- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

It’s nice to have you again here in the Community, Andres.

I can help make sure your employee can get the raise on his paycheck.

Since the paycheck has been deposited, there isn’t a need for you to edit it. This is to avoid messing up the taxes taken out from the check.

I have two suggestions you can choose from to ensure that your employee can still receive the raise. You can either create another paycheck specifically for the raise amount or add it to the employee’s paycheck on the next payroll run.

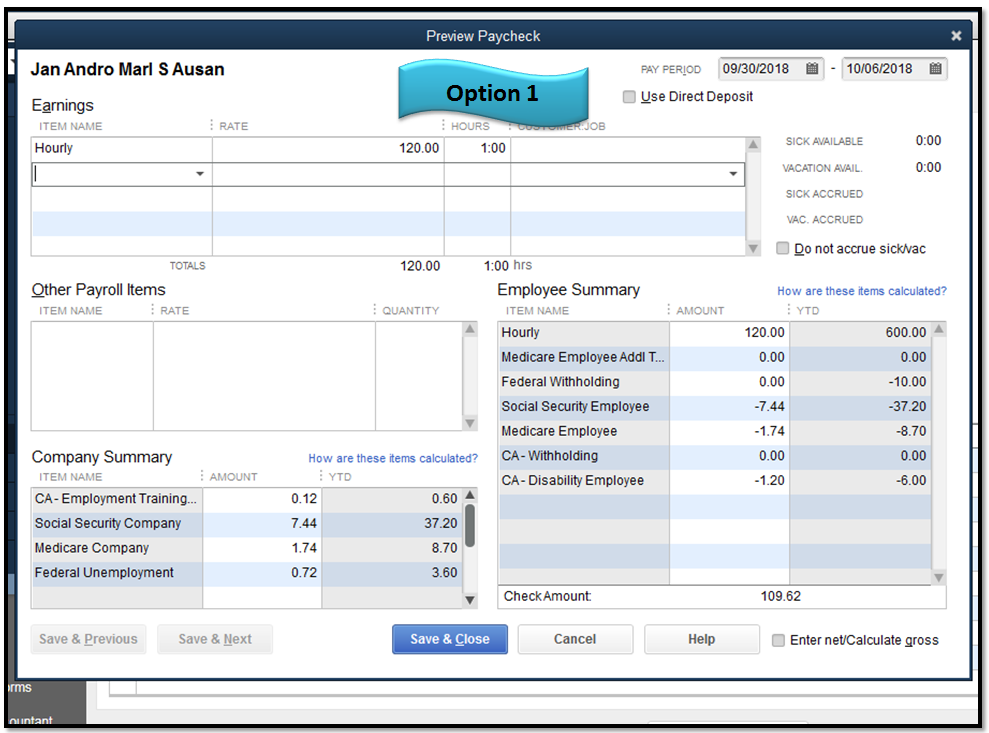

To create another check:

- Go to Employees at the top menu bar, select Pay Employees, then Unscheduled Payroll.

- Make sure that the Pay Period Ends date is the same as the original check.

- Put a checkmark before the name of the employee.

- Click the Open Paycheck Detail button.

- Under the Earnings item, select the Wage Payroll item type for the employee.

- In the Rate column, enter the entire raise amount.

- Put one (1) in the Hours column, then click Save and Close (see screenshot 1).

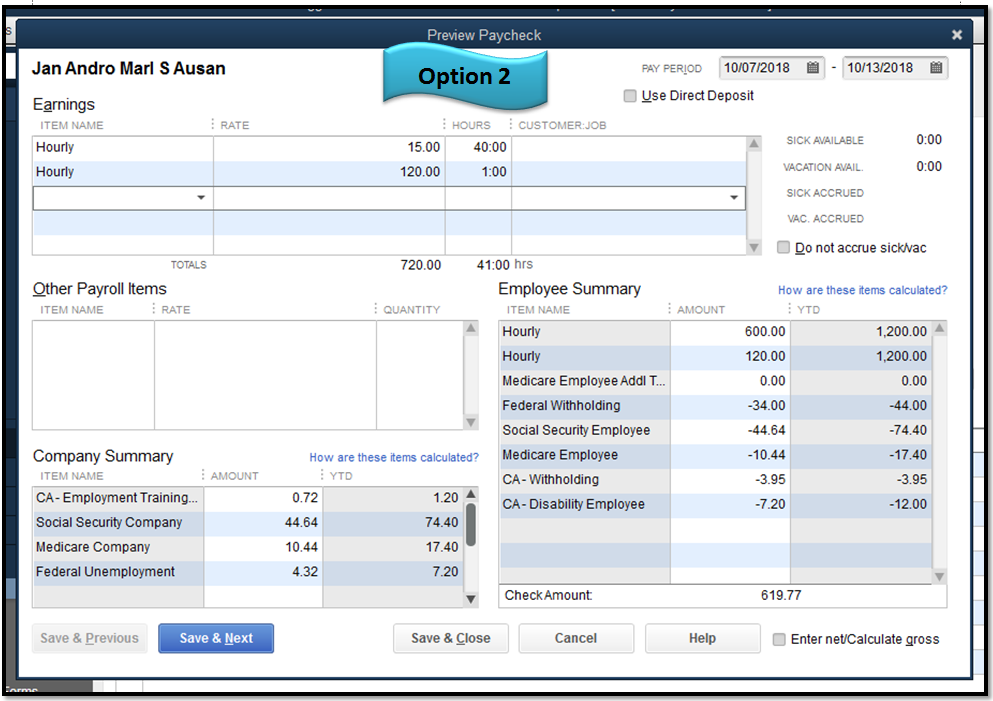

To add the raise amount in the next payroll run:

- Create the employee paycheck as how you normally do.

- In the Preview Paycheck screen of the employee, go to the Earnings table, then add the same wage payroll item in the second line.

- In the Rate column (second line), enter the entire raise amount.

- Put one (1) in the Hours column (second line), then click Save and Close (see screenshot 2).

That’s it! Rest assured, any of these options will give your employee the pay raise.

If you have other concerns, feel free to fill me in. I’ll be around.