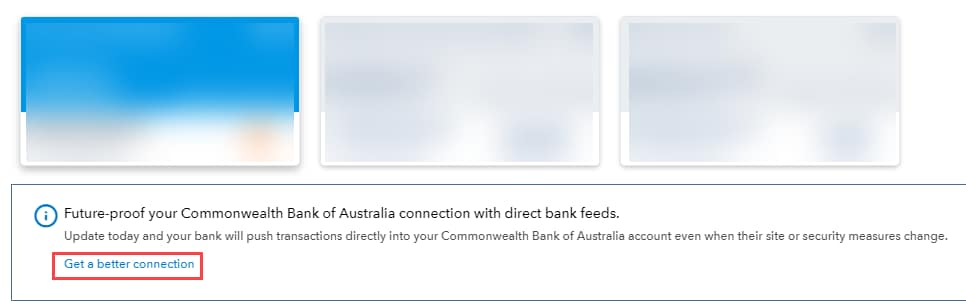

Direct bank connections (or direct feeds) provides a secure and reliable connection between your bank account and QuickBooks. By establishing a connection directly with the bank, QuickBooks can receive transactions without requiring you to enter your bank sign-in information into QuickBooks.

Frequently asked questions

| Have any other questions for our team? If any of your questions were left unanswered, we'd love to hear them! Pop over to our QuickBooks Community's discussion on bank connections where you can ask your questions, have them answered by qualified QuickBooks Online experts, and hopefully help others with the same questions out in the process. |