Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowThe person doing our books before me was paying sales tax online, then entering a check in QB for the amount paid and didn't use the QB "pay sales tax" function. Is there a way to correct this, so I can pay sales tax through QB for all future sales tax payments? (currently using QB Pro 2017)

I have attached a picture of what I see when I select "Pay Sales Tax"

Hello MEM8703,

Welcome to the Community. It would be my pleasure to lend a hand with your concern about the sales tax in QuickBooks Desktop.

Using the Write Checks or Pay Bills feature to pay your sales tax will lead to errors in your bookkeeping and sales tax reports. Deleting the previous payments not paid via Pay Sales Tax function and recording them the right way will correct the problem.

You can run the Account Quick Report and filter Checks to get rid of them more easily.

Here are the steps:

See these screenshots for your visual reference:

For additional reference into paying sales tax, I'm adding the article I recommend on this:

Please keep in touch with me here should you need any further assistance with recording sales tax payments. The Community always has your back.

I have worked this problem before and its not fun...

Unfortunately when the 'prior person' didn't use the filing & paying part of QB correctly, I would also question if the rest of the sales tax records in QB are right. Its very possible that the reason they didn't use the QB 'filing' is because they knew (or feared) it was wrong. That could have been due to the sales tax system setup being wrong, or not updating taxes and rates when they changed, or just plain not recording the taxes right in vendor and customer records. You need to do some review and try to get a sense of how wide and deep the issues are before you can really decide how to proceed.

If it was strictly a matter of bringing the prior payments into the sales tax records that will be doable. I am hoping that the payment cheques were coded to a sales tax liability account. But I cant predict if its possible to do this without changing prior period income/RE.

But if you find a real rats nest under the hood then your going to have a hard call between doing whats right and whats possible....

Hello, I have this same speil. Coming into an account that crazy messed up.

Our sales tax was paid the same way by check, then entered in QB from a spreadsheet rather than from the invoices..

On top of that, their are random invoices created over years, that were never marked paid, the sales tax is showing on my sales tax balance sheet. I guess cannot delete these invoices, because it will mess up balances from these previous years.

I also have the same kind of thing happening on my vendors, random bills enters, most till left unpaid.

Our accountant reviews our quickbooks twice a year I guess, and has just left it all there year after year.

I would like to start using quickbooks correctly, so I don't need a million spreadsheets that basically do what we pay quickbooks for.

Besides starting a new company file, I guess there's no way to correct it all, it's frustrating.

Hello Midstate309,

I appreciate you for dropping by here in the Community. I'm here to help provide information about recording transactions in QuickBooks Desktop.

I agree with you about making changes to transactions from the prior year will lead to mess up balances. There are other users who use the Journal Entry feature and a clearing account to get rid of the unpaid balances.

However, it would be best working further on this together with an accountant to ensure your books will be correct. Aside from making corrections from past years, the only way to start fresh is to start a new company file in the QuickBooks program.

To ensure it clears and show as paid moving forward, I recommend recording the payments using the correct process. I'm attaching the articles I found helpful for you:

I'm always up to answer any additional questions you may have regarding your past transactions in QuickBooks. The Community has your back.

My client is not using invoices in QB as of yet- she doesn't want to tackle customization and is providing those offline. She has manually tracked Sales Tax payable, but I can't figure out how to get it recorded in QB Desktop. She pays the tax twice a year, but I would like to see it tracked. Any thoughts?

Good day, @KB01,

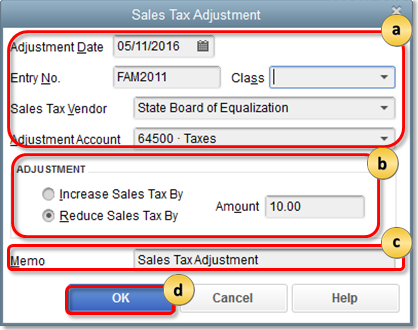

If you want to record sales taxes processed outside the program, you have the option to do an adjustment. This way you can create a liability that you can pay inside QuickBooks. Please note that this is something you can do temporarily and we do not advise to do it on a regular basis.

The adjustment option in the program is used for the the following scenarios:

To do the adjustment, follow the steps below:

To learn more about this feature, see this link: Process sales tax adjustment

When you're ready to make the payment, go back to the Vendors menu, then use Sales Tax and Pay Sales Tax. For the complete steps and explanation, refer to this help article: Pay sales tax in QuickBooks Desktop

Let me know if you need anything else with processing Sales Tax. I'll be more than happy to share additional insights for you. Have a good one!

I am in the same problem ever since the new tax update was done. Some of the payments have not been posted and the Payable Account is showing Negative. I just want to correct the Liability Account to match what is being paid for 2021. I want to get 2021 corrected an worry about 2020 later.

Can you tell me how to adjust the liability accounts to balance with the current daily work for 2021.

I can guide you correct the liability account to match what you paid for 2021, @MP65.

When you make sales tax adjustments, you move money into or out of your Sales Tax Liability account. To adjust your sales tax due, here's how:

For additional information, feel free to view this resource: Process sales tax adjustment.

Once settled, you can now collect taxes for certain goods and services you offer. For detailed steps, please check out this article: Pay sales tax.

Feel free to leave a comment below if you need some clarifications. I'll get back to you as soon as I can. Have a blessed Friday.

Using the pay sales tax option does not let you associate a class with the payment so it shows up as unclassified. Is there a way to record it and associate a class? Multiple classes are used when assessing sales tax.

Hello there, @Ren Michele.

I can see the importance of assigning class when paying sales tax. However, this option is unavailable as of now. I'd recommend sending feedback to our product developers to assess your suggestion. They may consider adding this option to the future enhancements of the program.

Here's how to send feedback:

I've included an article that will help you how to track the components of your transactions effectively: Customize reports in QuickBooks Desktop.

I'll be here if you have other questions. I'm here to ack you up. Take care.

Hello Jen!

This has been the most helpful sales tax post for adjustments I have seen in my searching. I am trying to figure out the best way to input sales tax owed from previous years from software that is not transferable to Quickbooks. We switched to Quickbooks in 2021 and I'm having a hard time getting all the opening balances correct. Do you have any suggestions?

Thanks for joining this thread, @Samantha77.

You can start by setting up sales tax items in QuickBooks Desktop. Then, you can follow the steps provided by Jen_D on how to record prior sales tax owed.

Once done, you can use the Pay Sales Tax function to pay your sales tax liabilities. For more details about this, please check out this article: Pay Sales Tax.

You can also run some sales tax reports to keep track of all your payable and the payments. Please read through this article for more insights: Review sales tax reports.

Please come back and fill me in if you've got more questions or any QuickBooks concerns. Have a great day.

I couldn't find a thread with my specific issue in it. Here it goes.

We had received a new program and a new terminal from our merchant company (I know - heavy sigh). The new program allowed us to pass on our fee to the customer. In the beginning we could turn it on and turn it off (they would pay or we would pay). I was told that the merchant fees passed on to the customer was not taxable. So I created a new invoice under the customer's account just for the merchant fee and marked it as non-taxable. Now we found out it is taxable. I've added that amount to the sales tax on paper and paid the GRT on line. I know how to do a sales tax adjustment. My question is, if I just adjust the sales tax it won't effect the customer account. Is that a problem. Now the customer account shows a 0 balance but their account doesn't show the fees they paid as taxable. If I change it to taxable it will leave an unpaid balance on their account. We have since made a change to the program and don't have to deal with this anymore but I need to get May fixed.

How can I set up Pay Sales Taxes direct to Florida Rev Web site?

Thanks for joining in on this thread, MBP2021.

I’m going to walk you through the details of setting up the sales tax.

Before you set up your sales tax items/groups, please make sure to check the tax rates and requirements with your tax agency.

Then, enable the Sales Tax feature by following these steps:

After the steps, add your sales tax item or tax group. The steps are included in this article: Set up sales tax in QuickBooks Desktop.

Once your done collecting the sales tax and reviewing the tax reports, please check out this link to guide you how to process the payment: Pay sales tax.

If you have additional questions regarding the process or need help with other concerns, please let me know in the comments below. I'll be around to help you out again. Take care and stay safe.

Thank you for sharing a solution to fix paying taxes recorded via writing a check rather than via the pay sales tax function. I have a similar situation and thinking to to delete all written checks and correct via paying sales tax. I did several payments throughout the year and am not sure hot to do that using pay sales tax. It only shows the total amount. I am afraid this will mess up the bank reconciliation I already completed. Any suggestions are much appreciated. I wish someone can walk me through a solution.

Hi there, @rkhiam. I'll walk you through how to correct this so you can pay through QuickBooks for all future sales tax payments.

To clarify, are you using QuickBooks Desktop? Deleting prior transactions can cause issues with your past reconciliations. These can unbalance your accounts and other reconciliations. It also affects the beginning balance of your next reconciliation.

If you wish to proceed, you have the option to reconcile sales tax payments manually or do a mini reconciliation. Before doing so, I'd suggest creating a backup copy. This way, you can restore it anytime you run into some problems.

Then, make sure to take note of all the written checks you want to delete. Also, ensure that the total balance matches the total sales tax due by running the Sales Tax Liability report. When paying sales tax, you can select a specific check date, and show sales tax due in a specific timeframe.

Here's how:

After that, reconcile them manually by going to the account register.

Here's how:

Alternatively, you can do a special reconciliation. This method uses an "off-cycle" reconciliation date to make a correction. I'm also including these articles for your future reference:

Please let me know if you need further assistance with this process. I'm always available to help.

You are awesome Marie! Thank you so very much for the very prompt solution. I have a follow-up question. So, I had to pay penalties a few times due to the delay in remitting the Sales Tax. How do I go about listing the late payment charge to the sales tax payment? So for example, the sales tax amount due for Jan was $20 and $10 as a late charge. I tried to use the pay sales tax feature and adjust the amount by completing the Amount Paid in the Pay Sales Tax window. Then, selected "Adjust", then selected an adjustment account (an expense account), selected the "Increase Sales Tax By", listed the amount in the "Amount" field. Unfortunately did not work. I window poped-up saying: "Because you made a Sales Tax Adjustment, the amount paid to each vendor has been reset." I wonder if I am doing something wrong. Your kind assistance is much appreciated.

Hello there, rkhiam.

I appreciate you for elaborating on the situation and giving such detailed information. Allow me to impart some details about the window popped-up.

If you entered the right amount of details in the adjustment this window will not popped-up. Please try to review the information then try to save the transaction.

For more detailed steps, you can check out this article: Process sales tax adjustment.

Additionally, I've added these articles below on how to customize reports and troubleshoot sales tax issues in QuickBooks.

Again, thank you for your ongoing business with us, and we look forward to serving you soon. Just drop a comment below. Keep safe and healthy.

Hello Abigail,

I tried a few things but still stuck. The adjustment is not listed under the same item. It is listed under "No item".

Would you be open to a Google meet sometime? I can share my screen and appreciate it if you can walk me through a solution. I can send you an invite to your email address. Sorry if causing any inconvenience.

Many thanks,

Ram

Thanks for always getting back here and sharing updates, Ram.

We'd really want to have this sorted out so you can record the sales tax payment.

I'd like to inform you that the Community is a public forum. Because of this, we're unable to arrange phone calls or private communications.

I'd be glad to share the steps on how to reach out to our phone and chat support teams instead. They can initiate a screen-share with you to check why the adjustment is not listed under the same item.

Here's how to reach out to them:

Here's an article to get more details about their contact details: Contact QuickBooks Desktop Support.

I'd also like to add a couple more sales-tax related articles for more references when using this feature:

Don't hesitate to join us again in the Community if you need more help with QuickBooks. We're always here to make sure they're all taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.