- Open FAM. From the File menu, select Backup.

- Leave the default location and select Backup.

- From the File menu, select Client Information.

- Go to the Dates tab.

- Change the current year to the fiscal year that you are rolling back to and select OK.

- From the Tools menu, select Recalculate All Assets > Recalculate all prior depreciation values.

- Select OK, then Yes on the backup prompt.

- From the Tools menu, select Prepare for next year.

- Select Yes. This will roll the program forward one fiscal year.

- Continue with steps 8 through 10 until the current fiscal year is displayed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Resolve errors or unexpected results in Fixed Asset Manager (FAM)

Fixed Asset Manager(FAM) is a program available in QuickBooks Premier Accountant, QuickBooks Desktop Enterprise and QuickBooks Desktop Enterprise Accountant that computes depreciation of fixed assets based on the standard published by IRS.

This article covers errors and unexpected results while using QuickBooks Desktop's Fixed Asset Manager. From the list below, choose the error or issue you experience then follow the steps provided to resolve it.

FAM file is showing wrong assets

The assets showing in FAM are assets from a different company file.

Possible reason: The folder where the QuickBooks Desktop company file is saved in may have been deleted or transferred to a different location.

Solution:

- Close FAM.

- Navigate to the proper location based on your QuickBooks Desktop version.

Note: The "clients" folder contains multiple client subfolders, each with a numeric name such as {0000101. Each subfolder represents one client.Version File Location QuickBooks Desktop 2018 or Enterprise 18.0 C:\Users\Public\Public Documents\Intuit\QuickBooks\Company Files\FAM18\clients QuickBooks Desktop 2017 or Enterprise 17.0 C:\Users\Public\Public Documents\Intuit\QuickBooks\Company Files\FAM17\clients - Identify the latest client file that you accessed by checking the Date Modified time stamp.

- Move the FAM folder to a different location outside of the "...\clients" subfolder.

- Open the company file that shows the wrong set of fixed assets.

- Open FAM.

- On the FAM wizard, select Create a new FAM client. Complete the process and close FAM.

- Move the FAM folder that you moved from step 4 back to its "clients" subfolder. The file should now open normally when accessed in the company file it was created in.

Cannot assign a FAM number to a Fixed Asset Item

You cannot assign a FAM number when creating or editing a fixed asset item.

Possible reason: QuickBooks Desktop and FAM are not in sync.

Solution:

Synchronize FAM and QuickBooks Desktop

- Create a new fixed asset item.

- Open FAM.

- Select the new fixed asset and go to the Asset tab. The new asset number will display in the Asset number field.

- Close FAM. This should synchronize your FAM to QuickBooks Desktop.

- From the Lists menu of your QuickBooks, select Fixed Asset Item List. The new item should now have the numbers under the FAM number column.

Unable to map columns when importing .CSV files into FAM

When you import data into Fixed Asset Manager (FAM) from a comma-separated values file (.csv), the import wizard prompts you to map the data from your *.csv file to the data in FAM. When you select the drop-down arrow and make a selection, the wizard displays an incorrect selection or gibberish options. If you then try to map other columns, the drop-down arrows do not work at all.

Possible reason: Conflict with dual monitor configuration or video drivers.

Solution:

Note:The following steps are technical in nature. If you are not comfortable following these steps on your own, consult an IT professional.

- Close all applications, then restart your computer in Safe Mode with Networking.

- Try importing your .csv file to FAM.

- (Optional) Do a selective startup to disable startup items and services.

Disposed assets still show in FAM even after closing the previous year

After closing the previous year, FAM still shows previously disposed assets.

Possible reason: QuickBooks Desktop and FAM are not synchronized.

Solution 1: Synchronize FAM and QuickBooks Desktop

- Open FAM.

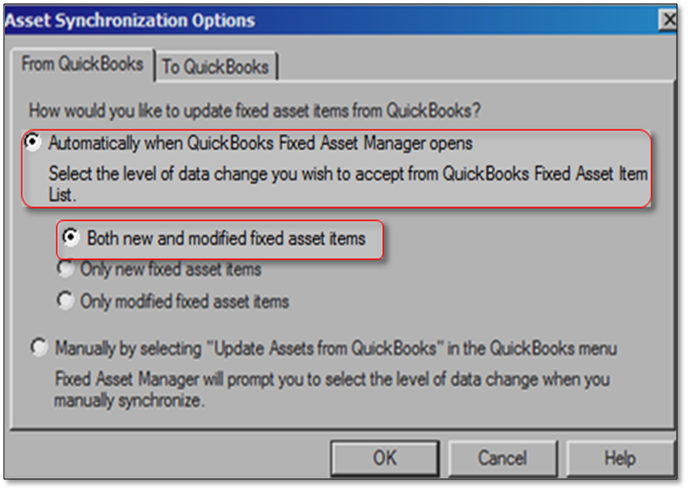

- From the QuickBooks menu of your FAM, select Asset Synchronization Options.

- Go to the From QuickBooks tab.

- Select Automatically when QuickBooks Fixed Asset Manager opens and Both new and modified fixed asset items.

- Select OK, then close and reopen FAM to ensure that FAM and QuickBooks Desktop are in sync.

Solution 2: Post a journal entry

- From the File menu of your FAM, select Client Information.

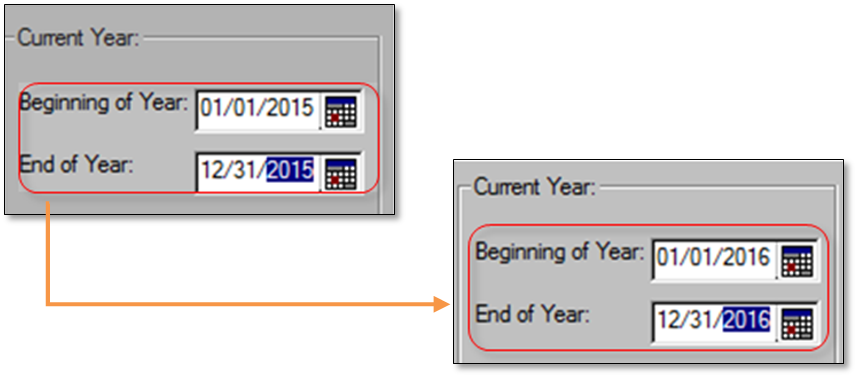

- Select the Dates tab. Add 1 year to the Beginning of Year and End of Year fields and select OK.

Example: Beginning of Year: 1/1/2015 and End of Year: 12/31/2015 to Beginning of Year: 1/1/2016 and End of Year: 12/31/2016

- Select OK on the Rebuild Completed Successfully window.

- From the Tools menu, select Recalculate All Assets.

- Select Recalculate all prior depreciation values > OK > Yes.

- From the QuickBooks menu, select Post Journal Entry to QuickBooks.

- Enter the posting date (Depreciation through date: 12/31/2016) and select Post Entry to QuickBooks.

- From the Tools menu, select Prepare for next year. FAM will roll the date forward to the following year.

- Repeat steps 6-8 until the current year has been reached. Once the current year is reached, the disposed asset should no longer appear in FAM.

Groupings are not showing up in FAM when adding or editing an item

Possible reason: FAM is set to not display groupings.

Solution:

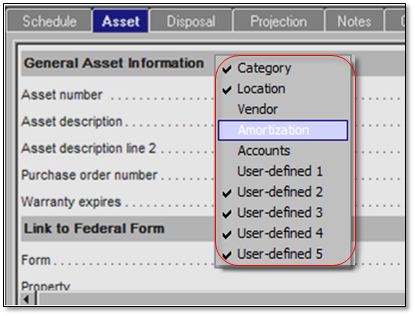

- On FAM, go to the Asset tab.

- Right-click the top header on your Asset screen and select the groupings that you want to see.

Incorrect depreciation amount shows in the QuickBooks column when posting journal entries from FAM to QuickBooks Desktop

When you post a journal entry in QuickBooks Desktop from FAM, the Accumulated Depreciation amount is not showing correctly in the QuickBooks column or the previously posted data is not recognized.

Solution 1: Confirm the Accumulated Depreciation Account for the Asset

- From the Asset tab, go to the General Ledger Accounts section.

- Confirm that the correct account is selected for the Asset, Accumulated Depreciation, and Depreciation/Amortization Expense accounts.

Solution 2: Merge the Accumulated Depreciation account to a new Accumulated Depreciation account.

Important: Merging of accounts is irreversible. Create a backup of your QuickBooks company file before following the steps below.

- From the Lists menu > Chart of Accounts.

- Right-click the old Accumulated Depreciation account and select Edit Account.

- Add a number after the account name (Example: Accumulated Depreciation1), then select Save & Close.

- On the Chart of Accounts window, select Accounts > New.

- Create a new Fixed Asset Account named Accumulated Depreciation, then select Save & Close.

- Right-click the old Accumulated Depreciation account and select Edit Account.

- Remove the number that you added in the account name and select Save & Close. Select Yes on the merging account prompt.

- Retry posting a journal entry to QuickBooks Desktop from FAM.

Error: Invalid Printer Driver

You may get this error when generating a report in FAM.

Possible reason: FAM is being used in a Terminal Services Environment and the printer name is more than 64 characters.

Solution:

Change the settings on the Terminal Server and shorten your printer's name. For better assistance, contact an IT professional.

Incorrect Calculations: Journal Entries

Solution:

- Check the “Depreciation Through” date.

- Make sure that the prior depreciation is correct.The Accumulated Depreciation account in QuickBooks must equal Prior Depreciation in FAM. If not, this indicates:

- Prior depreciation figures have been changed.

- The entire life of the asset was not tracked in the Fixed Asset Manager.

- The Accumulated Depreciation account is incorrect.

Incorrect Calculations: Reports

Solution:

Check the lower half of the Asset tab in FAM and verify if you have the right information

- Date Placed in Service: The date the asset is purchased is either inaccurate or blank.

- Cost or Basis: Make sure this value matches purchase price.

- Tax System: Verify that this is the correct tax system to be used for calculations.

- Depreciation Method: Verify that the depreciation method is correct for the type of calculation expected.

- Recovery Period: Verify if this is the correct recovery period.

Fixed Asset Manager Report is Missing

When you try to run a predefined report in Fixed Asset Manager, you receive an error saying the report is not available.

- Close FAM and QuickBooks.

- Find the following file: rptlsts.f## and delete it. The ## will vary depending on the year of FAM being worked with.

Location: C:\User\Public\ Public Documents\Intuit\QuickBooks\FAM##\SPRO\Reports\rptlsts.f## - Update QuickBooks Desktop.

- Close and reopen QuickBooks and FAM.

- Retry generating the predefined reports.

Note: If the issue persists, reinstall using clean install.

Journal Entry is out of Balance. The Debit and Credit totals must be equal.

When you view an asset placed in service in the same fiscal year, FAM displays an incorrect dollar value on the prior depreciation. This corrupts the depreciation figures which results to the specific error. This error may also caused by selecting Post Entry to QuickBooks.

Possible reason:

The Accumulated Depreciation account in QuickBooks Desktop must be equal to Prior Depreciation in FAM. If an asset has been tracked in QuickBooks Desktop and FAM from the time it was acquired, this journal entry should be in balance. If it is out of balance, it may be caused by one of the following:

- The asset was entered in QuickBooks FAM mid-life without entering the accumulated depreciation from its acquisition date.

Example: An item was purchased and entered into the Fixed Asset Item List in QuickBooks Desktop Pro (which does not have QuickBooks FAM). The file is then used in QuickBooks Desktop Premier Accountant by the company's accountant in order to calculate asset depreciation. If FAM is opened without first creating a correcting journal entry in QuickBooks, then FAM will read $0 as the amount of accumulated depreciation for the asset. - The calculated amount for prior depreciation was changed in FAM.

Example: FAM is rolled back to a previous fiscal year (possibly due to printing a report for that fiscal year). This can cause any value in the prior depreciation field to remain the same number it was prior to changing the dates. - The asset is marked as disposed and the asset value and accumulated depreciation value has not been cleared in QuickBooks Desktop.

Solution 1: Make an adjustment using a General Journal Entry in QuickBooks, then update FAM assets from QuickBooks Desktop

- From the Reports menu of your FAM > Display Reports > Depreciation Schedule by G/L Account Number.

- Select the appropriate Basis for your report (i.e. Federal, State, AMT, etc.). If you are not sure which Basis is appropriate, consult your accountant.

- In the Date field, enter the date that is the of beginning of your current fiscal year.

- On the report, make note of the total in the first Accumulated Depreciation column (the date below this should be the beginning of your current fiscal year).

- From the Lists menu of QuickBooks Desktop, select Chart of Accounts.

- Right-clickthe Accumulated Depreciation account and select Quick Report Accumulated Depreciation.

- Change the date to the end of the previous fiscal year, then make note of the total amount.

- If there are multiple subaccounts, make note of all the total amounts and add them together.

- Subtract the amount in step 4 from the amount in step 6. This is the amount that you must enter as an adjustment via a General Journal Entry in QuickBooks Desktop.

- From the Company menu of your QuickBooks Desktop, select Make a General Journal Entry.

- Change the Date to the end of the previous fiscal year and select Adjust entry.

- In the Account field, select the Depreciation Expense account. Enter the amount from step 7 in the Debit field.

- In the Memo field, type Adjust entry to match QB to FAM.

- On the next line, select Accumulated Depreciation account, then enter the same amount in the Credit field.

- Select Save & Close.

- If necessary, repeat the process for the subaccounts.

- In FAM, go to the QuickBooks menu and select Update Assets from QuickBooks, then select OK > Yes to All.

Solution 2: Roll FAM back to the appropriate fiscal year, recalculate assets and depreciation in FAM...

Unbalanced Posting Entry

After selling a fixed asset for either a profit or loss, the QuickBooks journal entry generated in FAM is not in balance. FAM does not support gain or loss account assignments nor does it know which QuickBooks Desktop accounts are associated with the gain or loss on the journal entry. The journal entry will be out of balance until you record the gain/loss and cash or receivable on QuickBooks.

Solution:

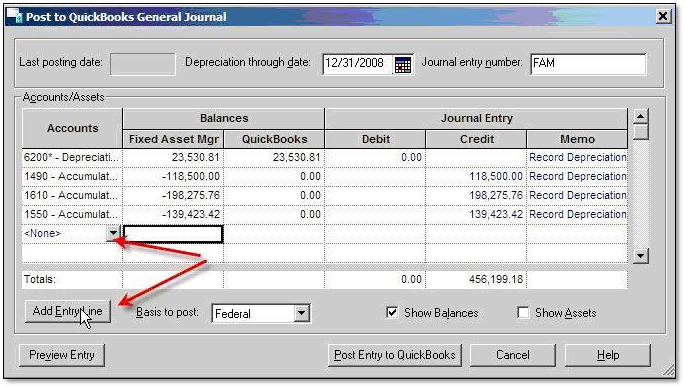

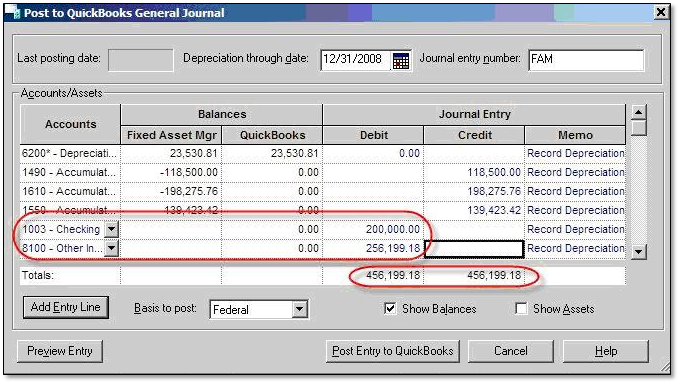

- From the QuickBooks menu of FAM, select Post Journal Entry to QuickBooks.

- Enter the posting date in the Depreciation through date field and select the Add Entry Line button.

- In the next available line, enter the account in QuickBooks Desktop you want to use (Example: a bank or checking account).

- Add another line by selecting Add Entry Line.

- On the second line, enter the account you would like to use to post gain or loss on the sale.

- The journal entry is now balance. Select Post Entry to QuickBooks to complete the entry.

An invalid recovery period has been entered

You must select an allowable recovery period for the selected depreciation method. It is recommended to consult your accountant or tax professional for more information. Check the IRS publication 946 for the years allowed.

- Under the Asset tab's lower half screen, enter the Date placed in service and Cost or Basis.

- Change the Tax System to Other.

- Enter the required information for the Depreciation method, Recovery Period and Convention.

Error 124: An unexpected error occurred...or cannot open Fixed Asset or Loan Manager, or FS Designer

Scenario: You are getting the incorrect information or the error An unexpected error occurred while refreshing data from QuickBooks. The error reported: This application requires Single User file access mode and there is already another application sharing data with this QuickBooks company data file (Error Code: 124) when opening Fixed Asset Manager, Financial Statement Designer or Loan Manager.

Possible reason: Multiple versions of QuickBooks Desktop are running.

Solution: Close all versions of QuickBooks Desktop that are open or running.

|

Note: When opening any add-on including Fixed Asset Manager, Financial Statement Writer and Loan Manager, remember to close all versions of QuickBooks Desktop, except the one you are using. Aside from the error described above, there can be instances where your add-on displays the wrong information after installing a new version of QuickBooks Desktop. This is because installing a new version of QuickBooks automatically installs a new version of add-ons. When opening an add-on while multiple versions of QuickBooks Desktop are running, the most current version that is open will dictate the information displayed by the add-on.

|

Error 80040400: QuickBooks found an error when parsing...XML text stream, in Fixed Asset Manager

Scenario: You encounter Error 80040400: QuickBooks found an error when parsing the provided XML text stream when trying to sync assets from FAM to QuickBooks, when closing FAM or after performing a manual sync. Also, changes made in FAM do not transfer or update the asset in QuickBooks Desktop.

Possible reason: Non-alphanumeric character(s) in your Fixed Asset Manager file.

Solution: Remove all non-alphanumeric character(s) in your FAM file.

Remember: Before synchronizing with QuickBooks Desktop, you must re-enter any changes you made before you received the error message.

- Search and delete all non-alphanumeric characters such as %,&,*,~,",) and ( from all FAM fields.

- From the QuickBooks menu, select Save Assets to QuickBooks.

- Select the desired option and select OK.

All changes made to the assets with non-alphanumeric characters should now reflect in the Fixed Asset Item list in your QuickBooks company file.

Error "Components required are missing" when launching Fixed Asset Manager

Scenario: When launching FAM, you are receiving the message Components required for FAM are missing and Fixed Asset Manager fails to launch. The message does not specify what component is missing

Possible reason: Damaged QuickBooks installation.

Solution 1: Run reboot.bat.

Solution 2: Repair your QuickBooks installation.

Solution 3: Reinstall your QuickBooks using clean install.

Error: Please close the other copies of QuickBooks in order to use Fixed Asset manager

Possible reason: Multiple versions of QuickBooks are open or multiple QuickBooks processes are running in the background.

Solution: Disable quick startup.

When you start your computer, QuickBooks Desktop is automatically loaded in the background of your computer to speed up the process when launching it. However, having QuickBooks pre-loaded can cause interference with other programs especially when you have multiple versions of QuickBooks Desktop in your computer.

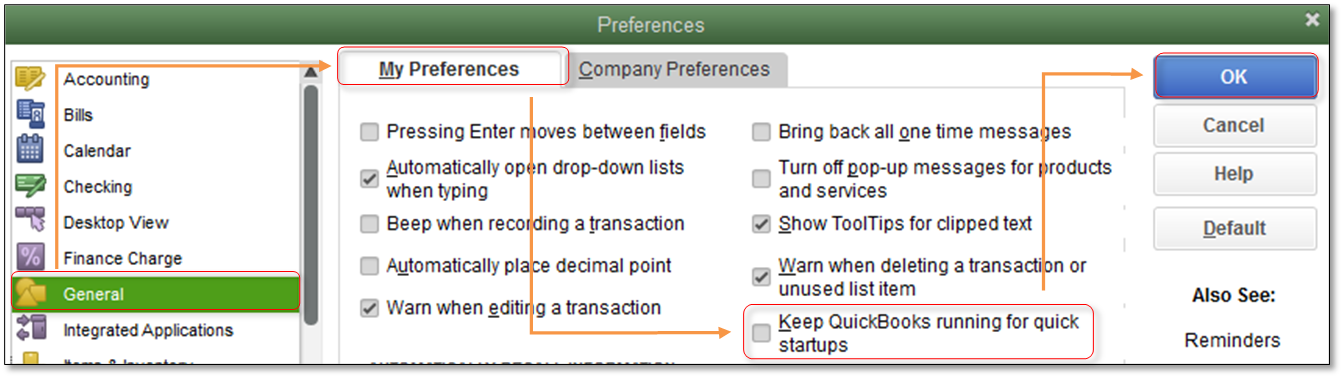

- From the Edit menu of QuickBooks Desktop, select Preferences, then select General.

- Select My Preferences tab and uncheck the Keep QuickBooks running for quick startups, then select OK.

- Close all programs and restart the computer.

- Launch the right QuickBooks Desktop version and try opening your FAM.

Error: Unable to Connect to QuickBooks

Scenario: You are getting the following error when opening FAM:

Title: QuickBooks Fixed Asset Manager

Message: Unable to connect to QuickBooks

Fixed Asset Manager does not have permission to access the QuickBooks file.

The QuickBooks administrator can give Fixed Asset Manager permission through the Integrated Application Preferences.

Possible reason: QuickBooks Desktop is set to deny access to FAM or UAC (User Account Control) is turned off.

Solution 1: Allow application to access QuickBooks Desktop through Integrated Applications or turn on UAC (User Account Control)..

Solution 2: Check the preferences for Integrated Applications:

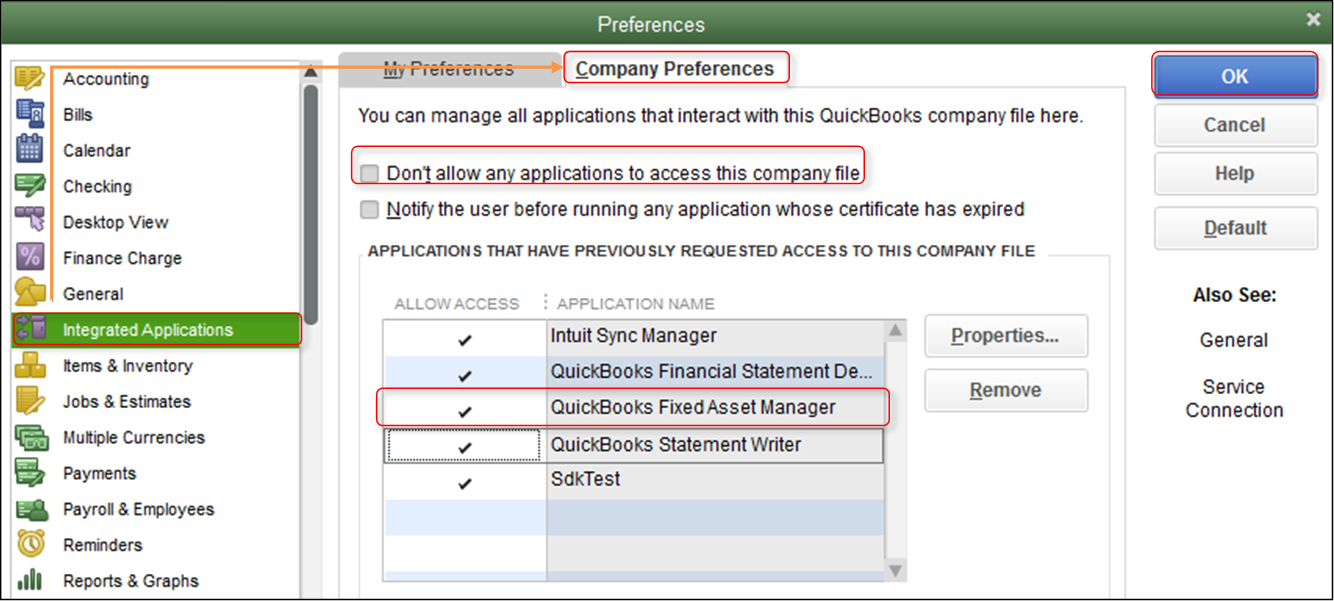

- Log in to the company file as the QuickBooks Administrator.

- From the Edit menu, select Preferences, then select Integrated Applications.

- Se;ect the Company Preferences tab, then uncheck Don't allow any applications to access this company file.

- In the Applications that have previously requested access table, select Allow Access for QuickBooks Fixed Asset Manager.

- Select OK to close the Preferences window.

Solution 2: Turn on UAC (User Account Control).

Fatal Application Error when Opening Fixed Asset Manager

Possible reason: Damaged QuickBooks installation

Solution 1: Repair your QuickBooks installation.

Solution 2: Reinstall your QuickBooks using clean installation.

No backup exists for this client error when trying to restore FAM file

Possible reason: Wrong file path

Solution: Use the appropriate file path for FAM backup files.

When you create a backup of a FAM client, QuickBooks creates a folder almost similar to {9990001 at the location you specify. To restore a backup, choose the location you selected and not the folder that QuickBooks created.

To create a FAM backup

- From the File menu of FAM, select Backup.

- On the Backup window, select Browse, then select the location where you want to save your backup.

- Select OK and back up.

To restore a FAM backup

- From the File menu of your Fixed Asset Manager, select Restore.

- On the Restore window, click Browse and select the location where you saved the backup.

- Select OK and Restore.

(DB/200)an Error has occurred accessing... when opening FAM afer conversion from a lower or old version

Possible reason: Data damage. This issue usually happens when QuickBooks Desktop and FAM are installed in a non-US version of Windows.

Solution 1: Restore a backup.

- From the File menu of your Fixed Asset Manager, select Restore.

- Choose the location where you saved your backup, then select Restore.

Solution 2: Create a new FAM file.

To do this, check out Set up Fixed Asset Manager (FAM).