Learn how to print 1099 and, if available, 1096 forms in QuickBooks Online, QuickBooks Contractor Payments, or QuickBooks Desktop.

Important: If you are filing electronically, Form 1096 isn't required by the IRS. For more info Form 1096 and About Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

To learn how to create and e-file your 1099s, choose your product:

Print your 1099s or 1096

The steps to print 1099s depend on whether you e-filed or not. Choose the scenario that fits your situation.

If you’ve already e-filed your 1099s:

QuickBooks Online

- Go to Taxes then select 1099 filings.

- Select View 1099 to view a PDF copy.

If you don’t see the archived or previously filed 1099, contact us to get a copy.

QuickBooks Online doesn't provide Form 1096. To get the same info, select View Summary to see a summary of your e-filed 1099s.

QuickBooks Contractor Payments

- Go to 1099 filings.

- Select View 1099 to view a PDF copy.

If you don’t see the archived or previously filed 1099, contact us to get a copy.

QuickBooks Contractor Payments doesn't provide Form 1096. To get the same info, select View Summary to see a summary of your e-filed 1099s.

If you didn’t e-file your 1099s:

If you don’t e-file with Intuit, you'll need to file yourself. You must file 1099s with the IRS and in some cases your state. You may also be required to file Form 1096. You can e-file 1099s directly with the IRS using the Information Returns Intake System (IRIS). To learn more see E-file Forms 1099 with IRIS.

For more info about IRS and state requirements, consult your accountant, and see:

Step 1: Purchase 1099 paper

Purchase your 1099 Kit by mid-January so you can print. Keep in mind the IRS filing and contractor delivery deadlines.

Step 2: Print your 1099s or 1096

Choose your product below to see the steps to print your 1099s.

QuickBooks Online and QuickBooks Contractor Payments

- Follow the steps for your product to get started.

- QuickBooks Online and Contractor payments with QuickBooks Online: Go to Payroll, and select Contractors (Take me there)

- QuickBooks Contractor Payments only: Go to 1099 filings.

- Select Prepare 1099s to create your 1099s.

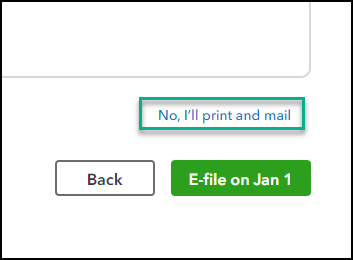

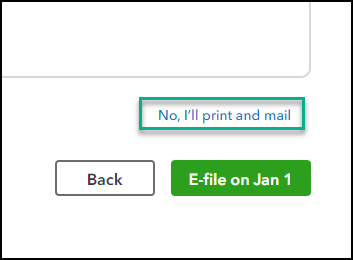

- When complete, choose the Print and mail instead option.

- Follow the on-screen steps to check your alignment and print your forms.

Need a 1096?

QuickBooks Online and QuickBooks Contractor Payments don't provide Form 1096. If you are filing electronically, Form 1096 isn't required by the IRS. For more info Form 1096 and About Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

To get the same info, you can view a summary of your e-filed 1099s from the 1099s filings tab.

QuickBooks Online

- Go to Taxes then select 1099 filings.

- Select View summary.

QuickBooks Contractor Payments

- Go to 1099 filings.

- Select View summary.

Have problems printing?

Sometimes your web browser can cause your printer not to print your 1099 forms correctly. Intuit recommends using Google Chrome or Mozilla Firefox. If printing still doesn't work on these recommended browsers, try these steps.

Chrome:

- Go to Chrome and select the three vertical dots in the upper-right corner. Then select Settings.

- Select Privacy and security then Site settings.

- Select Additional content settings then PDF documents.

- Toggle Download PDF files instead of automatically opening them in Chrome.

- Try to print your 1099s again.

If it still doesn't align, on the print window, select the dropdown for More Settings to verify Fit to printable area or Fit to paper is not selected in the Scale dropdown.

For more info about changing your print alignment from your browser, see Print from Chrome.

Firefox:

- Go to Firefox and select menu ≡, then Options.

- Select General.

- In the Applications section locate Portable Document Format (PDF).

- In the Action column select the dropdown and select your PDF viewer.

- Try to print your 1099s again.

When downloading as a PDF, if Adobe is not the application that opens the document:

- Right click the PDF.

- Select Open with and choose Adobe from the dropdown list.

- Try to print your 1099s again.

For more info about changing your print alignment from your browser,, see Fix printing problems in Firefox.

See also:

QuickBooks Desktop

- Update your QuickBooks Desktop file to the latest release. Be sure to select the Reset Update checkbox.

IMPORTANT: You must be on the latest release for your 1099s to print correctly. - Go to Vendors, then select 1099 Forms, then Print/E-file 1099 Forms. Create your 1099s.

- In the Choose a filing method window, select Print 1099-NEC or Print 1099-MISC.

- Specify the date range for the forms, then choose OK.

- Select all vendors you wish to print 1099s for.

- Select Print 1099. Select Print 1096s instead, if printing Form 1096.

- Double-check your printer settings, then select Print.

QuickBooks Desktop for Mac

- Update your QuickBooks Desktop for Mac to the latest release.

IMPORTANT: You must be on the latest release for your 1099s to print correctly. - Go to Vendors, then select 1099 Forms, then Print or E-file 1099/1096. Create your 1099s.

- In the Choose a filing method window, select Print 1099-NECs or Print 1099-MISCs.

- Specify the date range for the forms, then select all vendors you wish to print 1099s.

- Select Print 1099. Select Print 1096s instead, if printing Form 1096.

- Double-check your printer settings, then select Print.