Setting up provisions for leave liabilities in your QuickBooks Payroll journal

by Intuit•3• Updated 7 months ago

Many businesses using an accrual based accounting system prefer to keep up to date figures on leave liabilities without having to manually calculate and journal these figures into their Balance Sheet. To automate this process, you can configure the Chart of Accounts to map leave liability and expense GL accounts in QuickBooks Payroll powered by Employment Hero.

Once mapped, your payroll journals will then include the associated cost of any leave liabilities in relation to the difference in the leave value balance as at the end of the pay run in comparison to the previous pay run. This also takes public holidays into account.

Select the following headings to find the information you need.

Leave liabilities are any leave types that must be paid out to an employee upon termination. Examples include (but are not limited to):

- Annual leave;

- Time in Lieu/RDO;

- Long Service Leave (in specific cases).

The payroll system will treat a leave category as a liability. For Chart of Account purposes, the leave category setting 'Exclude from termination payout' is unticked. As such, and as a starting point to setting up leave liability provisions, you should make suure that all the leave categories set up in your business have this setting correctly applied.

To configure the leave provisions,

- Go to Settings

and select Payroll settings.

and select Payroll settings. - Select Chart of Accounts.

- Select Leave Provisions from the Primary Accounts section to expand the details.

For any leave category you want tracked in the journal, complete as follows:

This could be a generic leave liability account or a liability account specific to a leave category (and this depends on how your GLs have been set up which sit outside of payroll). If the liability account(s) are not appearing in the dropdown list this means they have not been brought across from the accounting platform or they have not been manually added to the payroll platform.

- Depending on the journal service you have linked (i.e. whether it is API based or a file export based journal) you will see either Import Accounts or Manage Accounts on your window.

- Select the button to then follow the process of importing the relevant GL accounts from your accounting platform or to manually add the GL accounts.

If you have assigned a liability account against a leave category, you must also assign an expense account in the same manner.

Important to note: this setting is only relevant (and activated) for leave categories that have the Leave Category Type setting assigned to 'Long Service Leave'.

This setting requires the user to set a 'Standard Contingent Period' and 'Standard Entitlement Period'. With regards to long service leave, the contingent period is that period before an employee's entitlement period where, upon termination, the employee can still be paid out their accrued entitlement based on certain circumstances.

By default, if the 'Accrue from Contingent Period' isn't ticked, the liability for long service leave will only start appearing in journals for employees that have reached their entitlement period. Ticking that setting means the liabilities will start appearing sooner but only once the employee has reached their contingent period (which is based off their start date).

Select this setting if you want the journals to split the associated liability and expense by location rather than appear as one lump sum amount. This setting only works if you have assigned a liability and expense account to a leave category. The employee's primary location will be the location used to assign the leave provisions, not the location where the employee worked.

The leave provisions settings can also be configured in the 'Location Specific Accounts' section of the Chart of Accounts screen. If you have Location Specific Accounts set up and wish to 'Accrue from contingent period' you will need to ensure this option is ticked for all locations where the employees work.

Journal entries for leave provisions will appear in a journal when anyeither of the following scenario occurs:

- When leave is accrued for a leave category that has been mapped in the Chart of Accounts;

- When leave is taken using a leave category that has been mapped in the Chart of Accounts;

- When an employee's pay rate changes;

- When a leave adjustment has occurred using a leave category that has been mapped in the Chart of Accounts;

- When leave is paid out upon termination for a leave category that has been mapped in the Chart of Accounts.

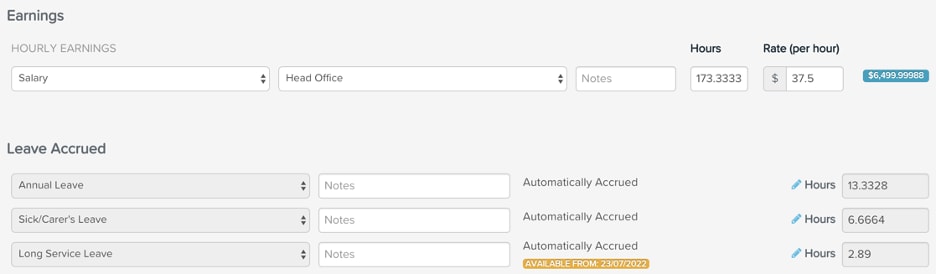

Now, assuming that the annual leave category has been mapped in the Chart of Accounts and an employee's pay for the pay period is as follows:

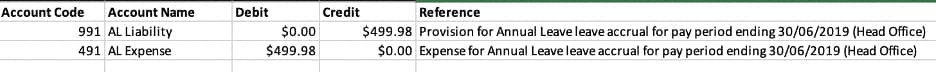

The corresponding journal transaction lines for the accrued annual leave provisions will appear as follows:

The amount is calculated by multiplying the employee's (base) pay rate x the number of annual leave hours accrued in the pay run. If an employee was also entitled to annual leave loading, the dollar value of the loading component will also be added to the provision amount.

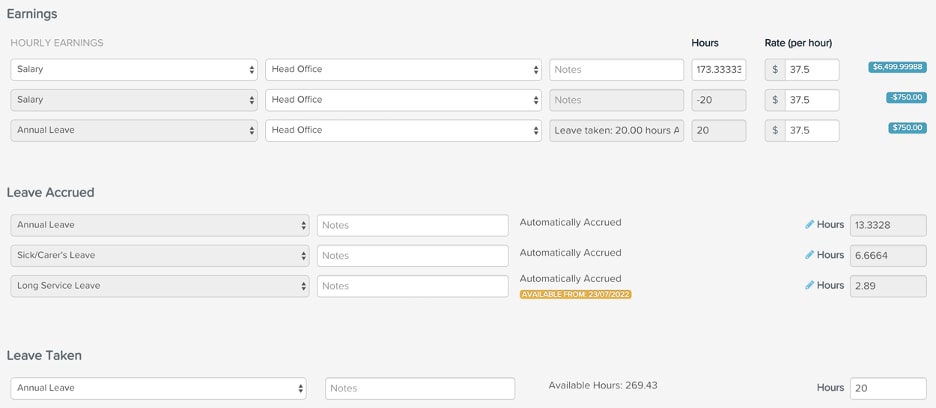

Now say the employee took annual leave during the pay period:

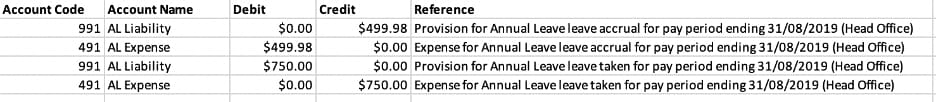

The leave provisions for the employee will appear as per below. The leave taken reduces the liability and is classed as a debit, rather than a credit.

Changes to the journal will calculate the difference in the leave value balance as at the end of the pay run and the previous pay run. In other words, the system will project leave taken forward from the end of the pay run and subtract the leave accrual projected from the previous pay run. This also takes public holidays into account.

The way that the leave liability will be calculated will mimic the current calculation of the leave liability report.

The following pay run activities will trigger a change in journal data:

- Pay rate changes;

- Rate loading;

- Change in hours worked;

- Leave taken;

- Adjusted leave.

In addition to the above, we will no longer journal the effect of pay adjustments on accrued leave as a separate line item. It will be combined in the leave accrual value.

Important to note: when calculating the difference, the 'previous' pay run is the most recent finalised pay run for the employee with a pay period start before the current period start and pay period end before the current period end. This is based on the pay schedule and does not include opening balances.

When salary sacrifice deductions are processed in a pay run, this amount will be deducted from the highest wage expense and allocated to super in the journal. In the instance an employee has taken paid leave for the entire pay run the salary sacrifice will deduct this amount from the leave category and allocate to super, in effect reducing the leave expense.

When an employee's pay has been adjusted (be it an increase or decrease), the adjustment value will be combined in the leave accrual value for any leave category that has been mapped to the Chart of Accounts.

The amount is calculated as the difference between the new rate vs the old rate multiplied by the employee's leave balance as at the start of the pay period. For eg, an employee's pay increased from $20 per hour to $25 per hour and at the start of the pay run the employee had an annual leave balance of 20 hours. Any leave accrued in the pay run will be calculated at the new hourly rate so the journal will only deal with the leave balance prior to the pay run.

The $100 is the result of multiplying the 20 hours balance by the difference of $5 per hour. On the reverse side, if an employee's pay was reduced from $25 to $20 per hour, the amount will still appear as $100 however as the rate reduction has reduced the leave liability, the liability amount will appear as a debit rather than a credit.

This section applies to businesses who have already been processing pay runs and have never tracked leave provisions in their balance sheet but want to start now. Remember that the above functionality only tracks leave activities on a per pay run basis. This means you will need to manually journal existing liabilities in your accounting platform in order to get a full picture of any leave liabilities of the business.

To do this,

- Generate a Leave Balances report as at the date of the last pay period end date.

- Ensure the report is grouped by 'Employee Default Location' and the 'Hide Leave Values' setting is unticked.

- Export the report in excel or csv - this will provide you the current dollar value of all leave liabilities against each location.

- Use this data to then transfer to your accounting platform.

A special note regarding long service leave: if you want to track long service leave take note of whether you want to apply it from the contingent or entitlement period. Then, make sure you only record the liabilities for the employees that have reached either their contingent or entitlement period (depending on what period setting you have applied).

Content sourced from Employment Hero.

More like this

- Set up and configure payroll chart of accountsby QuickBooks

- How to Add Leave Categories in QuickBooks Payrollby QuickBooks

- Set up a loan in QuickBooks Onlineby QuickBooks

- Record a loan for an asset in QuickBooks Onlineby QuickBooks