- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

QB Non profit (church) and monthly rebalancing Unrestricted Net Assets into Temp Restricted Net Assets (a fund and separate class).

Our organization wishes to run financial reports monthly. It is my understanding that in order to have the Statement of Financial Condition (Balance Sheet) accurate it is best to adjust the Unrestricted Net Assets table with the monthly the Net Assets results for the unrestricted funds classes and the Temp Restricted Net Assets Equity with Net Assets reported from I&E of the class containing those funds. I am wondering what will occur at month 12 when QB makes its closing entry into the Unrestricted Net Assets table. Since it seems the QB establishes an overall Net Assets by doing an internal I&E, with all funds taken together, what do I expect to see in the Unrestricted Net Asset Equity account on the last day of the year, and if QB generates a number for the year what do I do to maintain Net Assets across the funds?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

You'll need to do a journal entry at the beginning of the new year to move the reserves about the various funds. Quickbooks whilst recognising classes is not trying to keep a separate balance sheet for each.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

Hi there, @ClarenceT.

I'm here to provide additional information about sub-accounts in QuickBooks Online (QBO).

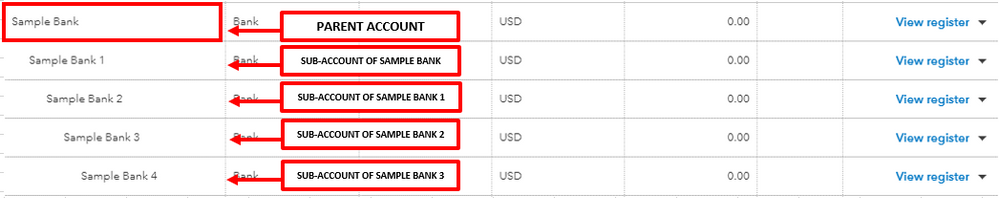

In QBO, you can divide your account by creating a sub-account/s under the Chart of Accounts. In addition, you can also set up a bank or credit card account with multiple sub-accounts to easily connect it to your bank and reconcile downloaded transactions.

When running reports, it'll show an amount on each sub-accounts created and a total to the parent account.

For further details about sub-accounts, you can check these articles:

You can also check this article for more information about fund accounting for non-profits: Fund Accounting for non-profits.

Let me know if you have any other questions about sub-accounts and class tracking in QBO. I'm just a post away to help you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reports and accounting

I can provide more details about sub-accounts, ClarenceT.

In QuickBooks Online, you can create four levels of sub-accounts. There will be a prompt once you've reached the maximum. It'll say "Nesting is limited to 5 levels deep". The 5 levels deep include the parent account.

You can follow the same article provided by Angelyn_T on how to create sub-accounts.

You can shoot me a reply if you have other questions.