- AU QuickBooks Community

- :

- QuickBooks Q & A

- :

- Manage suppliers and expenses

- :

- How do I split a bill payment to OS supplier with a bank fee

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

I have an Australian business but recently started buying and selling goods overseas.

I have set up foreign currencies in my quickbooks and set up my suppliers in the currency they want to be paid in.

(I have also opened up an online Payoneer account to transact in different currencies.)

Everytime I pay a supplier, Payoneer adds a small bank fee. My question is, how do I pay a supplier and tack on a bank fee to the payment transaction?

At the moment the only work around I can find is to add the bank fee to the invoice I receive from my supplier, but not an elegant solution because I get an invoice for say $1000 USD but after I pay the bill and find out what the bank fee is I have to go back and modify the bill in quickbooks for a higher amount eg $1006.53 USD and now the bill in quickbooks doesn't match the invoice my supplier sent me. Would be much easier to split the payment with 1000 going to my supplier and 6.53 going to "Expenses: Bank Fees", but quickbooks won't let me do it. I also can't seem to find out how to open the bill payment general journal entry and modify it accordingly. I remember in the PC version of quickbooks every transaction could be found in the general journal.

Solved! Go to Solution.

Labels:

Best answer September 06, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hi there, quickcut.

Let me join this thread so I can share more details on how to handle Payoneer transactions.

There's a better way so you don't have to manually record the bills from your supplier and match them. We can directly split the downloaded transaction. That way, we can properly categorize the actual amount you paid your supplier and the fee from Payoneer.

Please follow these steps:

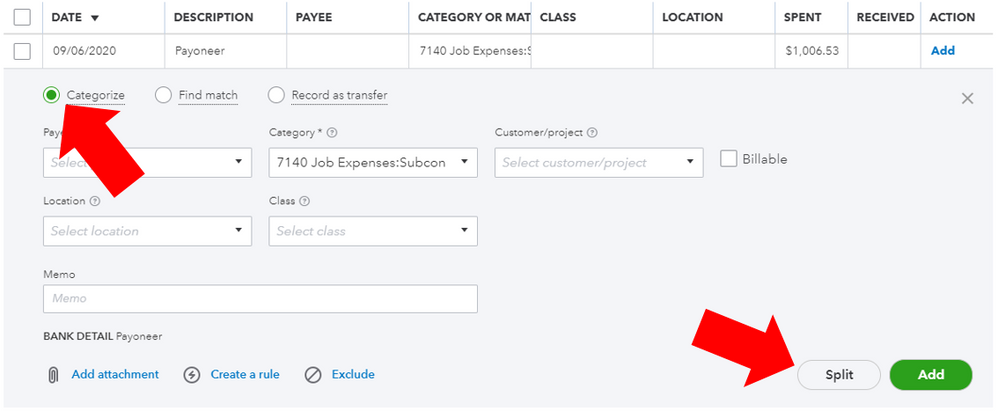

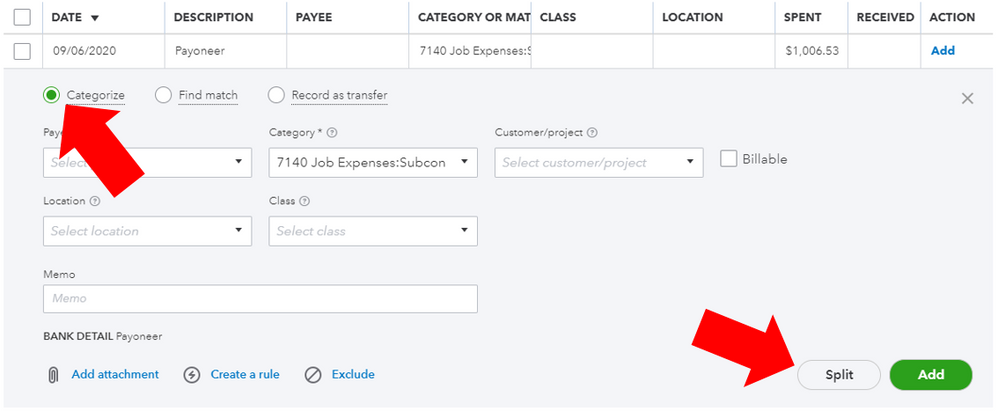

- From the Banking, select the downloaded transaction from Payoneer.

- Select the Categorize button and click Split.

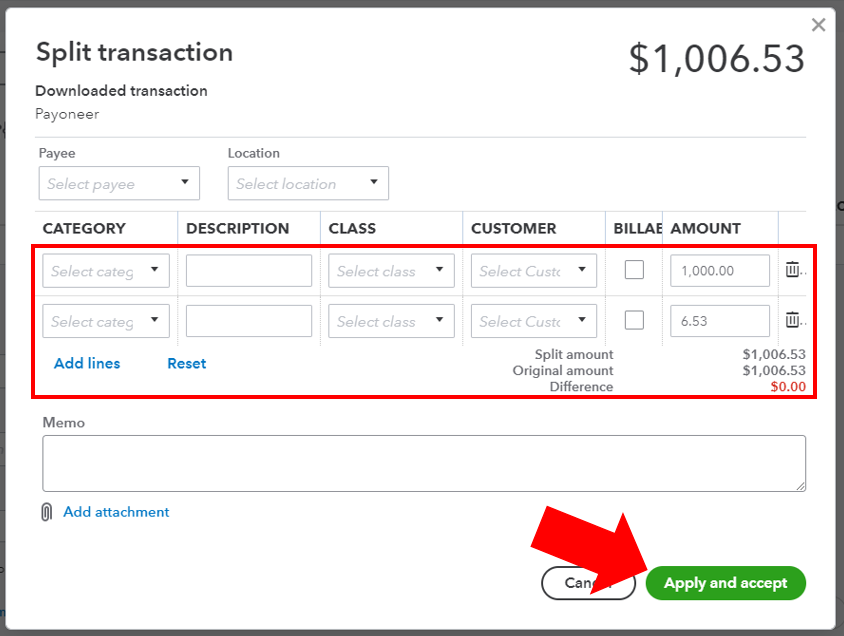

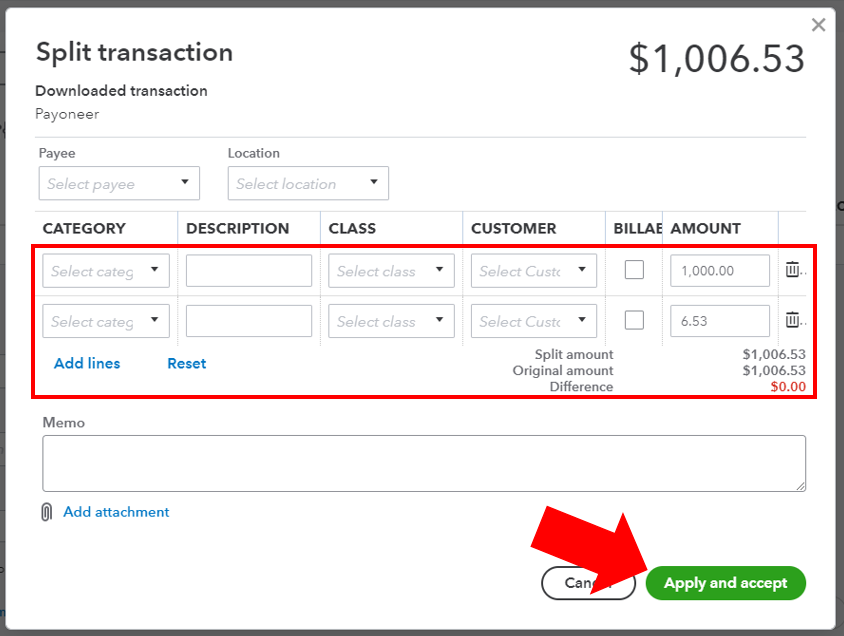

- Enter 1000 on the first line and 6.53 on the second one. Choose the correct accounts.

- Click Apply and accept.

Please refer to the screenshots below:

I've included this link if you need assistance in reconciling an account in QuickBooks Online.

Please post again if you need anything else. I'll be here!

8 Comments 8

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hello @quickcut,

You'll want to use the find match option from the banking section so you can add the bank fee. Let me walk you through how.

- Go to Banking, then Banking at the top.

- Select the transaction, then the Find match radio-button.

- A match transactions window will open, tick the bill transaction. Then, switch the Difference option.

- This will bring up the Add resolving transactions section. This is where you're going to add your bank fee account and amount.

- Click Save. See image below.

With these steps, you're able to record your bank fee correctly. You can learn more about bank fees at this link: How to account for Bank Fees when matching transactions in Bank Feed.

I'll also share with you our page about categorise and match online bank transactions in QBO which I'm sure you'll find helpful. It has detailed steps that'll guide you through the process.

That's all there it to it. Please drop a comment anytime if you have other questions or concerns. We're always here to help. Thanks for reaching out to us today, and have a lovely weekend ahead.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hi ShiellaGraceA,

Thank you very much for your prompt reply!

Unfortunately though, I'm only able to get to step 2 in your instructions. Please see my comments below (after the asterisks.)

ie

- Go to Banking, then Banking at the top.

*This I can do - Select the transaction, then the Find match radio-button.

* My payoneer accounts do not show up here however I downloaded a .CSV of my USD account and managed to get it to display on this screen similar to my other accounts.

* unfortunately when I select the transaction there is no "Match" radio button - it only shows with "Categorise" and "Record as a transfer" radio buttons.

* if I select "Categorise" I get 2 options for the transaction type drop down list "Expense" or "Check" (cheque?) neither of which will let me do what I want to do.

* cannot proceed from here. - A match transactions window will open, tick the bill transaction. Then, switch the Difference option.

- This will bring up the Add resolving transactions section. This is where you're going to add your bank fee account and amount.

- Click Save. See image below.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hi there, quickcut.

Let me join this thread so I can share more details on how to handle Payoneer transactions.

There's a better way so you don't have to manually record the bills from your supplier and match them. We can directly split the downloaded transaction. That way, we can properly categorize the actual amount you paid your supplier and the fee from Payoneer.

Please follow these steps:

- From the Banking, select the downloaded transaction from Payoneer.

- Select the Categorize button and click Split.

- Enter 1000 on the first line and 6.53 on the second one. Choose the correct accounts.

- Click Apply and accept.

Please refer to the screenshots below:

I've included this link if you need assistance in reconciling an account in QuickBooks Online.

Please post again if you need anything else. I'll be here!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hi There, I have a similar situation, but the previous example doesn't seem to address it 100%. Similar to AlexV, I receive invoices from my suppliers which I load as Bills as delivery is in the future and multiple payments will be made towards the bill total.

For the partial payments made towards the bill, I use a similar provider to Payoneer, which charges a fee for each transaction, we want to capture this (amount paid to supplier+ bank transaction fee) split.

The process indicated here, using the Banking->Categorise approach works fine for the split and is an easy way to create an Expense, however how do you match the newly created expense as partial payment to the original Bill for the supplier?

On the other hand, using the Bill Payment option to register a partial payment doesn't allow you to enter multiple lines/split categories as the Expense screen does. Again the idea is to split the total payment in 2 lines to capture the amount paid to supplier+ bank transaction fee.

Is Anyone able to shed to light on how to record partial payments towards a bill where those payments have to split categories? is there an time efficient way to do this or is it too much for QBO?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Thanks for checking in with us, Fpal.

In QuickBooks Online (QBO), we can add the fees on the bill so it'll automatically match the payment amount or check. If you haven't added the fees to the bill and your bank account is connected to QuickBooks, just resolve the difference when matching the transactions. Here's how:

- On the Banking page, go to the For Review column.

- Look for the downloaded transaction (check/payment).

- Click on it, then tap on Find match.

- Select the bill under the Select transaction to match page.

- Hit the button in between Resolve and Difference at the bottom of the page.

- Enter the fees under the Add resolving transactions section.

- Press Save.

For more details about this one, see the Categorise and match online bank transactions in QuickBooks Online article. Once done, you can start reconciling your account in QBO.

Feel free to visit our Banking page for more insights about managing your bak feeds transactions.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

I have been following this thread but the instructions don't resolve my similar issue. If I make a Bill payment in a different currency there is a bank charge. When I see the transaction on banking, it includes the bank charge and will not allow me to match the payment to the original bill.

I can split the expense, but then the bill still shows in my expenses and If I make a payment from there the bank reconciliation is wrong?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I split a bill payment to OS supplier with a bank fee

Hello there, @Virgo1.

I'm here to help share some information about fixing the penny difference in your QuickBooks Online account when matching payments.

When matching invoice transactions, you'll need to use the Resolve Difference button. This process will help you match transactions by resolving their difference until it is equal to zero.

Let me walk you through the steps:

- On the Banking page, select the For Review tab.

- Select the transaction to open it.

- Select the Find other records or Find match button to open the Match transactions window.

- Locate the Bill that you have paid with a bank fee.

By default, the Match transactions window lists All transactions within the date range, but you can narrow the results. - Use options on the Show drop-down menu to specify the type of transaction you're searching for,

- If the transaction you're looking for is outside the default date range, select the From and To date fields to change the dates.

- If the amounts are different, you can locate additional matched transactions, or select Resolve Difference to open the Add resolving transactions fields.

- Enter the exact amount to zero out the difference in the Amount column.

- Add the Category and Amount (and, optionally, Payee) of a resolving transaction until the difference equals zero.

- Select Save.

For more insights about this process, please refer to these articles:

- Add and match downloaded banking transactions.

- Why do I occasionally notice penny rounding differences?

If you're about to reconcile your accounts, I recommend checking out this article for your reference for the process: Learn the reconciliation workflow.

Drop me a comment below if you need further assistance in handling your other transactions. It's always my pleasure to help.