Introducing Prep for taxes

by Intuit•2• Updated 5 months ago

Learn how you can use Workpapers in QuickBooks Online Accountant to streamline year-end processes, manage client financial data, and work more efficiently with your team.

Workpapers helps you save time when preparing formal reports and financial statements. Everything you enter is automatically saved and only visible to you and your team—your clients won’t see it.

| This article is for accountants and bookkeepers using QuickBooks Online Accountant. |

Key features of Workpapers

- Trial Balance activity timeline: Filterable timeline showing client and accountant activities affecting balances.

- Adjust balances in Trial Balance: One-click access to transaction details.

- View other transactions: Displays all non-adjusting journal entries and reclassified transactions.

Accessing Workpapers

- Sign in to QuickBooks Online Accountant where you have client access.

- Select the link under the Workpapers column, or in the client file, go to Accounting review from the left navigation.

- Select Workpapers.

- Open the Review & adjust sub-tab. Here you can:

- Upload documents for each account line by browsing files, dragging and dropping, or pasting shared links (e.g., Google Drive).

- Leave notes for your team.

Note: There is no general document folder, but you can attach files or links per account line within Review & adjust.

Printing from Workpapers

- In the Tax mapping section, select the printer icon.

- In the Review & adjust section, select the printer icon.

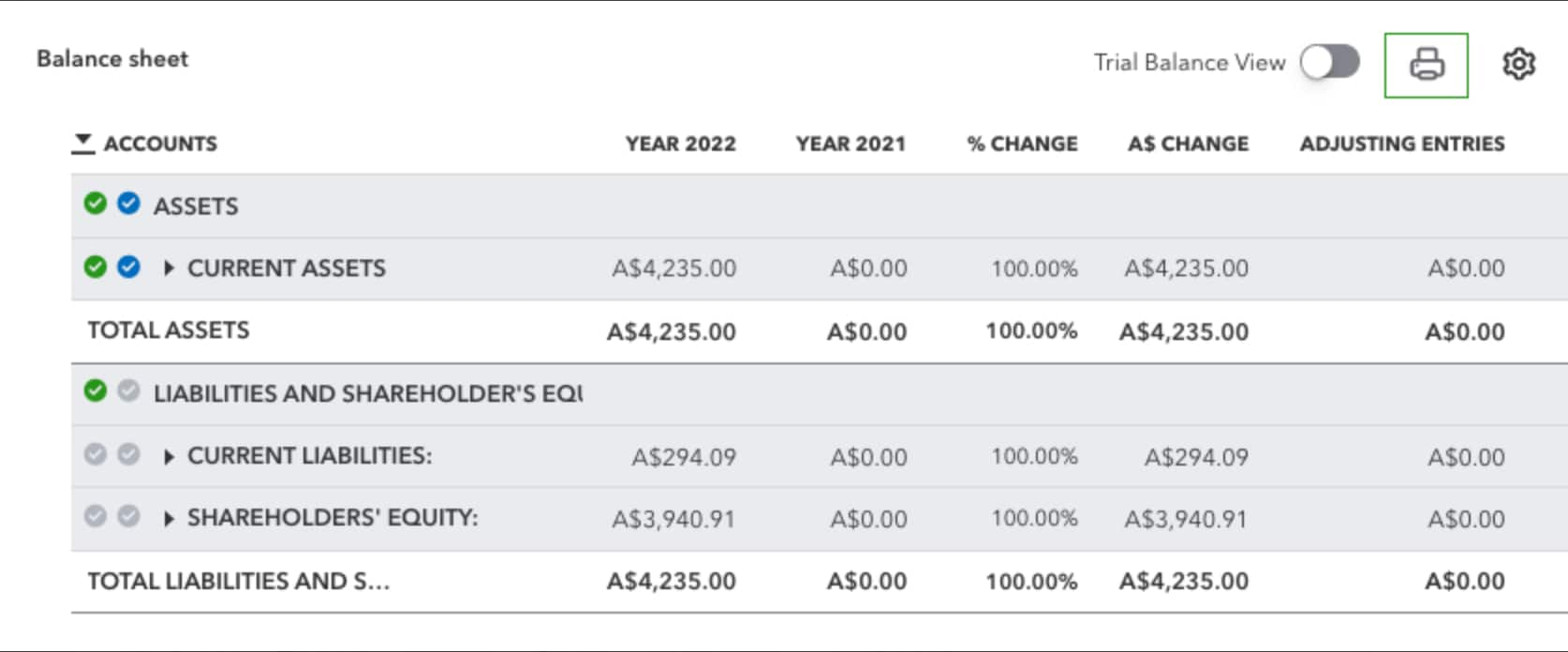

The 'Prep for taxes' or Trial Balance feature is designed for Accounting professionals to simplify year-end accounting processes. Its goal is to save time and resources required to gather formal reports and financial statements at year-end.

This feature is available in QuickBooks Online Accountant edition and is accessible through the Accountant dashboard through the Accountant Tools. All information and notes entered into the 'Prep for taxes' is automatically saved, and is only made visible to Accountants and Bookkeepers (clients will not have visibility).

Feature highlights

- Track progress: hover over the ticks to see when and who has prepared or reviewed each account.

- Trial Balance activity timeline: a filterable timeline that displays client and Accountant activities impacting balances.

- Make adjustments in Trial Balance: one-click access to transaction details.

- Add notes and attach documents that will only be visible to you and your firm.

- Other transactions: shows all non-adjusting journal entries and re-classified transactions.

How to access Prep for taxes

- Sign in the QuickBooks Online Accountant firm where you'll see the client you were granted access to.

- Select Prep for Taxes from the Accountant Tools section.

- The screen will display a Documents section. Select the sub tab called Review & adjust. You can also browse for documents, drag and drop, or leave notes for team members under the Prep for taxes column.

How to print from Prep for taxes

On the Tax mapping section, select the printer icon.

On the Tax mapping section, select the printer icon.

Frequently asked questions

How do I access my client's company files?

The process of accessing a client company's file remains the same, the navigational component will not change. Client files can be accessed directly from the QuickBooks Online Accountant dashboard through the Accountant Tools.

Is Prep for taxes only available to Accountants?

Prep for taxes is available to all Accounting professionals who use the QuickBooks Online Accountant software.

Can I use Prep for taxes for my personal tax return?

If another Accountant in my firm makes changes to Prep for taxes, how can I review the Audit trail?

You can review the changes made to Prep for taxes in QuickBooks Online by accessing the Audit Log under the Gear icon.

If another Accountant in my firm makes changes to Workpapers, how can I review the Audit trail?

Can you update Prep for taxes simultaneously with another user?

No, only one Accountant will have accessibility to update a client's file at a time. This ensures that redundant or duplicate work is not entered into Prep for taxes.

Does WorkPapers only work with ProFile?

Does WorkPapers work with TurboTax Business Incorporated?

Does WorkPapers work with non-Incorporated businesses?

More like this

- Introducing Intuit Intelligenceby QuickBooks

- Prep for Taxes Document Managerby QuickBooks

- What is Simpler GST?by QuickBooks

- Prepare and lodge a BAS for your client in QuickBooks Online Accountantby QuickBooks