- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payments

Delighted to have you here, @ LaurieXYZ.

I appreciate you for providing us with additional information about your concern. I'd like to share some details on how to record vendor credits for regular QuickBooks version.

When creating a credit or refund, always select the same bank account that is originally used in paying the bill. Since you've used a credit card in paying the bill, let's also make sure to post the credit on the same account.

Let's look for the vendor credits that you've created and link this to the bill.

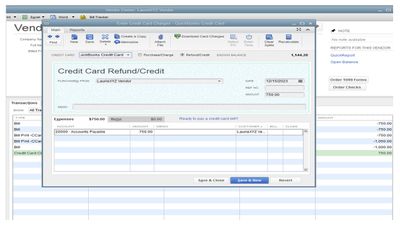

- Record the credit card as a credit card credit

- Go to the Banking menu.

- Choose Enter Credit Card Charges.

- From the Credit Card drop-down, select the credit card account.

- Select the Refund/Credit radio button.

- Choose the appropriate Vendor name and enter the Date, Ref No. and Amount.

- Enter an appropriate memo to describe the transaction.

- If you returned Items, click the Item Tab and enter the Items and Amounts from the refund.

- If the refund does not have Items, click the Expenses Tab, select the appropriate Accounts and enter the Amount.

- Click Save & Close.

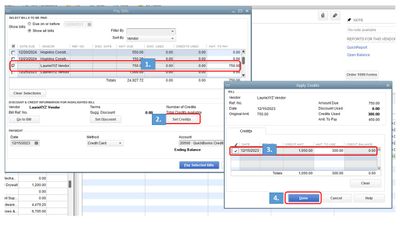

- Pay the Bill.

- Go to the Vendors menu.

- Select Pay Bills.

- Choose the Bill/s corresponding to the Check.

- Click Set Credits.

- Go to the Credits tab.

- Put a check on the credit. Change the amount as needed.

- Select Done, then choose Pay Selected Bills.

Keep in touch with us here in the Community if you have other questions about applying vendor credits in QuickBooks. I'm here to help.