Update foreign employee information for STP Phase 2

by Intuit• Updated 2 years ago

With STP Phase 2, employees of a business who are located overseas and classified with an income type of foreign employment will also have to have their work Location configured to the country they're working in.

This will allow for earnings paid to employees to be reported against the country of the location such earnings have been allocated to.

As such, and only for businesses with foreign employment income type employees, we strongly suggest reviewing the location set up in the business and make sure that:

- separate locations are set up for each non-AU country where employees work

- non-AU locations are separated by country, for eg if there is an employee working in Greece and another employee working in Italy, a location per country (as a minimum) should be set up

- foreign employment income type employees are assigned a primary location that is specific to the country they work in and, if such employees are required to submit timesheets, they are submitting timesheets for locations specific to the country of work

The above rules will ensure that, when reporting earnings for foreign employment income type employees, the country code will be reported as per Phase 2 requirements.

What do I need to do?

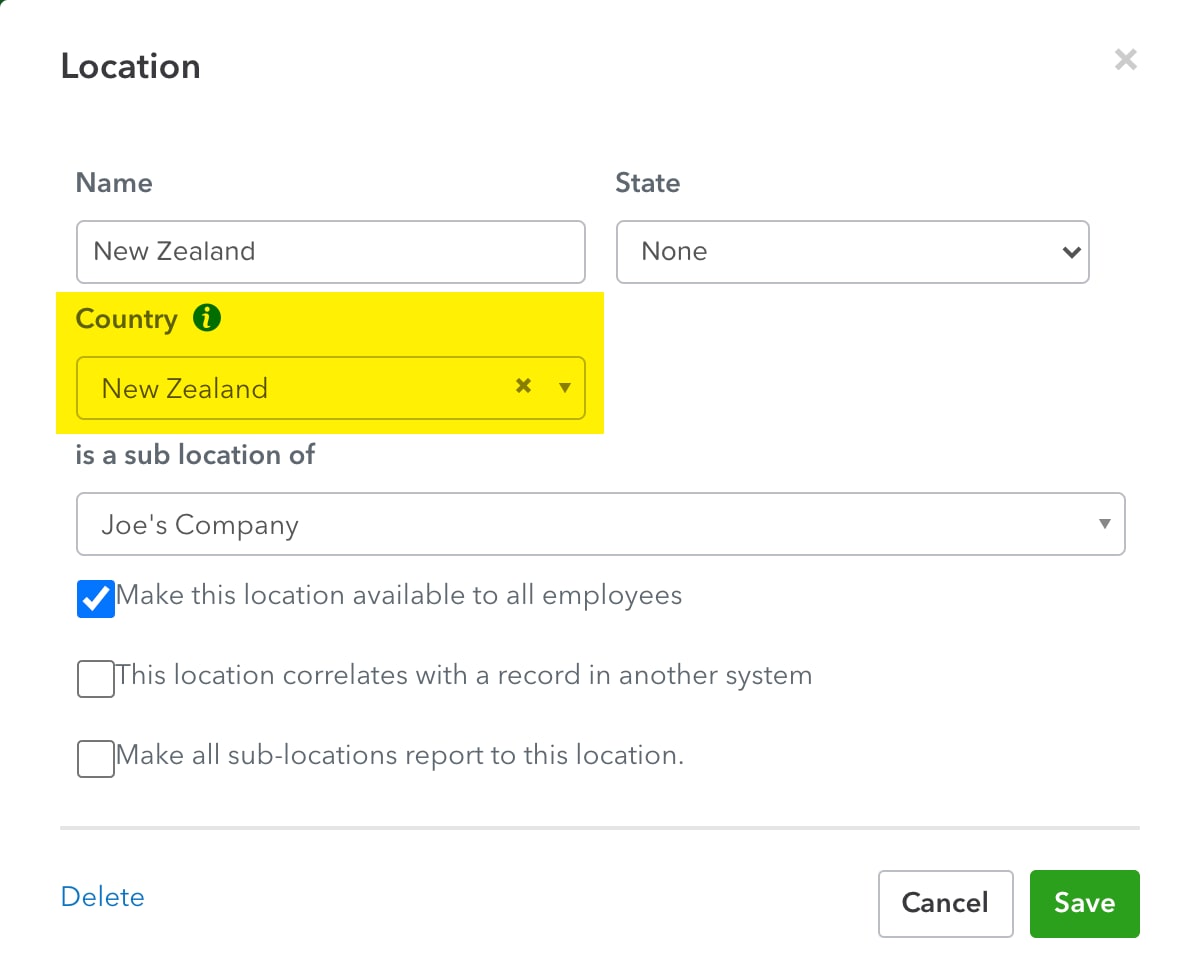

To make changes to Location information:

- Select Employees, then select Payroll Settings.

- Select Locations under Pay Run Settings.

- Select the location you want to change, then select the Country under the dropdown menu.

- Select Save.

I've updated my foreign employee's status, what's next?

Below are the changes that most businesses will need to make in preparation for STP Phase 2:

- Update pay category classifications

- Update leave category classifications

- Update deduction category classifications

- Review employee tax file declaration information

If any of the following apply to your business, make these changes as well:

- If any employee is closely held, under foreign employment, an inbound assignee to Australia, labour hire or other, update their income type in the employee's settings

- If the business terminated an employee from 1st July 2021, provide a termination reason

- If you have working holiday maker employees, classify them correctly and state their country

More like this