- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payments

You're most welcome, calicoellie!

I'd be happy to guide you on how to apply the payment to the invoice if they pay you that way.

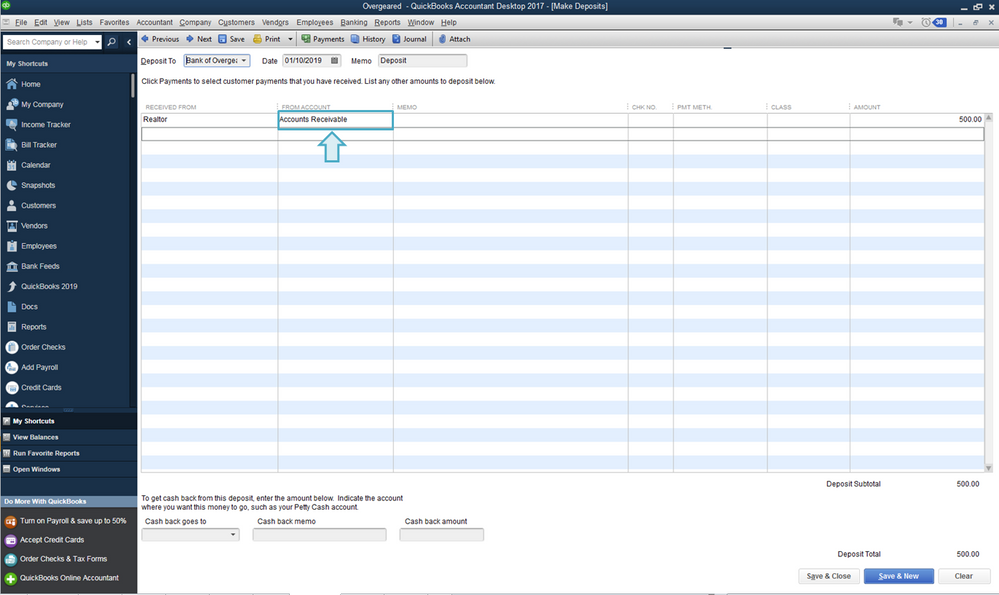

To clarify, are you referring to the deposit method? If so, we just need to enter Accounts Receivable in the From Account, instead of an income account. This way, QuickBooks will consider it as a credit that we can apply to the invoice. Let me show you how this works:

To enter the deposit using Accounts Receivable

- From the Banking menu, select Make Deposits.

- Enter the Date and the necessary details in the following fields:

- Received From: Enter the name of the realtor.

- From Account: Choose the Accounts Receivable account.

- Memo, Chk No, Pmt Method, and Class: You can leave these fields blank. Although, if these details are necessary, then you may go ahead and enter them.

- Amount: Total amount of their monthly fee. - Click Save & Close.

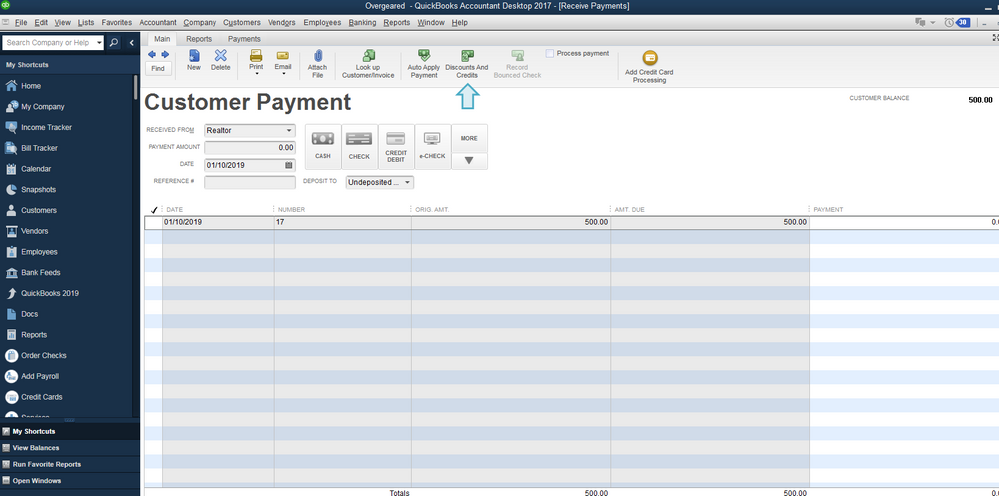

To apply the deposit to the invoice

- From the Customers menu, select Receive Payments.

- Click the Discounts and Credits icon.

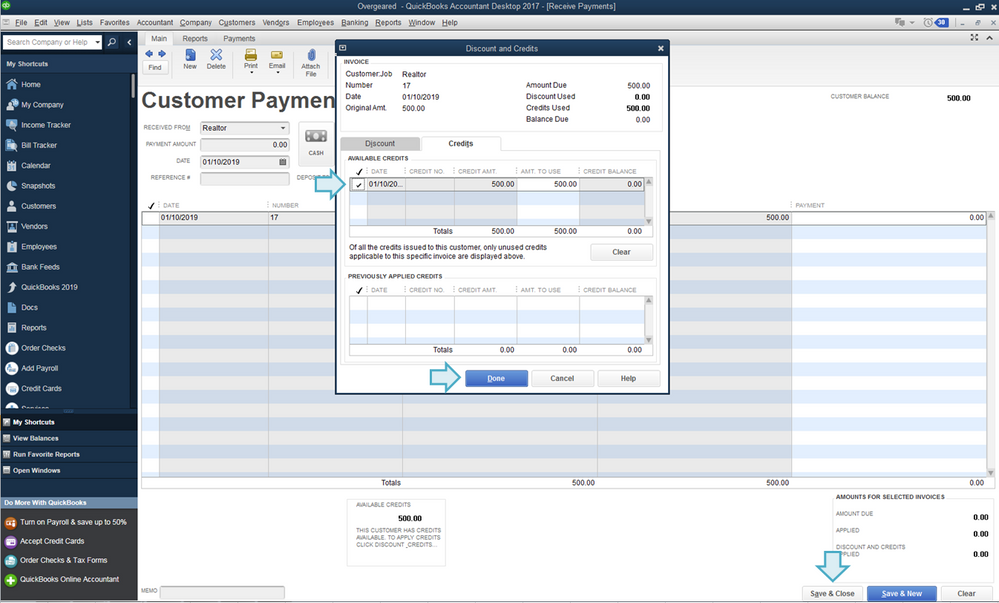

- In the Credits tab, select the Available Credits (deposit).

- Click Done, then Save & Close.

There you go. You'll be all set with the deposit and the invoice after following these steps. We also offer this information in our guide on how to resolve common issues when applying a payment towards an invoice.

Before you go, I just want to let you know that I've also updated my previous post. I reviewed it and noticed that I wasn't able to include the process on how to receive the payment after creating invoices.

Please know that I'm always here to provide further assistance and answer any questions that you may have, I want to ensure your success. Thanks for coming to the Community and take care.