- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Hi there, @Anonymous.

Thank you for joining this thread. I can help you correct the taxes for the final 2018 paychecks.

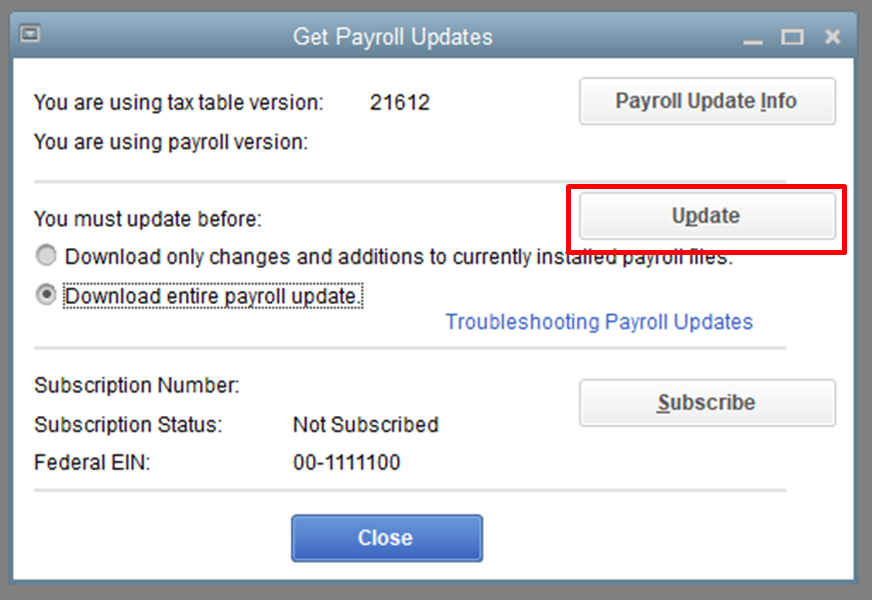

If the tax table is outdated, this can cause calculation errors on your employees' paycheck. To resolve this, let's run the payroll tax table update:

- Click Employees.

- Choose Get Payroll Updates.

- Select the Download entire payroll update radio-button.

- Choose Update.

- Wait until the update is complete.

Since you've already issued the paychecks, you will have to void and re-create them to show the right taxes. This will automatically update your taxes and form amounts. Any difference in net amount can be adjusted on the next payroll.

For in-depth information, please refer to this article: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

That should correct the paychecks and the forms in your QuickBooks, Martha.

Let me know if you have follow up questions about payroll. I'm always here for you. Wishing you all the best!