- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

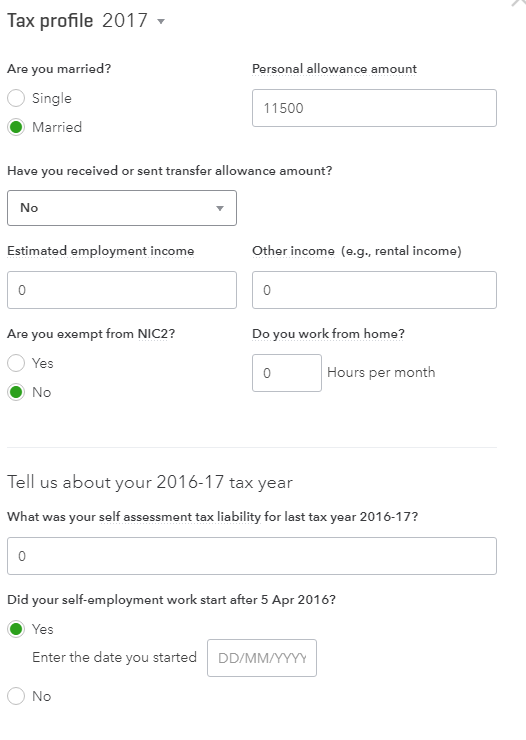

QuickBooks Self-Employed UK Tax Profile Set Up

We will calculate your self-employment taxes based on your business income, spending, allowable expenses and the information you have set up in your Tax Profile.

To go to your Tax Profile page, select Gear ![]() > Tax Profile.

> Tax Profile.

You can toggle the Tax Year on top of the window to select the Tax year you would like to set up. Answer the necessary fields required to complete the set up. The hours you work at home per month will determine your Home Office Deduction that will be reflected in your Self-Assessment Summary. Select Save to save your changes.

Please take note that your taxes are only calculated at the start of your self-employment date. Transactions before your self-employment date will be ignored in your Self-Assessment Summary. There are chances that the system will download and show transactions before your self-employment date, but those transactions will not be reflected and calculated when you go to your Self-Assessment Summary.