Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello there, @calicoellie.

I'm here to help ensure you're able to pay your vendor with the fee deducted from their commission.

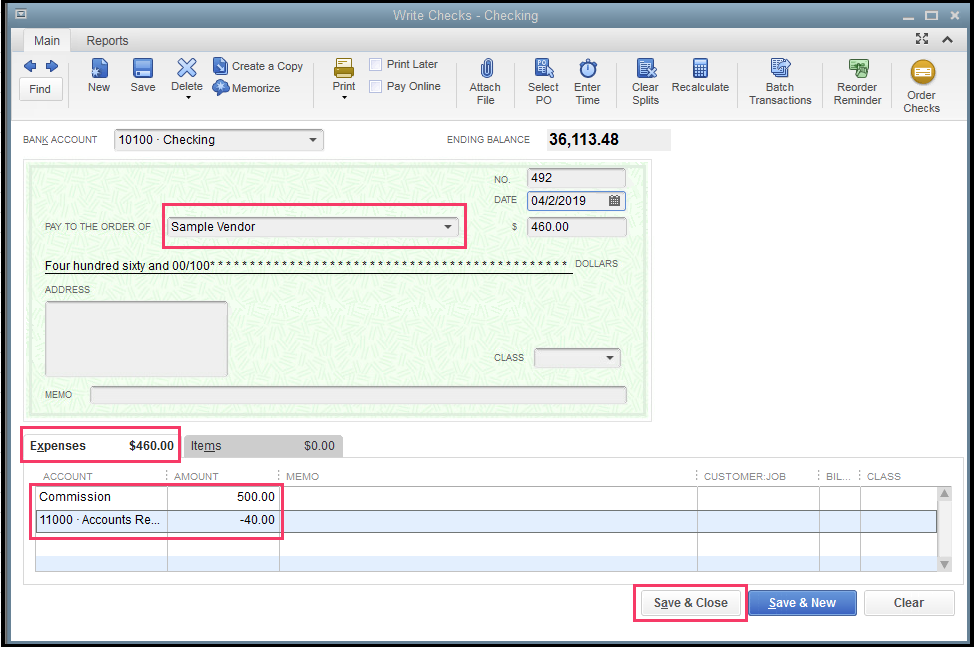

You can write a check for the commission expense, then create another line for the fee with a negative amount. QuickBooks automatically provides you with the net amount in the transaction.

Let me guide you through on how to accomplish this:

To be accurate with your 1099, you only need to map the commission expense.

You can also read through this article for additional information about writing a check: Create, modify, and print checks.

That will answer your concern for today about handling commissions and fees in QuickBooks Desktop.

Let me know if there's anything else I can help with your QuickBooks. Just drop me line and I'll get back to you.