What Are the Benefits of Employee Time Tracking?

Better Project Management: Using time tracking to get reliable data on your workflow can be a big help. Employee start time, project name, and scope of the project are instantly available to you, so you can keep tabs on projects in real time—all without having to pester your staff for time estimates. Seeing the project status at a glance makes it easier to find inefficiencies and spot tasks that need additional help. You can also see if the project is on track in terms of budget and adjust your workflow accordingly.

Accurate Client Estimates: When you give a client an estimate, you’re essentially guessing how much time you need to complete the project. But with the help of time-tracking systems, you have access to a database of accurate records that show exactly how long it takes your team to do a similar project.

Efficient Workflows: If your employees aren’t using their time efficiently, it can eat away at your budget without increasing profits. Time tracking can help you spot inefficiencies and teach you how to organize time.

Reduced Scope Creep: Scope creep happens when clients ask for one thing, but then add extra requests and deliverables over time, which can prove to be expensive for small businesses. Time tracking can help you eliminate scope creep. Are your employees spending time on requests that weren’t in the original contract? You can show the client the time-tracking records. Then, the client can stop the additional requests or pay out more money to cover the extra work. Either way, your business wins.

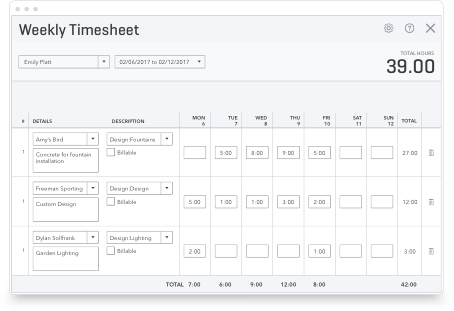

Improve Morale: Automated time accounting software can actually improve your employees’ workflows. They don’t have to worry about timecards or struggle to remember how much time they spent on a project. Instead, they can track time instantly with just a few clicks. Plus, if you choose a cloud-based system, your staff can record time from anywhere, on any device.