At QuickBooks®, we understand that one of the most important factors in a small business’s success is effectively managing their most valuable resources – the humans that make their business work. We empower them do this through QuickBooks Payroll. QuickBooks Payroll is the number one payroll provider for small businesses, as it leverages the power of the QuickBooks platform to help small businesses turn their dreams into teams.

One of the most important features of QuickBooks Payroll is it ensures small businesses are paying employees accurately and on time. Now, QuickBooks Payroll can also help with employee benefits, like health insurance.

We recently surveyed more than 2,000 small business owners and human resource professionals, and found that 58 percent believe offering health insurance is very important to retaining employees, and 56 percent believe it’s very important to employee morale. What’s more, two-thirds (66 percent) said it’s also very important to offer health insurance to attract employees. Business owners in our survey said they would rather provide their employees with health insurance than other benefits or perks, such as unlimited vacation, free meals or annual bonuses.

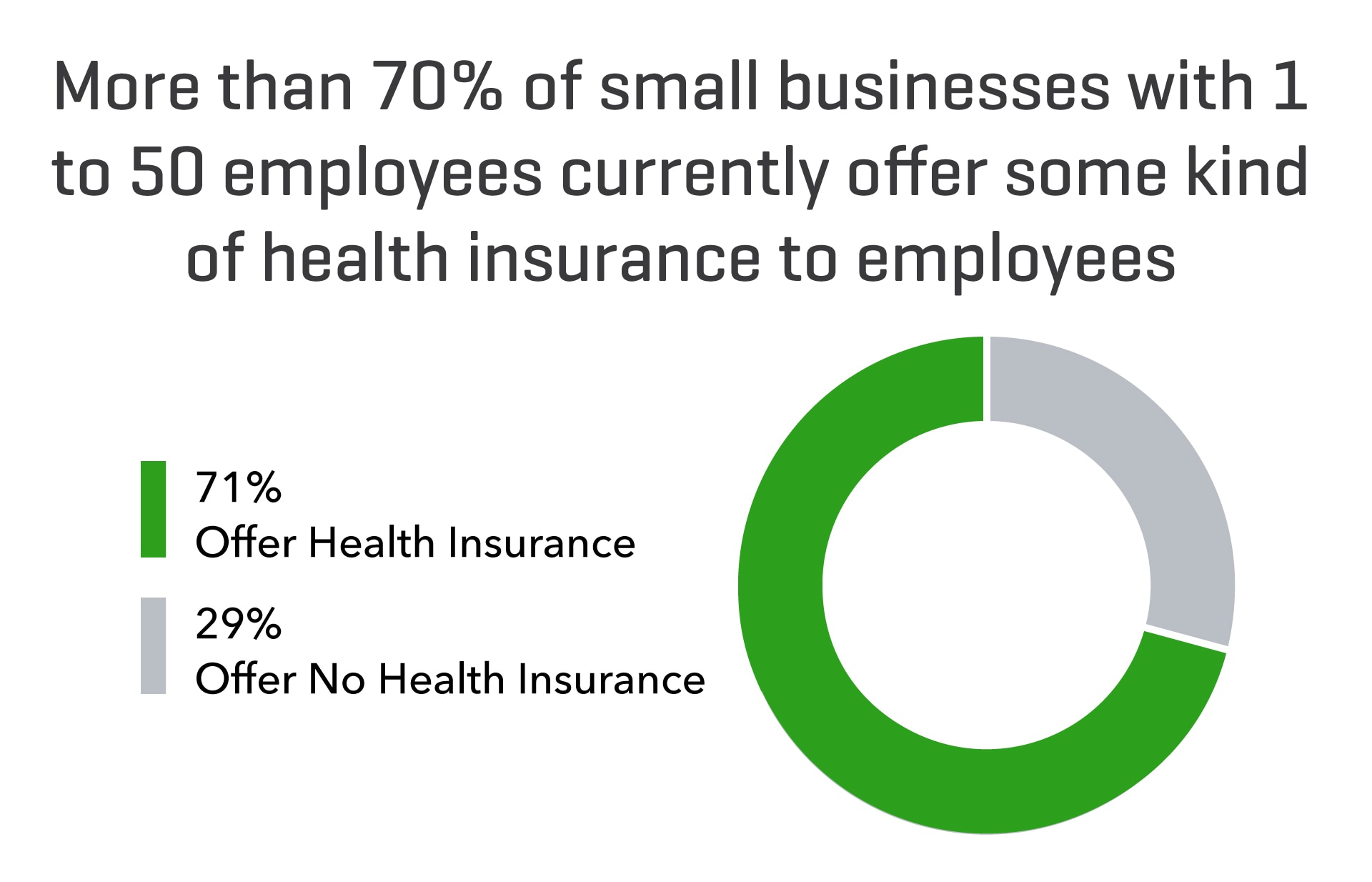

This is likely why the majority (71 percent) of the small businesses we surveyed with 1 to 50 employees already offer some kind of health insurance benefits to their employees.