As a tax professional it is important to keep on top of all relevant information to ensure you are prepared for a successful tax season. In order to maximize tax savings you will need to be informed on your clients residency status, business expenses (such as home office deductions), tax laws and more. These 10 tax tips for accountants will allow for an easier tax prep and a smoother tax season.

10 Tax Tips for a Smooth Tax Season

1. Determine if Your Clients Are Filing as Residents or Non-residents

Your client’s residency status will affect which income taxes they are subject to pay. To determine residency status, all of the relevant facts must be considered, including residential ties with Canada and the length of time, purpose, intent, and continuity of the stay while living inside and outside Canada.

A person who is considered a resident of Canada must pay Canadian income tax on their worldwide income, so the income generated inside and outside Canadian borders will all be subject to Canadian income tax.

Factors that will determine if your client is a resident of Canada include:

- If they maintain a residence in Canada

- The amount of time spent in Canada

- Where their drivers license was issued

- Where they work

- Where they pay childcare expenses

- How many relatives they have in Canada

- If they have bank accounts in Canada

- Other social and economic ties

Non-residents are only obligated to pay taxes on their Canadian sourced income. A person is considered a non-resident if they:

- Normally, customarily, or routinely live in another country and are not considered a resident of Canada

- Do not have significant residential ties in Canada and any of the following applies:

- you live outside Canada throughout the tax year

- you stay in Canada for less than 183 days in the tax year

A person who is not a resident of Canada for any part of the year, but who visits Canada for a total of 183 days or more in a year, may be deemed to be a resident of Canada, and is still liable for Canadian income tax on their worldwide income for the entire year.

2. Brush Up on Tax-Free Allowances

The basic personal tax-free allowance has been increased by $579 from $13,229 to $13,808 in 2021. This means you can earn up to $13,808 without paying federal tax on your income.

The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a full reduction from federal income tax to all individuals with taxable income below the BPA. It also provides a partial reduction to taxpayers with taxable income above the BPA.

A non-refundable tax credit reduces what you may owe. However if your total non-refundable tax credits are more than what you owe, you will not get a refund for the difference.

Residents and non-residents are entitled to claim the BPA (also known as the tax-free allowance) on their income tax return as a nonrefundable tax credit.

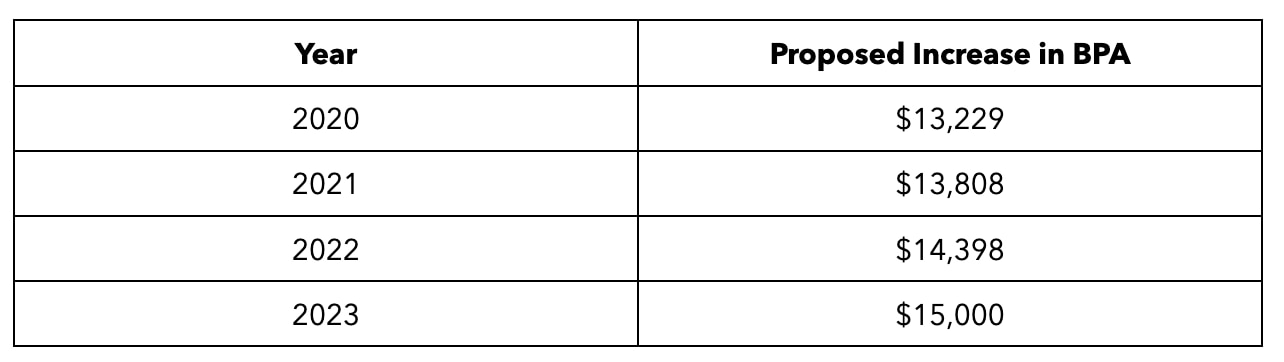

Furthermore, the Canadian government has proposed that the tax-free threshold will continue to increase until at least 2023.

Here’s the breakdown:

In 2021 the maximum BPA has increased from $12,421 to $13,808 for individuals with a net income of below $151,978 or 29% tax bracket.

However, the increase has been gradually reduced for individuals with net income between the 29% and 33% ($216,511) tax brackets. If the client's net income is above $216,511, the change does not apply to them. Their BPA will be $12,421.

Your client’s TD1 forms will be used to calculate the correct amount of tax that should be deducted from their employment income and will determine if they are eligible for tax credits.

3. Keep the TD1 Form In Mind If Your Client Changed Jobs This Year

When your client’s employment situation changes (such as changing jobs) they must fill out a new TD1 form. If there has been a significant change to their income while they are at the same job, they need to update the information on their existing form.

An employee does not need to fill out a new TD1 form every year unless there was a change to their tax credit amount. If an employee has to change their tax credit amounts, they must complete and give their employer a new form within seven days of said change.

Additionally, people who need to fill out a TD1 form include are those who are:

- Interested in increasing how much tax is being deducted at the source

- Beginning to receive pension payouts

- Looking to claim a deduction for living in a prescribed zone

4. Understand the Latest On Home Office Deductions and COVID-Related Filing Protocol

If a business owner works from home they can deduct expenses related to the physical workspace inside the home, as long as they meet one of the following conditions:

- The home is their principal place of business

- They use the space only to earn business income, and use it on a regular and ongoing basis to meet their clients, customers, or patients

Business owners can deduct part of their maintenance costs such as heating, home insurance, electricity, and cleaning materials. They can also deduct part of their property taxes, mortgage interest, and capital cost allowance (CCA). To calculate the part you can deduct, use a reasonable basis, such as the area of the workspace divided by the total area of the home.

If part of the home is used for both business and personal living, calculate how many hours in the day the rooms are used for business, and then divide that amount by 24 hours. Multiply the result by the business part of the total home expenses. This will give you the household cost you can deduct. If the business is run for only part of the week or year, reduce your claim accordingly.

For more information, go to Income Tax Folio S4-F2-C2, Business Use of Home Expenses.

Employees have different options when it comes to tax deductions on their home workspace. In response to the COVID-19 pandemic the federal government implemented two methods to assist employees with their work from home expenses, these include the detailed method and the temporary flat rate method.

5. Remain Up to Date on Tax Legislation

In 2021, a multitude of amendments were made to the Tax Act and its regulations to extend and vary existing federal relief measures such as the Canada Emergency Wage Subsidy (“CEWS”) and Canada Emergency Rent Subsidy (“CERS”), and to introduce new measures such as the Canada Recovery Hiring Program (“CRHP”), the Tourism and Hospitality Recovery Program, the Hardest-Hit Business Recovery Program and the Local Lockdown Program. At the time of writing, these newer measures are legislated to be available until May 7, 2022 and may be further extended by regulation until July 2, 2022.

The 2021 Fiscal Update provides the Government’s assessment of the fiscal health of the country by outlining the economic measures previously adopted and proposed by the Government to address the immediate needs of individuals and businesses relating to COVID-19 pandemic and to support Canada’s economic recovery. This has reaffirmed the Government’s intention to implement certain tax measures announced in Budget 2021, including the DST and tax incentives to promote clean energy investment. The 2021 Fiscal Update did not announce any changes to the corporate or personal federal income tax rates, but did announce the following new tax measures:

- A 25% refundable tax credit for small businesses that incur qualifying expenditures relating to air quality improvements at qualifying locations between September 1, 2021 and December 31, 2022; and

- A refundable tax credit to return fuel charge proceeds paid by eligible farming businesses under the federal carbon tax, starting in the 2021-2022 federal carbon tax year.

6. Collect All Necessary Business Documents From Clients That Have Their Own Business

Here are the business records you will need to prepare your client’s taxes.

Deposit slips

Bank statements

Business credit card statements

- Income records:

- Sales invoices

- Receipts

- Bank deposit slips

- Fee statements

- Contracts

- Loan Agreements and year-end balances statements

- Detailed year-end inventory listing

- Receipts on capital purchases or sales in 2021

If they have employees and/or subcontractors:

- T4SUM: Summary of Remuneration Paid

- Worker’s compensation payments or benefits

- Payroll, source deductions and taxable benefits for employees

- If you make payments to subcontractors (construction only)

- T5018: Statement of Contract Payments

7. Know Their Estimated Tax Payments

Estimated tax is a quarterly payment of taxes for the year based on the filer’s reported income for the period. It is the amount you’re responsible for paying on earnings that aren’t subject to withholding. This includes income from dividends, awards, rent, self-employment and alimony. Anyone who’s receiving money from a pension or salary that’s subject to withholding may also owe estimated tax if they haven’t paid enough income taxes.

Most of those required to pay taxes quarterly are small business owners, freelancers, and independent contractors. They do not have taxes automatically withheld from their paycheques as regular employees do.

Estimated taxes may be made for any type of taxable income that is not subject to withholding. This includes earned income, dividend income, rental income, interest income, and capital gains.

It's important to pay quarterly estimated tax payments because if you don’t pay or under pay you will owe penalties and interest on late payments or underpayment on taxes.

8. Assess Your Staff Requirements

In order to be running at peak performance levels you need the right staff. Evaluate your business flow to bring forth key insights that could give you an indicator on how to improve client experience. For example if you know your practice will have a busier period, ensure to hire more staff during that period.

Be sure to always check in with clients so that you know they are receiving the service they expect. This will make them feel cared for and create a better client/accountant relationship.

Although an imperfect method, observing competitors can offer important insight into a company’s estimated staffing needs. This is called benchmarking. As the Harvard Business Review notes, there are even a few wide studies that outline ideal staffing needs for companies based on size and type, which is invaluable data for companies to consider and utilize. A business that has a similar size and location and offers a similar product will likely have similar staffing needs to another business.

9. Charge for Late Changes Made to Completed Returns

When it comes to filing tax returns, your client may need to make last minute changes to their already completed returns. In this case you are entitled to charge them for the amendments, as this does amount to extra work for you.

You can request a change to the tax return by amending the amount entered on specific line(s) of the return. Do not file another return for that year, unless the return you want to amend was a 152(7) factual assessment.

Wait until you receive your notice of assessment before asking for changes to your return.

Generally you can only request a change to a return for a tax year ending in any of the 10 previous calendar years. For example, a request made in 2022 must relate to the 2012 or a later tax year to be considered.

10. Limit Email Exchanges With Clients During Busy Season

Sometimes responding to every email just isn’t feasible. Tax season is when you will see the most volume of client queries and you will need a strategy to tackle them all while still maintaining a level of customer satisfaction.

Ranking the questions from most urgent to least urgent, will give you a better idea on who needs to be responded to first. This way you are less likely to fall behind on certain deadlines amidst the chaos. It’s also a good idea to ask your clients to always use the subject line in the email to give you a quick idea of what the email entails.

The tax process requires meticulous attention to detail. In order to keep your workload more manageable this tax filing season, use QuickBooks Accountant for filing taxes, client returns, financial statements, creating a tax bill and more.