- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

Hello Ashley65,

I hope you’re both doing well! I’ve thoroughly read this thread and followed the conversation you had with ClayJ.

It’s good you’ve found the Class tracking feature in QuickBooks Desktop useful. ClayJ has provided accurate details on how you can use it specifically to your situation. Let me add some information as well.

You’re right! In order for the labor costs per job to show on the Job Profitability report, you need to manually enter paychecks for the employees. There isn’t a need to purchase a payroll subscription for this; you can simply activate the Manual Payroll functionality.

Then, you’d have to create the paychecks against the timesheets entered in the program. However, you’ll have to manually enter the taxes taken out from the employees’ pay.

To activate the Manual Payroll functionality:

- From the Edit menu, choose Preferences.

- On the left pane, choose Payroll & Employees then go to the Company Preferences tab.

- In the QuickBooks Desktop Payroll Features section, select the Full Payroll radio button.

- Click OK.

To set it up:

- Go to the Help menu, then QuickBooks Help (or F1 on your keyboard).

- In the Help Search field, type manual payroll then press Enter.

- Select the topic Process payroll manually (without a subscription to QuickBooks Payroll).

- Under Set your company files to use the manual payroll calculations setting, click the manual payroll calculations link.

- Select Set my company file to use manual calculations link, then Ok.

- Close and reopen QuickBooks.

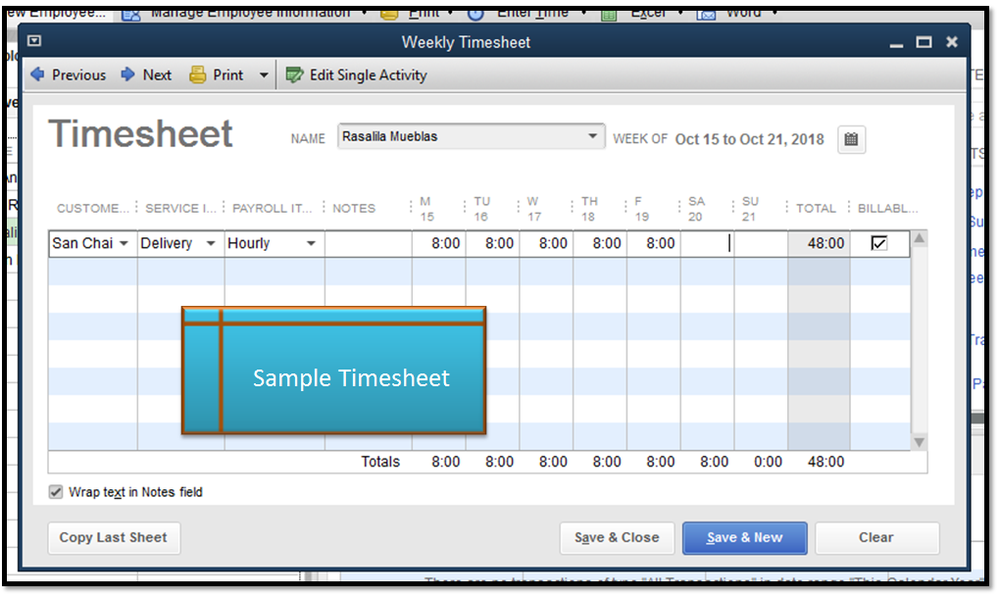

To record the paychecks:

- Click Employees at the top menu bar, then select Pay Employee.

- Make sure that the Pay Period Ends and Check Date are correct.

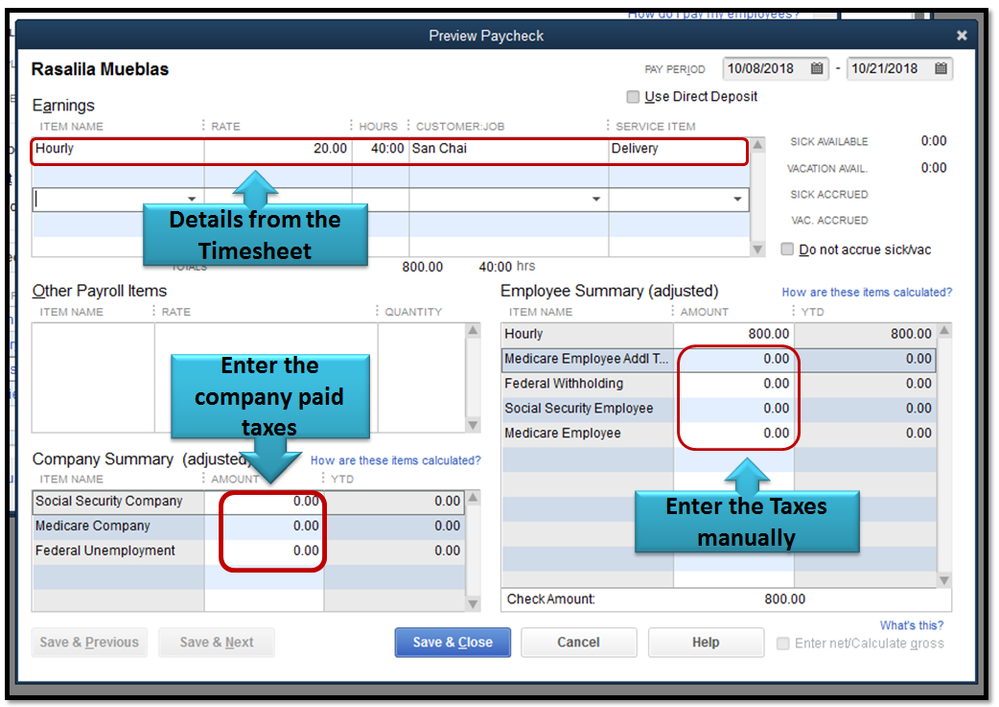

- Select the name of the employee, click the Open Paycheck Details link.

- In the Employee Summary section, enter the taxes taken out from the paycheck.

- From the Company Summary, type in the taxes contributed by the company.

- Click Save and Close, then Continue.

If there are already existing checks created for the corresponding paychecks, you have to delete them to avoid double entries. Here’s how:

- Go to Lists, then Chart of Accounts.

- Open the Bank account you’ve deposited the checks to.

- From the register, open the check one at a time, and then press Ctrl+D to delete them.

- Click Save and Close.

I’ve added screenshots as visual reference.

Once done, open the Job Profitability report and you should be able to see the labor cost per job.

Don’t hesitate to update this thread on how things go. I’ll be around!