Manage Pay Run Tasks

by Intuit•1• Updated 1 month ago

As a payroll manager, you get requests coming in all the time from staff that can potentially affect your pay runs. You may get ad hoc requests to add a child support payment or adjust a salary sacrifice super amount or to change an employee bank account. Sometimes these requests can be processed in advance, but you may need to adjust them in a pay run.

On top of this, you have the normal things you have to do like check the bank account for funds, review timesheets to ensure they’re all approved, check for employees taking more leave than they should and more. These are standard operating steps that can easily be forgotten or missed on each pay run.

Pay run tasks make it easy to track all your pay run processing steps by allowing you to set up recurring and one-off tasks that can be applied to the entire pay run or specific employees.

From within the task management screen, you can quickly add new tasks as well as review upcoming tasks for a given pay run.

Getting Started

- Follow this link to complete the steps in product

- Select Pay Runs tab and select Manage tasks.

Creating a task

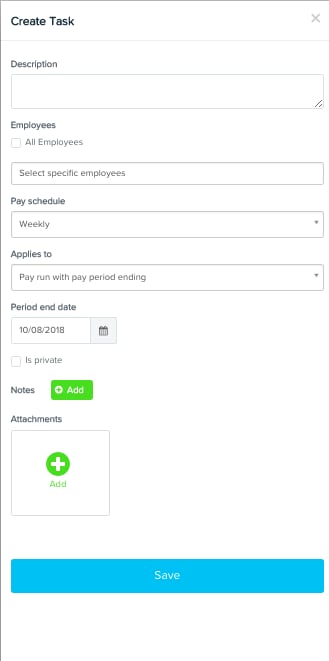

Click Create a Task and use all or some of the following options to configure the task:

- Description

- Employees (all or specific employees)

- Pay schedule

- Applies to

- Period end date

- Private or public

- Add notes to relevant tasks (When adding a note, you can choose whether managers are able to view the note or not.)

- Attach any documents relevant to the task

View and manage tasks

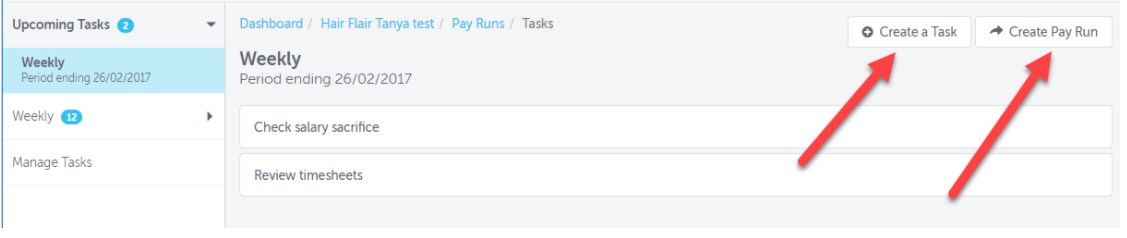

You can do a number of things from within View Tasks:

- Create a Task

- Create Pay Run

- View upcoming tasks

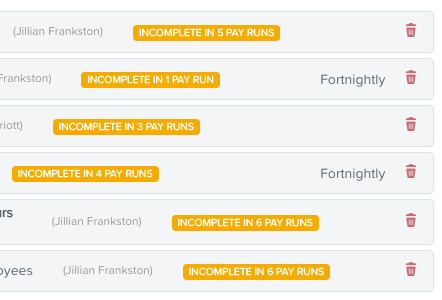

- See a snapshot of tasks that haven't been completed in pay runs

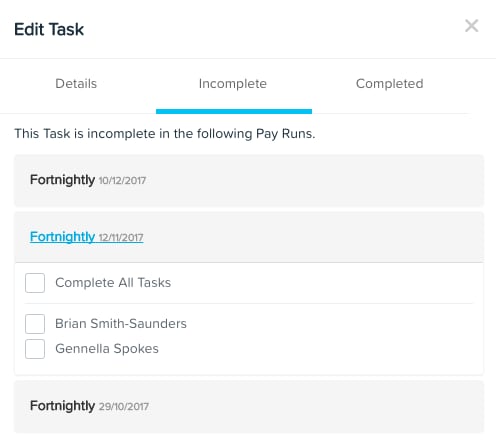

- Mark a task as complete for a historic pay run

Select a task to open the context panel. You will be able to view details of the task, and see which tasks have been completed for each pay run.

Tasks in the Pay Run

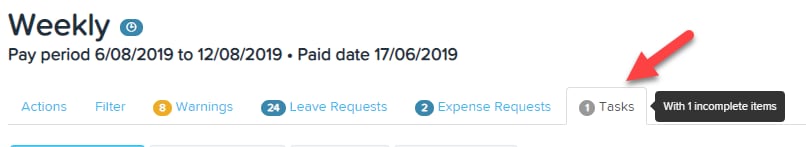

When you go to process a pay run, the task list will be present and you’ll be able to view which tasks need to be completed.

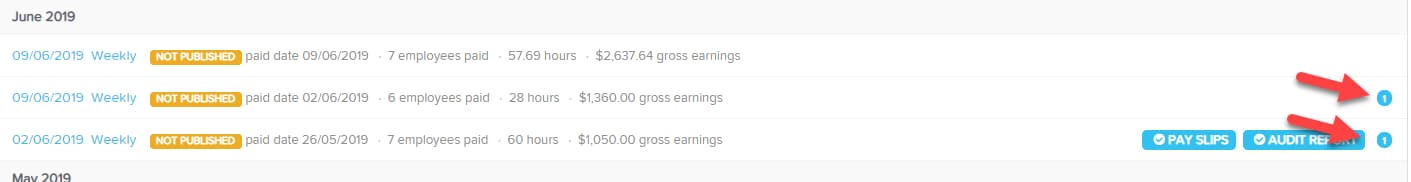

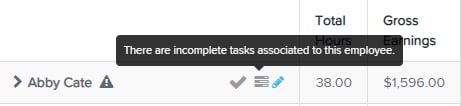

You can quickly see which pay runs have tasks pending in the pay run list view.

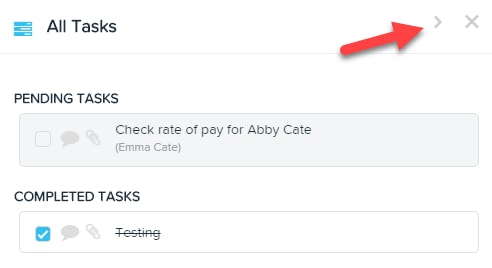

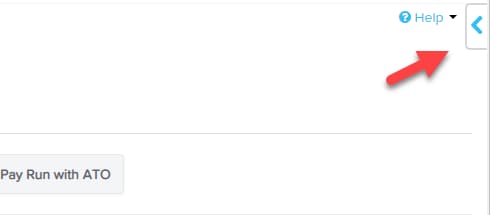

From within a pay run you will be able to view the task list and then use the minimise arrow to Move the list aside while you action the task.

Then you can return to the list by selecting the arrow again.

You can also quickly see which employees have a task assigned as they’ll have the Tasks indicator next to their name in the pay run.

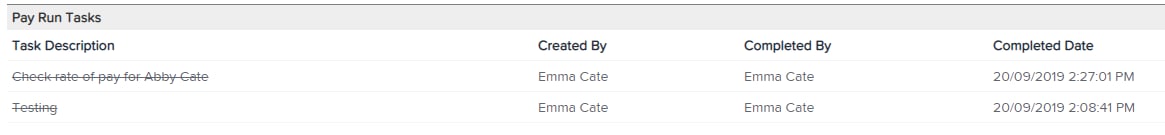

Finally, you can review the completed tasks in the pay run audit report. You can also generate a Task Report to get more details of tasks for a specific pay run or date range.

More like this