FAQs on Cloud Accounting Software

How Does Cloud Accounting Work?

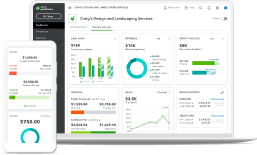

Cloud Accounting hosts all your accounting information online so that you can access such information from multiple devices anytime, anywhere by simply connecting to the internet.

How Secure is Online Accounting Software?

One of the top priorities of cloud accounting software is security for it uses the same security standard as used by banks and other financial institutions.

What are the Benefits of Working in the Cloud?

Working on the cloud lends mobility, provides data security, saves time and cost, brings automation, and prevents data loss.

How Cloud Accounting Software Can Take Your Business To The Next Level?

Cloud accounting software allows for scaling up to cloud capacity, accessing financial information on the go, and facilitating collaboration among multiple users.

What Type of Industries are Using Online Accounting Software?

Cloud-based accounting software is typically by businesses providing services or those in the basic trading industry.

What is Cloud Accounting Software?

Cloud-based accounting software is also known as online accounting software and it helps you manage your books of accounts and store information online.