Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI submitted an invoice for $40K, I received $21K and expect to receive the rest in 30 days. How do I enter the receipt fo the $21K now? I only see Mark as Paid as an option.

Thank you,

It's great to see you here, @emco.

I'd like to take this opportunity to share some resources on how QuickBooks Self-Employed handles partial invoice payments.

QuickBooks Self-Employed only offers a simplified invoicing feature. Currently, the ability to apply partial invoice payments directly is not yet available since it doesn't have the Balance forward feature. What you can do is to duplicate the said invoice.

Here's how:

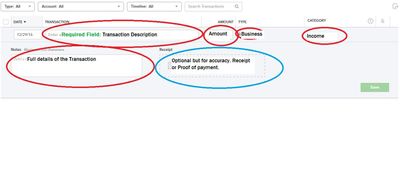

Just a heads-up though, marking an invoice as paid does not automatically record the payments in your Transactions page. You have 2 ways how to record the partial payments.

That should do it! This should get you on the right track recording partial invoice payments and marking it as paid.

Keep us posted here in the Community, if you have other questions about the invoicing feature in QuickBooks Self-Employed. I'm always here to help.

how do I enter a discounted payment in QuickBooks?

How do I enter discounted payment in QuickBooks?

Hello, QUICK24.

In QuickBooks Self-Employed, you can add another line on the invoice to embody the discount. Just make sure to enter a negative amount on the discount line item.

However, if you’re referring to QuickBooks Online, you can refer to this article for the detailed steps: https://quickbooks.intuit.com/community/Help-Articles/Discount-as-line-item-on-invoices-and-sales-re....

You’re always welcome to visit us here again if you have other questions.

I figured out a simplier way just do step 6 on the original invoice to reflect the partial payment and in the description of that line item say" payment"

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.