Making it easy for customers to pay you quickly is one of the best ways to improve your cash flow. For in-store transactions, customers can wave their near-field communication-enabled smart devices in front of NFC-enabled terminals to make fast and easy contactless mobile payments , while apps that enable website or marketplace sales ensure you have the money in hand before you ship products or deliver services. Regardless of whether they pay in-store or over the internet, your customers can shop with confidence, knowing your business doesn’t capture their details but instead issues payment receipts at the point of sale or by email. With that in mind, it makes sense for your small business to consider accepting NFC-enabled payment apps and bank or digital payment services.

Benefits of Online Payment Apps

Benefits of Online Payment Apps

Accepting online payments lets you receive your money immediately, whether you have a brick-and-mortar location or an online sales website. This option eliminates the need to send out invoices and wait days or weeks for a response. Online payments also benefit your accounting department by requiring no follow-ups and creating less paperwork. Additionally, many customers appreciate the option to pay immediately because they don’t have to wait for an invoice or remember to make the payment at a later date. Lightening-fast app payments also decrease time in the checkout line to improve customer satisfaction. Likewise, immediate payment means that those customers and clients have immediate access to in-store merchandise or in-house services and that you can ship online orders out quickly and risk-free.

Potential Disadvantages of Payment Apps

While online payment apps offer many advantages, you should keep a few things in mind to make sure everything goes smoothly. Of these disadvantages, fraud proves the biggest drawback. While financial institutions provide security for app users, fraudsters have been known to create dummy apps and make them available in online app stores. Dummy apps usually ask for lots of personal information, which ends up being used for nefarious purposes. You can still, however, enjoy the benefits of accepting online payments by encouraging your clients and customers to acquire payment apps only from legitimate sources.

For instance, legitimate sources include a link on a bank or payment service’s official website that takes customers to an app. By contrast, online payment app links sent via email or displayed in banner advertisements may not be legitimate. Your customers and clients can steer clear of shady-looking apps by only downloading apps from official sources. If you have a brick-and-mortar business, consider providing business cards with links to legitimate payment apps so your clients can better avoid dummy apps designed to harvest their information. If you have an online-only business, you can create a FAQ that helps customers recognize these fraudulent apps by linking official mobile apps and digital payment services on your company’s website.

QuickBooks Payment App

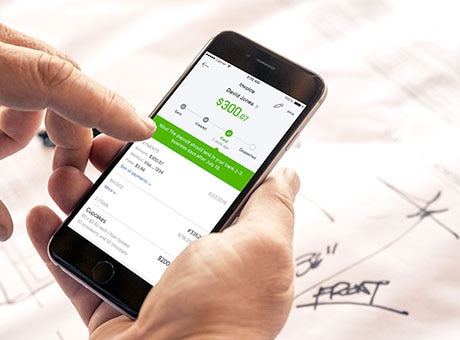

The QuickBooks Online Payments app lets you easily accept credit card payments both in-store and online. For one-time sales, you can send customers a Pay Now link from QuickBooks Online. If your business offers recurring billing, the app securely stores customers’ credit card information and automatically processes payments on the due date. No matter how many transactions you process, you only pay a set, straightforward rate for confusion-free payment processing. Plus, you receive your money quickly so you can reinvest your profits back into your business promptly.

Keeping cash flowing into your business steadily ensures you have enough on hand to purchase new merchandise, hire new workers, and upgrade your equipment as needed. As the world moves faster than ever before, so should your company. QuickBooks Online can help you get paid faster. Start accepting payments today with QuickBooks.