Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWhen I view our A/R Aging Detail report, the bottom is cluttered with a few pairs of offsetting entries. For example, the oldest pairing is a credit showing -$283.10 and an invoice (for the same customer) showing $283.10. If I open the Invoice or Credit Memo, both show a remaining balance of zero, and if I open the transaction history for both, I can see the entry where the credit was applied to the invoice. If I go to "Receive Payments" for that customer, the invoice does NOT show up there. In every other way, it seems like the credit and invoice should both be closed, but for some reason they both show up on "A/R Aging Detail." How do I get them (and other pairings like them) off that report?

In a similar vein, we have some old journal entries that also appear on the "A/R Aging Detail" report. The oldest example is a General Journal entry for $5,503.51, followed by an offsetting General Journal entry (for the same vendor) for -$5,503.51. How can I get these to apply to each other so that they no longer appear on the "A/R Aging Detail" report?

All of these old transactions were done before I took over the books. I cannot edit any of the transactions either, as they are several years old and have already been accounted for on prior years' taxes.

Thanks for any help or solutions you can offer!

Hello, @Anonymous.

Let me help figure out why your A/R Aging Detail report is still showing some offsetting entries.

Generally, these entries should no longer show on the A/R Aging after receiving the payment.

If you run the report prior to the date it was linked, then it will still show on the A/R Aging since these transactions were still open before receiving the payment.

This will be same as the journal entry created, after receiving the payment to get them to apply to each other, you'll need to run an aging report on the date it was linked to clear these entries on your aging report.

Let me know if you have additional questions about your A/R Aging report. I'll be here to help however I can.

Hi Lily,

Thanks for your response.

I am running the A/R Aging Report on today's date, long after all four transactions mentioned. What I see is (fake transaction numbers are used for clarity):

Credit Memo 111... 10/28/2013... Customer A... -283.10

Invoice 222... 01/22/2014... Customer A... 283.10

General Journal 333... 01/31/2015... Customer B... 5,503.51

General Journal 444... 02/01/2015... Customer B... -5,503.51

Once I realized that the General Journals were applied to a customer and NOT a vendor (the name exists in our system in both forms), I WAS able to apply one General Journal to the other on the "Customer Payment" screen and get them to cancel out. One down, one to go!

Credit Memo 111 has already been applied to Invoice 222. If I pull up the "Receive Payments" window for Customer A, Invoice 222 does not appear in the list of open invoices and Credit 111 does not appear in the "Discounts and Credits" window. If I open the transaction for Credit 111 or Invoice 222, they both show zero balance remaining. The A/R Detail Report (even run long after payments were applied) is the only place that they still appear as somewhat "open".

One weird thing is that if I pull up Credit Memo 111, the original amount of the credit was $257.99, which is LOWER than the $283.10 that appears where it shows up on the current A/R Aging Report. If I pull up the "Transaction History" for Credit Memo 111, I see it applied to a large number of different invoices:

| Transaction | Amount | Credit Balance |

| Invoice 150 | -34.99 | 223.00 |

| Invoice 151 | -8.05 | 214.95 |

| Invoice 152 | -8.76 | 206.19 |

| Invoice 153 | -14.90 | 191.29 |

| Invoice 222 ************** | -283.10 | -91.81 |

| Invoice 154 | -5.76 | -97.57 |

| Invoice 155 | -5.76 | -103.33 |

| Invoice 156 | -90.41 | -193.74 |

| Invoice 157 | -78.77 | -272.51 |

| Invoice 158 | -10.59 | -283.10 |

So the credit appears to have been applied in some crazy where the balance of the credit was allowed to go negative? But when I open up the Credit Memo itself, it DOESN'T show a -$283.10 balance--it shows a $0.00 balance!

Does this make any sense to you? Thanks again.

I appreciate you providing more detailed information, Ocean Equipment.

Allow me to step in for a moment and help you resolve the data issue you're getting in QuickBooks.

Ideally, once the credit memo and invoice are already closed (zero balance), it'll no longer show on the A/R Aging Detail report. Since this isn't the case on your company file, it would be a good idea to run the Verify/Rebuild tool.

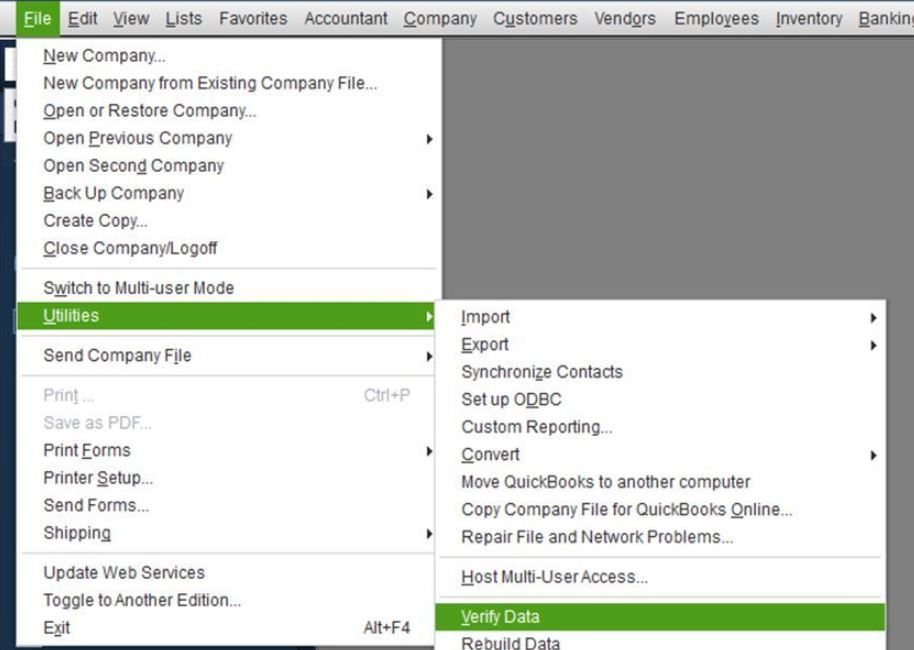

This tool allows QuickBooks to self-identify data integrity issues that can cause unusual behaviors and resolve them. Follow the steps below on how to verify data:

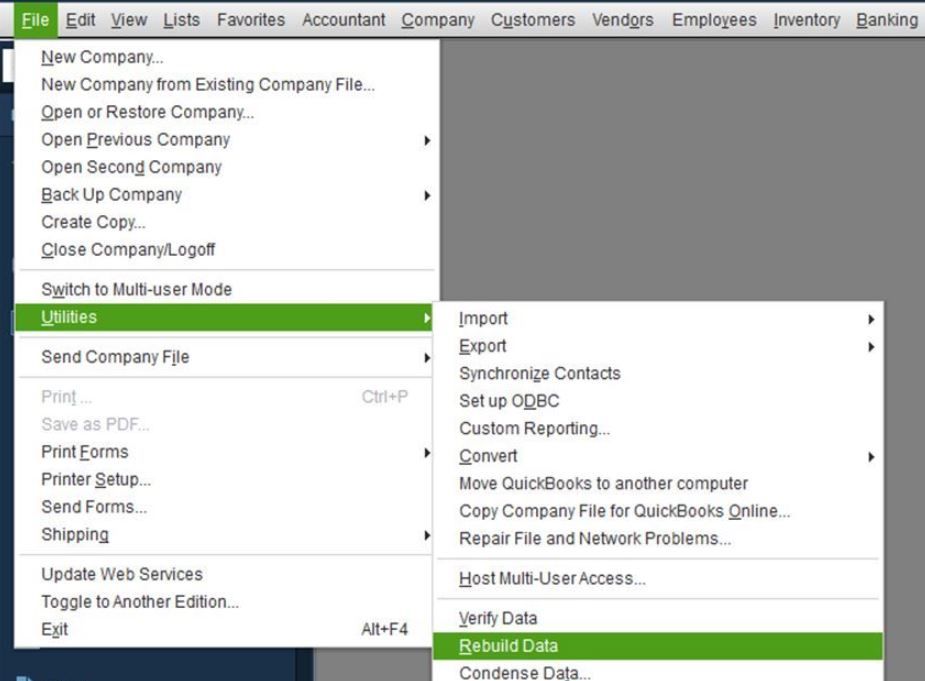

Next, here's how to rebuild data:

After that, run the A/R Aging Detail report once again. It should already resolve the report issue. Otherwise, you have to try more steps on the Resolve data damage on your company file article.

Please let me know how it goes or if you have any follow-up questions. I'll be here if you need further assistance. Just leave a comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.