Review your clients' books in QuickBooks Online Accountant

by Intuit•1• Updated 2 days ago

Learn what to review every month for each of your clients in QuickBooks Online Accountant.

With so much going on for every client, it can be hard to stay on top of everything. Fortunately, you can use the Books review tool to finish specific tasks in each client's QuickBooks Online account every month.

The books review tool focuses on common yet tricky bookkeeping areas: incomplete transactions, reconciliations, and account balances. It lists key tasks so you can quickly tie up any loose ends, prioritise work, and customise your own tasks for review. You can even collaborate on transactions with your client directly in QuickBooks, send and receive messages, and upload documents.

Step 1: Start a books review

Do books reviews for each of your clients, one at a time.

- Open a client's QuickBooks Online account.

- Select Books review.

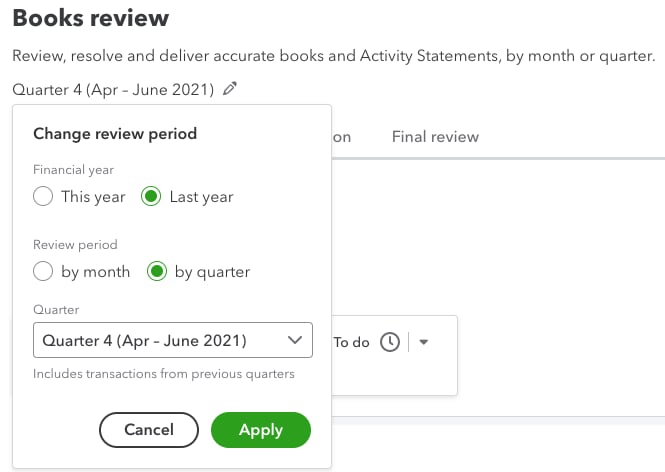

- Select Edit ✏️ next to the date to choose the Review period.

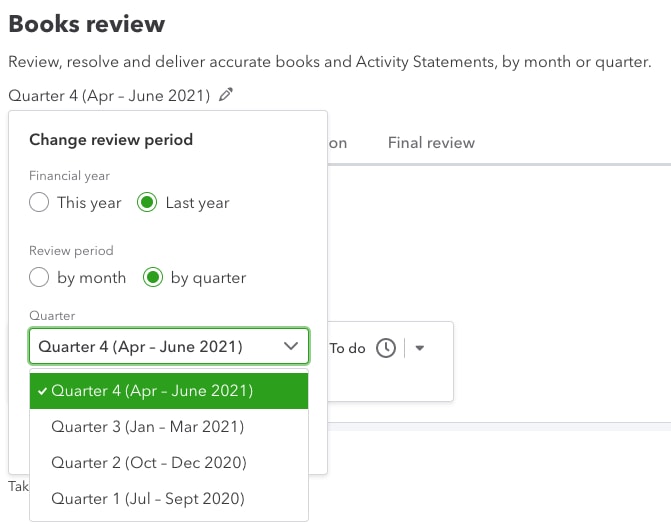

- If you select the review period by quarter, select the Quarter dropdown to choose the quarter to review.

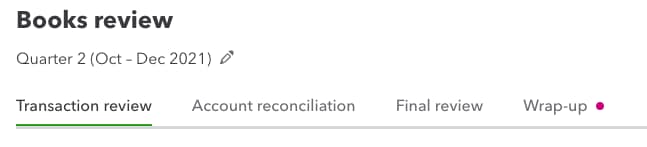

Tasks are divided into four sections. Follow the tabs in order. Start with the Transaction review tab. Then move on to the Account reconciliation, Final review, and Wrap-up tabs.

Step 2: Fix incomplete transactions

The Transaction review tab shows transactions with missing or incorrect info. QuickBooks flags uncategorised transactions, transactions without payees, transactions without GST, duplicate transactions, undeposited funds and unapplied payments.

If data is missing, you'll see a blank line in the column. Select a transaction to open it and make corrections. You can also collaborate with your clients to capture missing transaction-level information. Here’s how:

- Select one or more transactions. In the Action pop-up that displays, select Ask client.

- The Create a request form automatically fills out a name and description along with the request for missing transaction-level details. You can edit these fields, such as the due date when you’d like a client response, or add additional documents.

- Select Share. Your client is sent an email notification to open QuickBooks Online and respond with additional details for the transaction(s).

- Have your client log into QuickBooks, then go to My accountant, then the Requests tab. Here, they can open each request to explain what they bought and why.

- Once your client has responded to the request, you can find the reply in Books review. Select Client requests ▼ dropdown, then View all requests.

Step 3: Finish reconciling accounts

The Account reconciliation tab lists accounts you need to reconcile. Make sure to use Select accounts to narrow down the list you'll be reconciling.

Select an account to start reconciling it. Use the info in each column as a guide so you know how much work needs to be done. Outstanding transactions appear in the Unreconciled column.

Step 4: Check account balance issues

The Final review tab lists any unusual or unexpected balances that you may need to adjust, as well as financial reports you should check every month. Scroll down to the Reports section and select Review to open a report. QuickBooks automatically filters reports for the month you select.

Step 5: Wrap up your clients' book review

The Wrap-up tab lets you prepare reports, send the reports package, and close the books. You can also customise the report template on this screen.

Check the books review progress

You can easily check the status of current books reviews for each of your clients:

- In QuickBooks Online Accountant: Follow this link to complete the steps in product

- Select the Bookkeeping tab.

- Review the status of the Books review column.

- Select the icon in the Books review column to see which tasks are finished or open.

![]()

Note: Client requests with due dates set for a future year won’t appear in the Books review tab in QuickBooks Online Accountant. To view these requests, go to your client’s QuickBooks Online company and find the task in the My accountant menu.

Create additional items to track monthly tasks

Under each tab, you can create your own tasks. These help you keep track of items you need to accomplish for your month-end close. To create a task, go to the Shortcuts section and select + Add.

- Go to the Additional items or Reports section.

- Select + Add.

More like this