- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Other questions

Thank you for providing me with so much detail, bhtproperty.

I can help you tag this transaction in QuickBooks Online.

You're on the right track with creating a security deposit. Yes, the funds should be treated as a liability to show that it doesn’t belong to you until it’s used to pay for services.

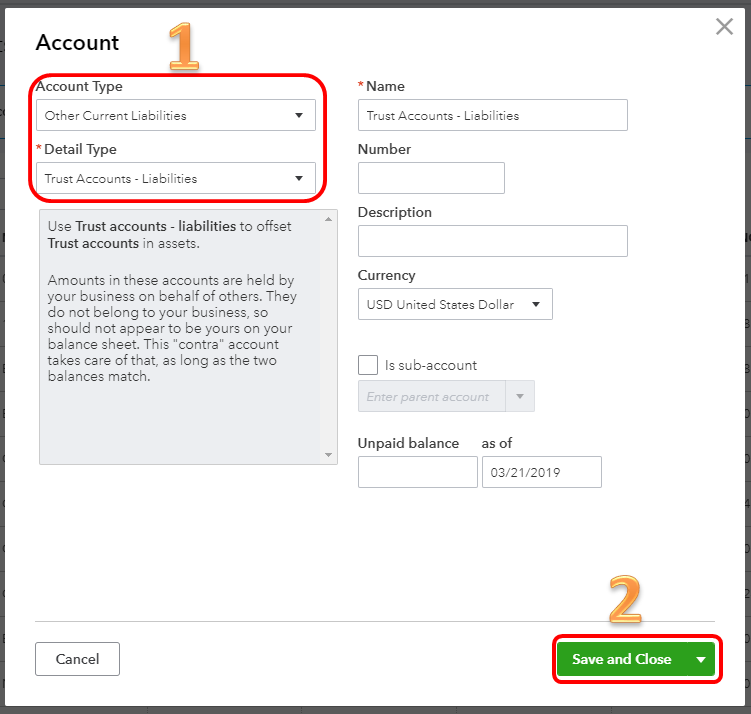

First, let's create a liability account to track the amount of security deposits. Let me show you how:

- Select Accounting on the left pane, then choose Chart of Accounts.

- Click New.

- Choose Other Current Liabilities from the Account Type drop-down list.

- Select Trust Accounts - Liabilities under the Detail Type drop-down.

- Enter a name for the account (for example, Trust Liabilities) or accept the suggested name.

- Click Save and close.

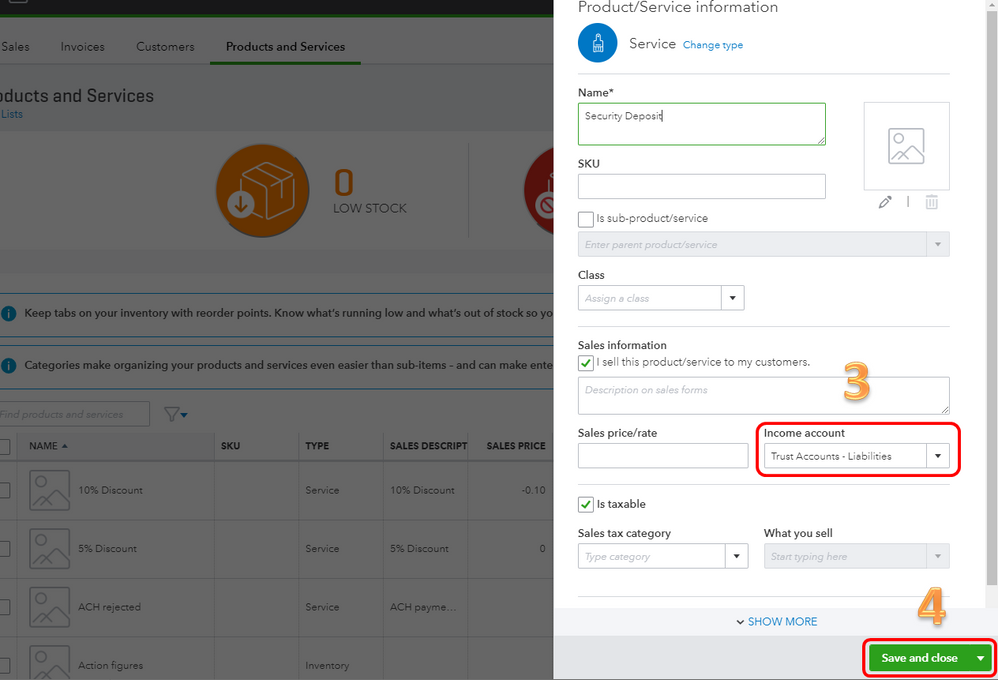

Next, create a service item that you can use when recording security deposits. Here's how:

- Click the Gear icon and choose Products and Services.

- Select New.

- Choose Service from the Product/Service Information.

- Enter a name for the service item.

- From the Income Account drop-down, choose Trust Liability Account.

- Click Save and close.

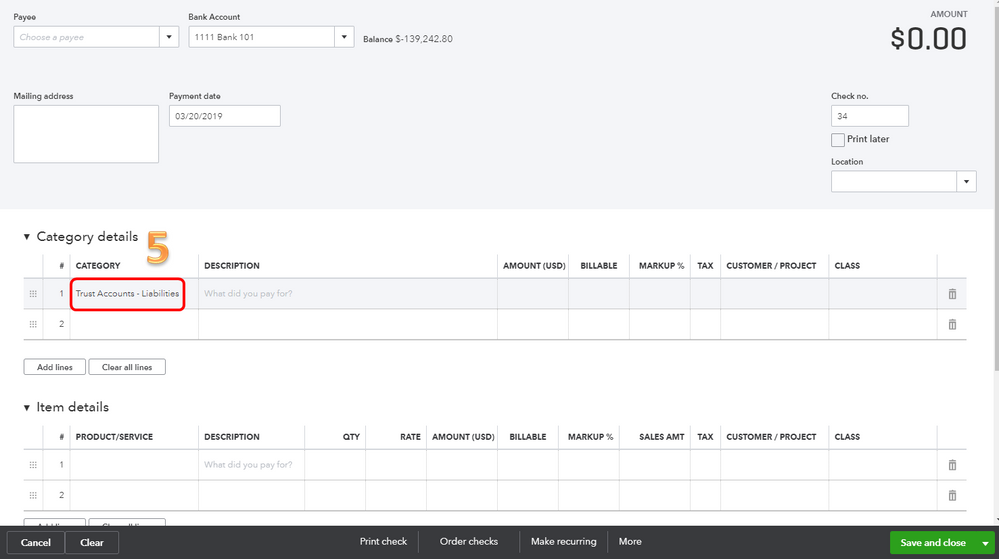

When refunding a security deposit, you must first issue a check for the portion to be refunded.

Here's how:

- Click the Plus icon (+) and select Check.

- Enter the check information.

- In the Account details section, select the liability account you use for security deposits from the Account column drop-down list.

- Select Save and close.

Here are some articles for the complete details about security deposits:

The information above should help you with the security deposits. I'm happy to help some more if you have other questions in QuickBooks. Enjoy your day.