Build on what you’ve established in QuickBooks.

Get business funding when it matters.

Applying won’t affect your personal credit score.

No origination fees, no prepayment penalties,

no hidden charges.

no hidden charges.

Work with someone you trust

Get credit for what is in your books

We understand your business and see your potential.

Apply right in QuickBooks

Save time—it only takes minutes to apply.

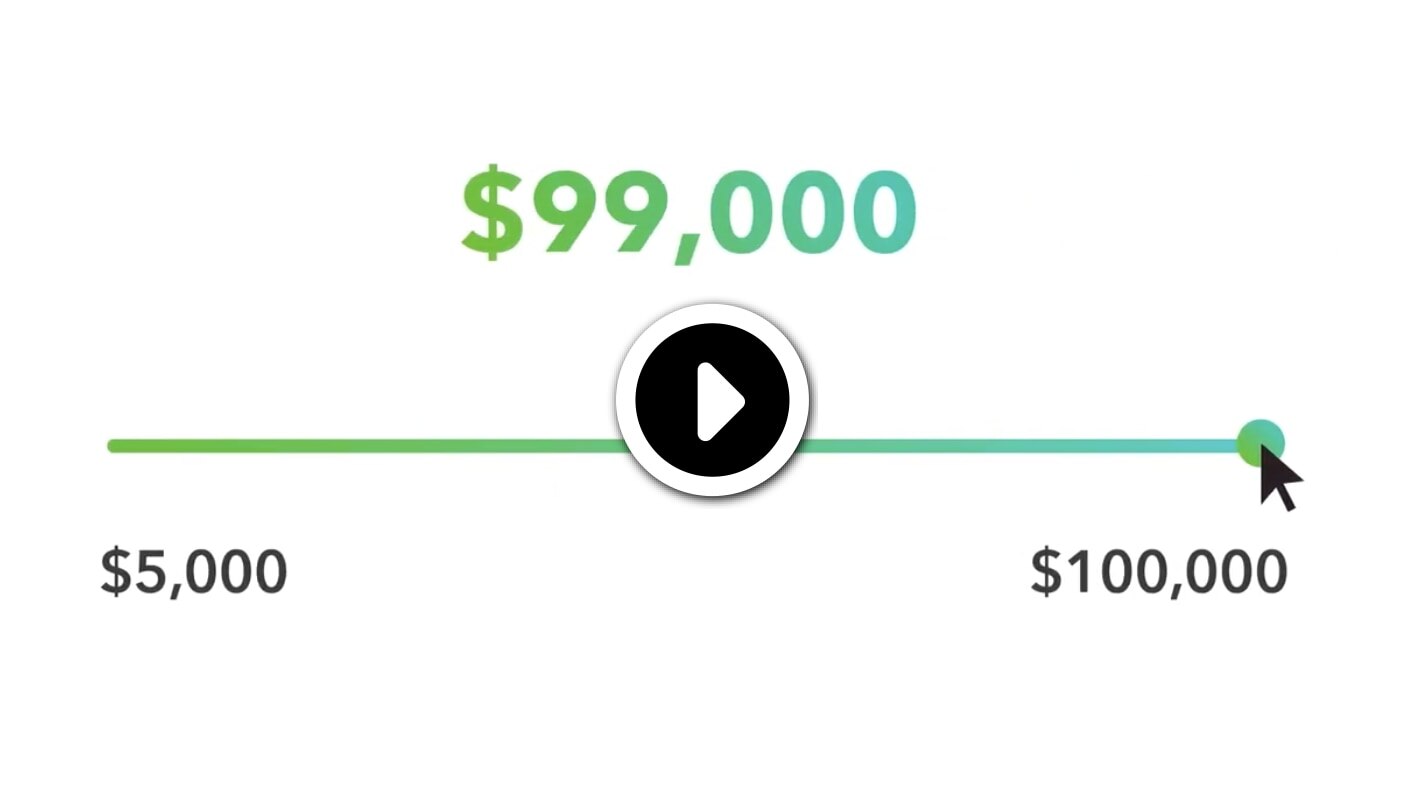

How does it work?

Watch this one minute explainer video to learn more.

Product terms and features in this video (e.g., loan amounts, terms, pricing, eligibility requirements, etc.) are subject to change.

98% of customers say QuickBooks

Capital showed them the total cost

of funding up front with no surprises.

Capital showed them the total cost

of funding up front with no surprises.

(QuickBooks Capital 2018 Customer Survey)

96% of customers say they

trust QuickBooks with their

financial information.

trust QuickBooks with their

financial information.

(QuickBooks Capital 2018 Customer Survey)

Caitlyn and Jim bought business supplies with funding from QuickBooks Capital

Caitlyn and Jim provide canvas tents for events. When a client requested a new style of tent for a big event, they used funding from QuickBooks Capital to buy the materials they needed to meet their deadline.

Since we use QuickBooks, they could see our history and growth. We didn’t have to prove ourselves—they were on our side.

99% of customers say it was easy

to apply because we already had their

business information

to apply because we already had their

business information

(QuickBooks Capital 2018 Customer Survey)

Important offers, pricing details, and disclaimers

QuickBooks Term Loans (“Term Loan”) may be issued by QuickBooks Capital or WebBank.

All screen images are simulated and are for illustration purposes only.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Capital is licensed as Intuit Financing Inc. (NMLS #1136148), a subsidiary of Intuit Inc. Our service is limited to commercial or business loans only. In CA, loans are made or arranged under CFL License #6054856. Additional lending licenses held by Intuit Financing Inc. include: AK #10000990, DC #ML1136148, FL #CF9901279, MD#1136148, MN #MN-RL-1136148, ND #MB102690, NM #1899, NV #IL11125, NV #IL11126, NV #IL11127, NY #OSL104837, RI Licensed Lender #20183583LL; and small loan lender #20183584SL, SD #1136148.MYL, TN #166418, UT, VT #7194 and VT #7195.