Glad to see you here in the Community, @SS16.

Let's check the transactions and the filing period so you can successfully re-file your sales tax return.

Here are the possible reasons you're seeing different numbers under the Prepare return page:

- There are transactions that are changed, deleted, or added after un-filing the return.

- The filing period is incorrect.

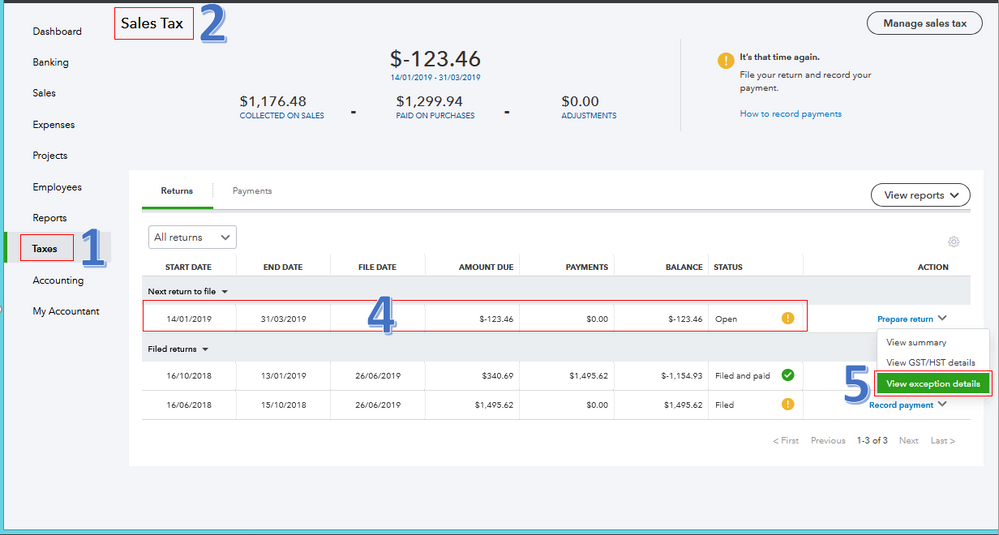

To track any changes to your taxes and returns, you can pull up the Sales Tax Exception report. Here's how to view the exception amounts:

- Go to Taxes from the left menu.

- Select the Sales Tax tab.

- Next to Sales Tax at the top, locate the tax agency associated with the return.

- Find the tax you're going to file under the Returns tab.

- In the Action drop-down, choose View exception details.

- The report will give you the transaction by transaction detail for your exceptions.

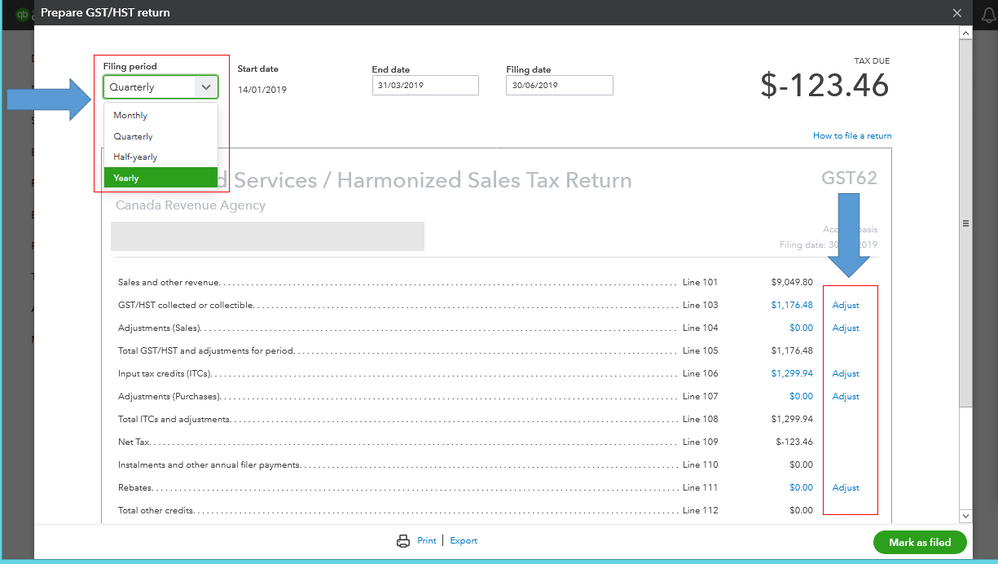

Once reviewed, make sure to select the correct filing period under the Prepare return page. Then, you can use the Adjust link at the right of the line to increase or decrease the amount (see the screenshot below). However, it would be best to seek advice from your accountant when doing the adjustment. This is to ensure your chart of accounts and financial reports are accurate.

Once done, you can re-file the return by performing the steps below:

- You must have your four-digit access code before you submit your GST/HST return online to the CRA. The access code is printed on the electronic filing information sheet (Form GST34-3) or the personalized return (Form GST34-2) that you received in the mail.

- Go to the CRA website on a different window.

- Type in your User ID and password.

- Choose Submit a return.

- Select the period that you want to file.

- Copy the amounts from the program and paste them into your sales tax return in the CRA window.

- Close the CRA window and go back to the system.

I'm adding this helpful article for a step-by-step guide on how to file your sales tax returns in the program: File Sales Tax. To get answers about the frequently asked questions on un-filing the return, you can read through this article: How do I Un-file A Sales Tax Return?.

The resources above will help you get back on track, @SS16.

I'm just a post away if there's anything else you need. Have an awesome day.