Understanding Owner’s Equity

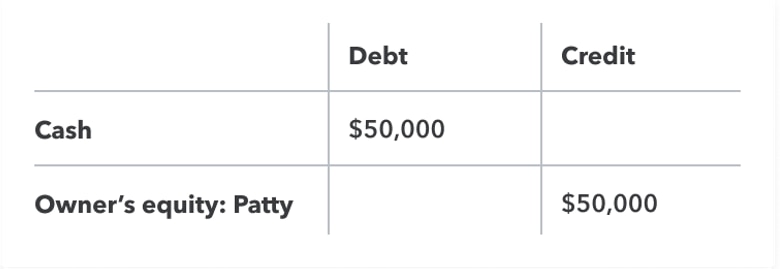

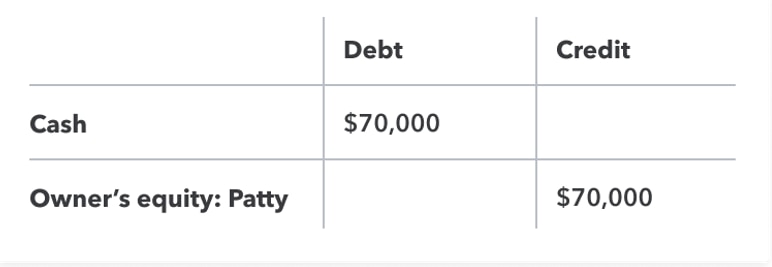

Once you form a business, you’ll contribute cash, equipment, and other assets to the business. When you contribute assets, you are given equity (ownership) in the entity, and you may also take money out of the business each year. To make the salary vs. draw decision, you need to understand the concept of owner’s equity.

What’s equity? To put it simply, it’s an accumulation of money that has not been spent on the business or withdrawn over time for personal use. Equity is based on the balance sheet formula:

Assets — liabilities = equity

Assets are resources used in the business, such as cash, equipment, and inventory. Liabilities, on the other hand, are obligations owed by the business. Accounts payable, representing bills you must pay every month, are liability accounts, as are any long-term debts owed by the business.

If a company sells all of its assets for cash and then uses the cash to pay all liabilities, any cash remaining is the firm’s equity.

Each owner can calculate his or her equity balance, and the owner’s equity balance may have an impact on the salary vs. draw decision.