- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invite a contractor to add their own tax info

Learn how your contractors can add their own 1099 tax info.

Just like having an employee fill out a W-4 when you hire them, you should ask your contractor to complete a W-9. A W-9 will allow you to gather your contractors name, address, TIN or Social Security number. For more information about W-9s see Instructions for the Requester of Form W-9.

Collecting W-9s through QuickBooks Online lets you invite your contractors to complete their own profile and submit a signed W-9 online anytime. It only takes a few minutes, and when you do, you'll have what you need for tax time, which makes creating 1099s a breeze. This feature also encrypts your contractor’s sensitive tax info so they can feel comfortable about sharing it.

If you use our 1099 e-file service, your contractors will also be able to view and get their 1099s from the same account. If you are ready to create your 1099s, see What is a 1099 and do I need to file one?

To watch more how-to videos, visit our video section.

Step 1: Invite your contractor

- In QuickBooks Online, go to Payroll and select Contractors (Take me there).

- Select Add a contractor.

- Enter the contractor’s name and email in the fields provided, then select Add contractor. We’ll send your contractor an email in real time. The contractor’s profile will save in both the Contractors tab and the Vendors tab.

For additional steps about how to add contractors, see How to set up contractors and track them for 1099s in QuickBooks.

Step 2: Wait for your contractor to submit their W-9 info

We’ll send your contractor an email inviting them to fill out and submit their W-9 info. They’ll either log in with an existing Intuit account if they have one or create a free account to securely share their tax info with you. The whole process should only take a few minutes.

Next, they'll enter their W-9 info and digitally sign the form. Once completed, their info is saved in their account. For more info and detailed steps, direct your contractor to this article Fill out a W-9 and view your 1099-MISC.

Step 3: Check your QuickBooks Online account

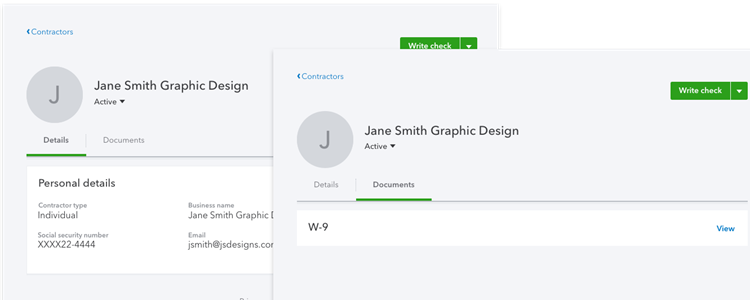

When your contractor submits their W-9, QuickBooks adds their info and a PDF of the signed W-9 to their profile in your account.

- In QuickBooks Online, go to Payroll and select Contractors (Take me there).

- Select the contractor’s name.

- Select the Details tab to see the contractor personal info and the Documents tab to see a copy of the W-9.

If the W-9 info is not entered into QuickBooks, you can resend the invite to your contractor.

- Go to Payroll and select Contractors (Take me there).

- Select the contractor’s name.

- Choose Send a reminder or Send email.

Need to make updates?

If the contractor updates their info at any time in their account, QuickBooks will automatically update it in your QuickBooks Online account. For more info and detailed steps, direct your contractor to this article Fill out a W-9 and view your 1099-MISC.

What about 1099s?

Come tax time, if you e-file your contractor’s 1099 form through QuickBooks, your contractor will have access to it in their account. For more info and detailed steps, direct your contractor to this article Fill out a W-9 and view your 1099-MISC.