Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowGreat to see you here, @rb9876,

Thanks for joining the conversation. I want to make sure you're able to enter your employer paid taxes.

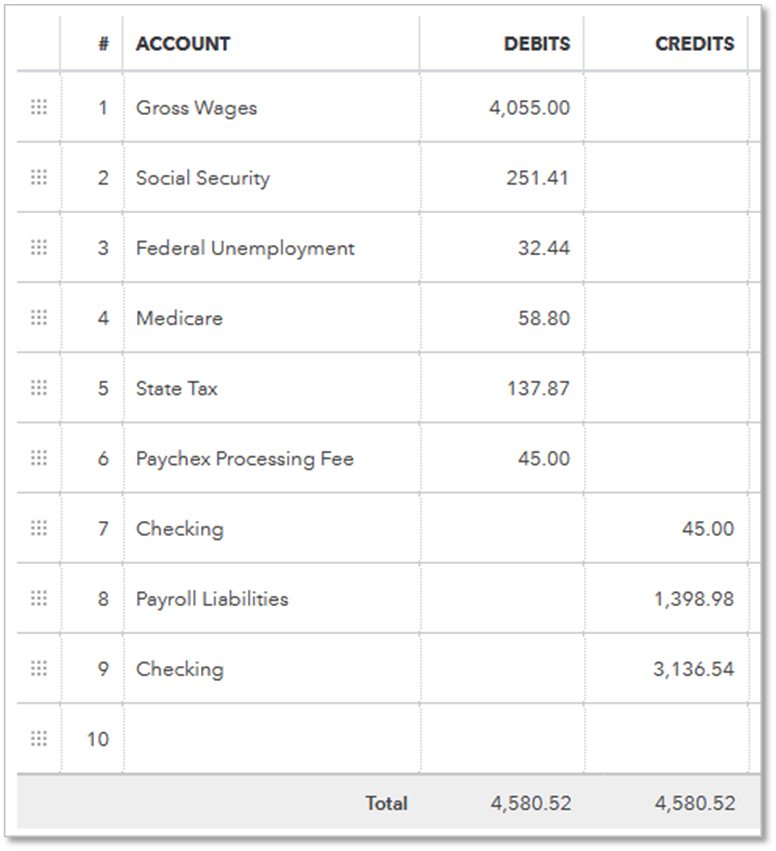

I've checked and verified that the link provided by my colleague is fully working. If you'd like to record payroll liabilities paid by your company, you can follow the steps below:

However, if you have a different situation, I'd recommend checking this article for further instructions: https://quickbooks.intuit.com/community/Help-Articles/Record-payroll-transactions-manually/td-p/1856...

Please let me know how it goes, @rb9876. You got me here to help whenever you needed me. Have a great day!