Manage sales tax payments in QuickBooks Online

by Intuit• Updated 4 weeks ago

Learn how to record, adjust and delete sales tax payments in the tax center.

The tax center has everything you need to handle tax in QuickBooks. You can run reports for your sales tax liabilities, record or edit sales tax payments, and see your payment for different time periods.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

Here's how to manage tax payments and other tasks in the tax center.

| Note: | If you don't see the features mentioned below, you may be using the Auto tax feature. Learn more about setting up and using Automated tax. |

Review sales tax reports

Get a sales tax liability report

- Go to Taxes, then Sales tax (Take me there).

- Under the Related Tasks list, select View sales tax liability report.

The report shows each sales tax agency, the taxable amount of sales, and payments.

See all of your tax payments

- Go to Taxes, then Sales tax (Take me there).

- The list of recorded payments is displayed in Recent Sales Tax Payments section.

Manage sales tax payments

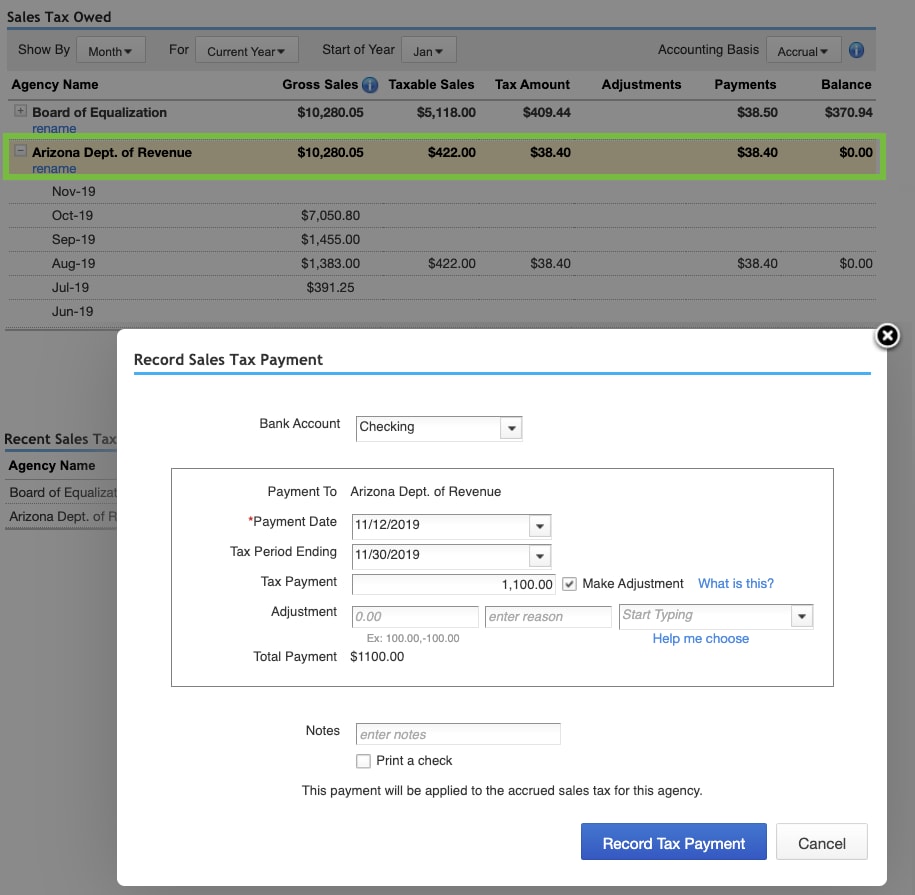

Record a sales tax payment

- Go to Taxes, then Sales tax (Take me there).

- From the Sales Tax Owed list, select the tax agency you're recording the payment for, then select Record Tax Payment.

- From the Bank Account dropdown, select the account you're making the payment from.

- Select the Payment Date.

- Enter the tax payment amount in the Tax Payment field.

- When you're ready, select Record Tax Payment. If you need to print a check for the payment, check the Print a Check checkbox and then select Record Payment and Print Check.

Adjust a sales tax payment

If you need to make an adjustment, select Make Adjustment when you record a sales tax payment. Use this when you need to decrease or increase the amount of sales tax payment for things like credits, discounts, fines, interest, penalties, and corrections for rounding errors.

Enter the adjustment amount and reason for the adjustment. You can enter a positive or negative amount.

Then select an account to track the adjustment. Don't select the sales tax Payable account. Instead, use the following:

- Credit or applying a discount: Select an income account, such as Other Income.

- Fine, penalty, or interest due: Select an expense account.

- Rounding error: Select an income account for negative errors, or an expense account for positive ones.

| Note: | Sales tax can get complicated. If you have questions, reach out to your accountant or tax agency. |

Delete a sales tax payment

- Go to Taxes, then Sales tax (Take me there).

- From the Recent Sales Tax Payments list, select the payment you want to delete, then select Delete Payment.

- Select Yes to confirm.

Note: After you delete a payment, the page doesn't refresh automatically.

Leave and come back to the Taxes menu. The payment shouldn't appear anymore.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Set up and use automated sales tax in QuickBooks Onlineby QuickBooks•1913•Updated 3 weeks ago

- Set up where you collect sales tax in QuickBooks Onlineby QuickBooks•733•Updated 3 weeks ago

- Set up your sales tax in QuickBooks Onlineby QuickBooks•825•Updated 3 weeks ago

- Learn how QuickBooks Online calculates sales taxby QuickBooks•2959•Updated 4 weeks ago

- Enter and manage expenses in QuickBooks Onlineby QuickBooks•6205•Updated May 17, 2024