- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Other questions

Its nice to see you in the Community, JDCSupply.

Thanks for providing such detailed information. I have a suggestion on how you can record these orders.

You can create bills to record the purchase of the items, then mark them billable to your customers. This way, the program recognizes that the ordered products are charged to your clients.

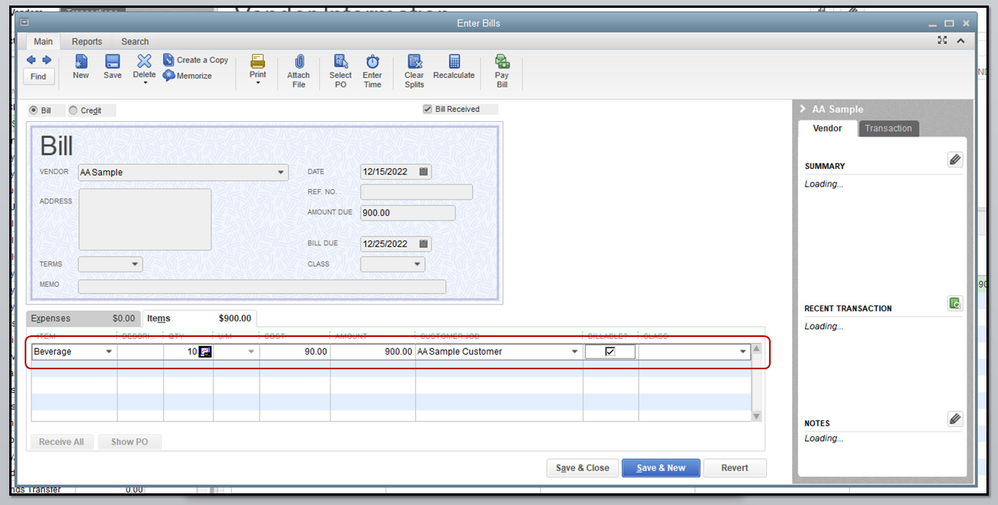

To mark a bill as billable:

- Go to Vendors at the top menu bar and select Enter Bills.

- Click the Items tab, enter the inventory you've entered.

- In the Customer:Job column, enter the name of customer.

- Put a check mark in the Billable field.

- Click Save and Close (see screenshot below).

To record the bill payment:

- Re-open the bill you created for the vendor.

- Click the Pay Bills button at the upper right side.

- Choose Ok, then Done.

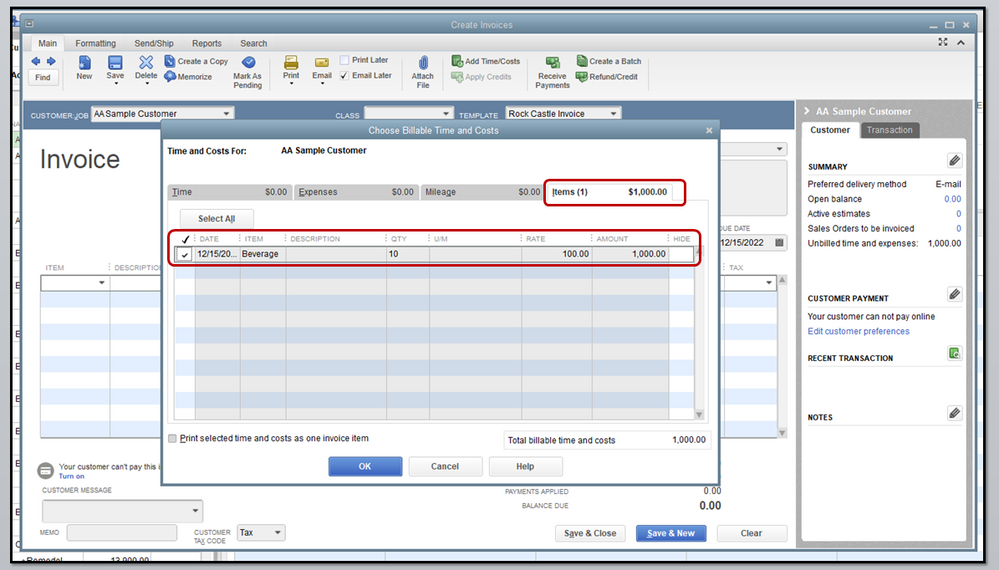

Once done, create an invoice to link the billable charge. Check out the steps below:

- Go to Customers at the top menu bar, then select Create Invoices.

- In the Customer:Job field, choose the customer you've charged the bill to.

- Mark the Select the outstanding billable time and costs to add to this invoice radio button and click Ok.

- From the Choose Billable Time and Costs box, pick the Items tab.

- Select the items you need.

- Click Ok (see screenshot below).

- In the Invoice screen, click Save & Close.

To receive the payment:

- Re-open the invoice you've created.

- Click the Receive Payments button.

- Select Save and Close.

That should do it! Though you've entered the inventories in QuickBooks Desktop, the program will recognize them as sold. Therefore, the income incurred for selling these items will be recorded regardless if they've been drop shipped.

Let me know if you have questions or if you're referring to something different. I'll be around!