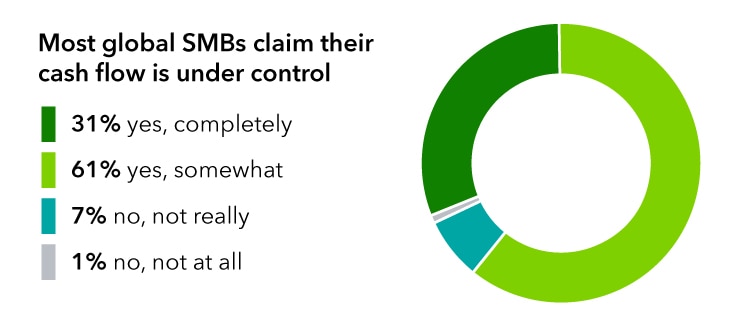

So, while SMBs are concerned about the economy and experienced cash flow issues in the past, they feel confident in their businesses and do not anticipate this potential financial dip to have an impact on their companies.

QuickBooks is working to arm small businesses with tools that take the guesswork out of being a small business owner by being a one-stop shop where all of the accurate information about a business can be found, acting as a single source of truth. Everything they need to know, do, and prepare for cash flow highs and lows can be done through the QuickBooks platform. We are committed to solving cash flow issues for small businesses and the self-employed by delivering services and features that help businesses get money as soon as possible, and keep it in their accounts longer, which includes instant deposit payments, end-to-end payroll services, and loans up to $100,000 based on the data within QuickBooks.

We have also launched a QuickBooks Cash Flow Planner that will enable small businesses to predict their cash flow up to 90 days out. Designed for regular use, the app predicts recurring expenses and income, while giving small businesses the opportunity to modify inputs based on what they know about their business. This unique design combines the power of artificial intelligence with full transparency and data from the QuickBooks platform. Beyond automatically alerting business owners when a cash crunch is coming up, the QuickBooks Cash Flow Planner shows what is causing the crunch, so owners can decide how to navigate their challenges.

Has your cash flow ever stressed you out? Comment below with how you overcame your cash flow struggles using QuickBooks!

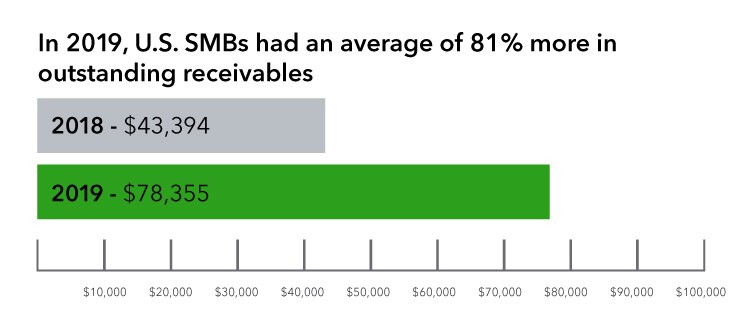

Research Methodology: The Intuit Cash Flow Survey was conducted by Wakefield Research among 3,500 small business owners at companies of 0-100 employees, including 1,000 in the U.S. and 500 in the U.K., Australia, Canada, India, and Brazil, between November 1 and November 18, 2019, using an email invitation and an online survey. When reporting tracking data, quotas were set to ensure samples could be compared to data collected in 2018 in the U.S., U.K., Australia, Canada, and India.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results.