Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm here with some information regarding multicurrency in QuickBooks Online, @userakerslbrianlbria.

Adding transactions in a foreign currency ($US), QuickBooks Online will calculate the amounts and GST in $US on the sales forms. Not to worry, your reports convert all foreign currency to home currency amounts, and automatically reflect exchange rate changes.

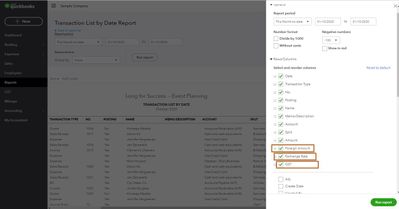

You can pull up the Transaction List by Date report to show all your transactions in a specific period, which can be customized to show the foreign amount, exchange rate, and GST.

Here's how:

For additional insights about GST and Multicurrency, check our these articles:

The Community has your back, so feel free to let me know if you have any additional questions with the GST transactions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.