Using break-even point to determine level of production

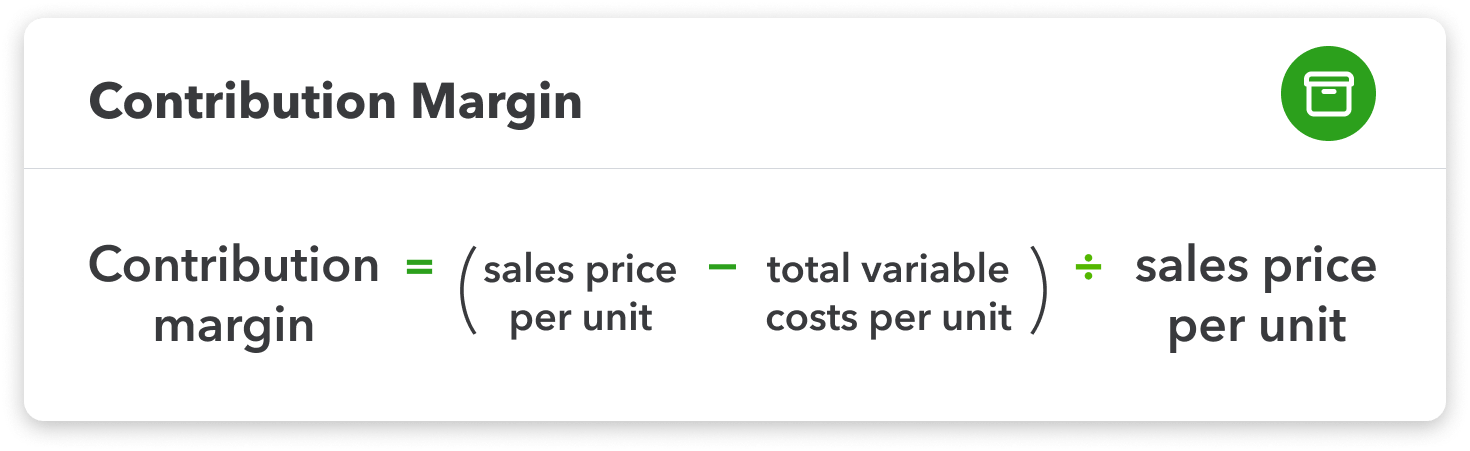

Let's say you’re trying to determine how many units of your widget you need to produce and sell to break even. Again, here’s what we know about your business:

- Fixed cost of running your business: $20,000 per quarter

- Unit variable cost: $10

- Proposed unit price per unit sold: $30

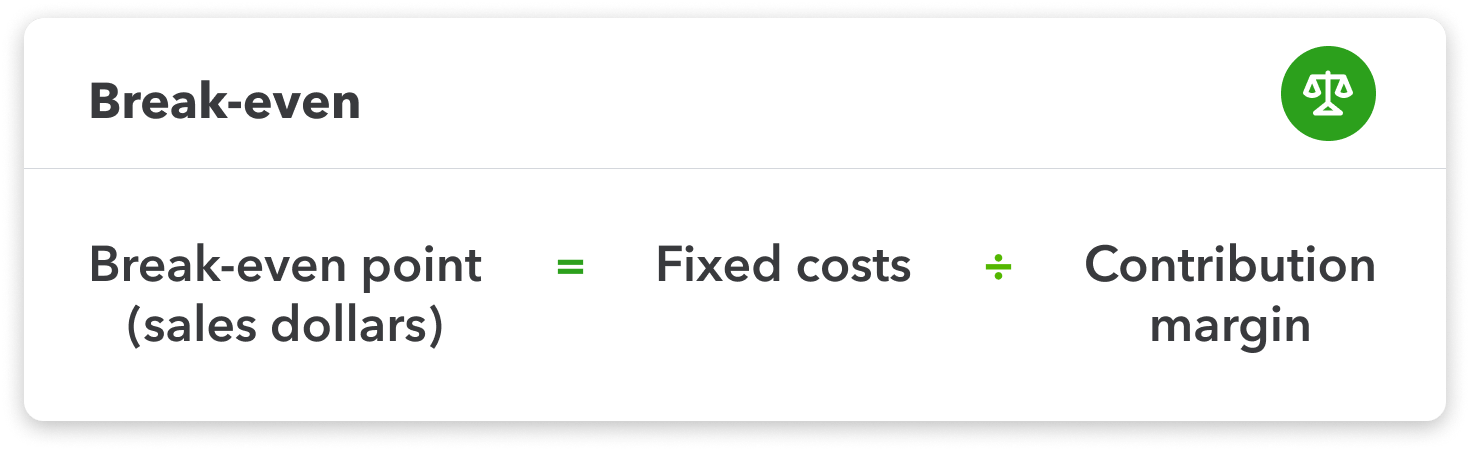

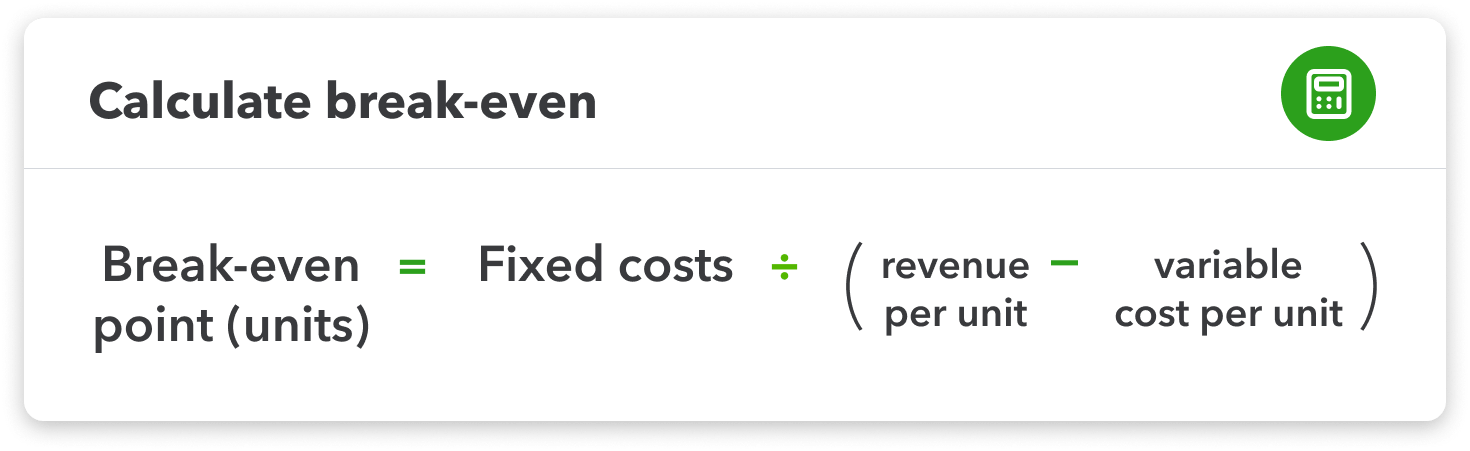

To determine our break-even point in units, we’ll calculate the following:

Break-even point (units) = $20,000 / ($30 - $10)

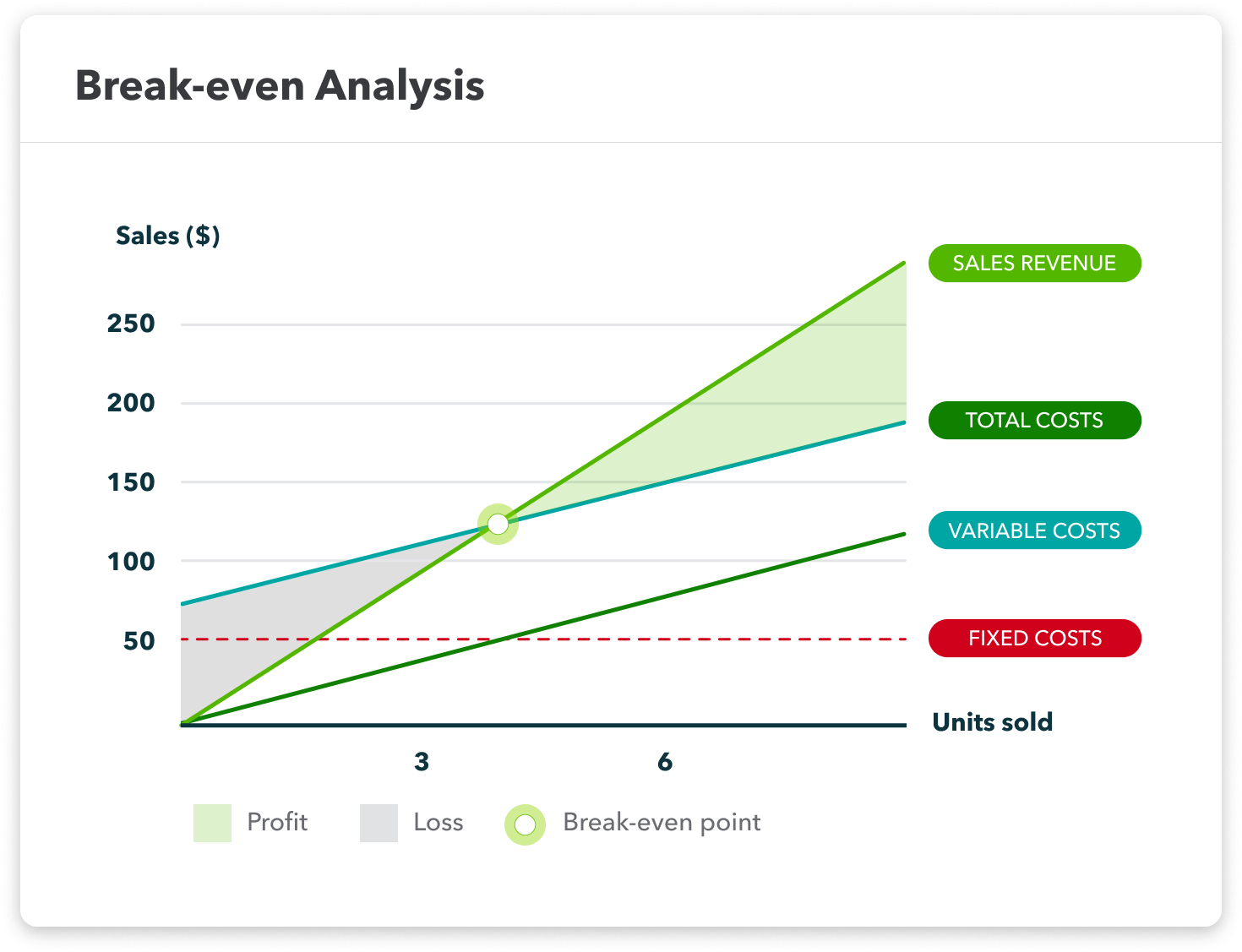

According to the above formula, you’ll need to generate and sell 1,000 units to break even. Any more than that will generate profit. How does that compare to your total sales forecast? If the units sold to break even is greater than your forecasted sales volume, you may want to:

- Increase your level of sales

- Increase your unit production by increasing direct labour.

Performing a break-even analysis can give you insight into many different elements of your business. It can help you understand the following:

- Is a product’s price realistic? If you won’t be able to reach the break-even point based on your current price, you may want to increase it.

- Are your labour costs too high? If your product is so expensive to make that your contribution margin simply isn’t working out, you may need to bring down labour costs.

- Is a product worth bringing to market? If the demand for your product is smaller than the number of units you’ll need to sell to break even, it may not be worth bringing the product to market at all.

As a small business owner, there are so many risks that you take each day. The best way to protect yourself and your business is by limiting your risk. Break-even analysis is an important way to help calculate the risks involved in your endeavour and determine whether they’re worthwhile before you invest in the process.

If you’re looking for other small business tips and financial reporting tools, we’re here to help. QuickBooks can assist with all small business accounting needs, from bookkeeping and reporting to managing invoices. Contact us today to discover what QuickBooks can do to help you and your small business.