This article outlines important features in the GST Centre/GST tab in QuickBooks Online.

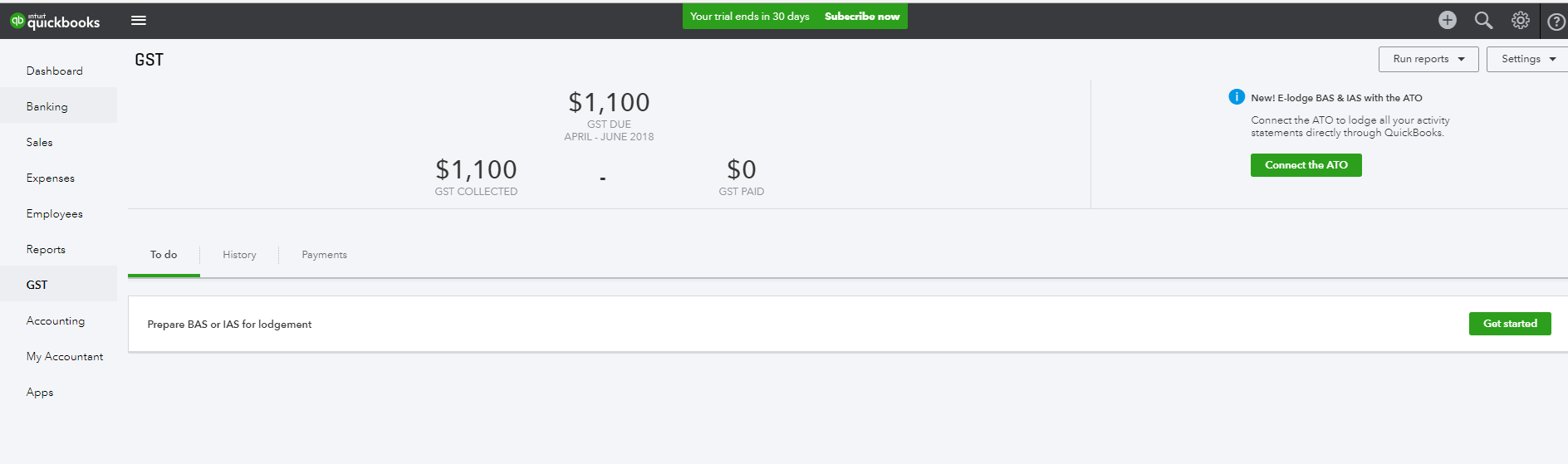

- Go to GST. On the To do tab, you can lodge your first BAS or IAS by selecting Get started. Also, any outstanding BAS/IAS payments will show up in this tab.

- The GST Summary at the top will display figures related to GST only, including GST due, GST collected, and GST paid, for the current period.

- Run reports in the upper right hand corner of the GST Centre holds all GST related reports, which will default to the current GST period based on today's date.

- The Settings menu allows you to access GST settings, Edit rates, and Add Group Rates.

- The Prepare IAS/BAS button kicks off our completely new lodgement experience.

- The History tab displays all activity statements lodged in QuickBooks that have been paid, enabling you to view the lodgement details, whether it was lodged electronically with the ATO, and run Summary, Detail and Amendment reports against that lodgement.

- The Payments tab displays all BAS/IAS payments or refunds made against lodgements in QuickBooks to date, and also enables you to delete the payments or refunds if necessary.